In the volatile reality of cryptocurrency, the notion of “HODLing” has become synonymous with believers in the long-term potential of digital assets. The mantra “stay long” has become a rallying cry for supporters in the long-term potential of digital assets. The idea is simple: hold onto your preferred cryptocurrencies and watch them appreciate over time. However, as miners and crypto enthusiasts know all too well, staying long can be difficult when you need access to liquidity for everyday expenses or business operations.

Here we explore SALT’s approach to crypto-backed lending for miners, offering a solution that allows them to stay long on crypto while staying liquid in a world of limited financing options and to maintain their mining operations.

Understanding Crypto-Backed Lending

Crypto-backed lending is a concept that allows individuals and businesses to leverage their cryptocurrency holdings as collateral for loans. At the core of this method is the recognition of the importance of liquidity in treasury management, especially for crypto miners.

The fact remains, that traditional financial systems often create barriers for miners who want to access cash. SALT bridges this gap by allowing miners to hold onto their crypto assets while still tapping into the financial resources they need to operate effectively.

The benefits of crypto-backed lending are numerous. It enables users to retain ownership of their assets, manage taxable events, and participate in the potential appreciation of their holdings while accessing much-needed liquidity.

Crypto-backed lending offers several appealing benefits to miners and other cryptocurrency enthusiasts:

Liquidity Without Selling: Miners can use their crypto assets as collateral to secure loans without having to sell their precious holdings. This allows them to access liquidity while still maintaining exposure to potential price appreciation.

Manage Capital Gains Tax: When miners sell their crypto holdings, they may incur capital gains taxes. By taking out a loan with their crypto as collateral, they can defer the tax liability until they decide to sell the assets, potentially reducing their overall tax burden.

Hedging Against Market Volatility: Cryptocurrency markets are highly volatile. Miners can use crypto-backed loans to manage price fluctuations. If they expect the value of their assets to increase, they can secure a loan, and if the price rises as anticipated, they can repay the loan with cheaper dollars.

Diversification: Miners can use the borrowed funds to diversify their investments or expand their mining operations. This can help mitigate risks associated with holding a single asset and potentially increase their overall returns.

Retaining Ownership and Exposure: Crypto-backed loans allow miners to maintain ownership and exposure to their assets. They can benefit from price appreciation, participate in governance activities (for tokens that offer this), and continue to receive rewards like staking or mining rewards.

No Credit Checks: Crypto-backed loans typically do not require traditional credit checks, making them accessible to individuals who may not have a strong credit history or any credit history at all.

Quick Access to Funds: Traditional loans can involve a lengthy approval process. Crypto-backed loans often provide quick access to funds, making them suitable for miners who need fast capital for equipment upgrades or operational expenses.

Flexible Loan Terms: Borrowers can often choose from various loan terms and interest rates, allowing them to tailor the loan to their specific needs and risk tolerance.

The Importance of Long-Term Holding for Miners

One of the fundamental principles of cryptocurrency investment is the concept of “HODLing,” which involves holding onto your assets for the long term. This approach aligns with SALT’s mission to help users stay committed to their crypto assets.

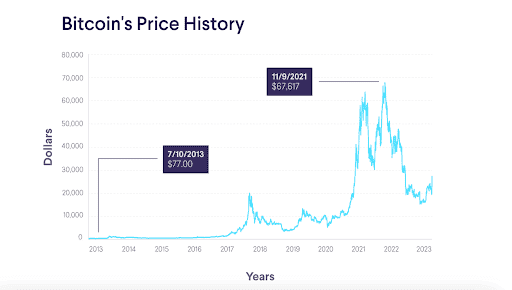

Miners are inclined to hold onto their crypto assets, especially Bitcoin (BTC), due to the rollercoaster ride of its price over the years. With Bitcoin’s value consistently above the $20,000 mark in early 2023, there’s optimism that the crypto winter of 2022 is thawing, hinting at a broader recovery in cryptocurrency prices.

Despite the extreme volatility, Bitcoin has showcased remarkable potential for substantial gains for early investors. Those who had the foresight to buy and retain Bitcoin have often witnessed phenomenal returns. However, it’s crucial to acknowledge that the crypto market’s price swings, exemplified by the turbulent events of 2021 and the subsequent declines in 2022, have also resulted in significant losses. Miners, being deeply embedded in the cryptocurrency ecosystem, are well aware of this dynamic and tend to hold onto their assets, anticipating potential future gains as the crypto market continues to evolve and mature.

Picture Credit: https://www.sofi.com/learn/content/bitcoin-price-history/

Long-term holding offers several advantages, including capital appreciation and participation in the growth of the crypto ecosystem. While crypto markets can be highly volatile in the short term, historical data has shown steady year-on-year growth, making it a compelling long-term investment.

SALT’s Approach to Being Your Own Lender

SALT empowers users to become their own lenders, offering a versatile treasury management solution for miners and crypto enthusiasts alike. Here’s how SALT’s approach works:

- By using their crypto assets as collateral, users can obtain loans of up to 70% loan-to-value (LTV) ratio.

- SALT acts as a bridge between the traditional financial world and the crypto space, enabling users to convert their crypto holdings into cash without selling their assets.

- Users have flexibility in choosing loan terms and collateral options that suit their needs.

- The application process for a SALT loan is straightforward, providing quick access to funds with minimal hassle.

- SALT helps lower costs for miners with Luxor Mining Pool Partnership: One of the key challenges miners face is the high cost of energy required for cryptocurrency mining. Energy expenses often need to be aligned with the rewards generated from mining activities. This balancing act can be complex, and miners strive to optimize their operations to reduce costs.

- SALT understands the importance of cost optimization for miners. As part of our mining solution, we collaborate with Luxor Mining Pool, which allows miners to lower their pool fees. This cost-saving measure is a crucial step toward achieving profitability in the mining industry.

To illustrate the practical benefits of SALT’s approach, consider this scenario:

Consider the scenario where a mining company urgently needs $100,000 to cover their power bills or payroll. Traditionally, they would be compelled to sell their hard-earned Bitcoin assets immediately, often at unfavorable or ill timed market prices, just to meet this financial obligation.

This lack of flexibility can have a significant impact on their overall profitability. Here’s where SALT’s crypto-backed lending solution shines.

With SALT, miners gain a broader window of opportunity to decide when and how much of their crypto assets they sell, allowing them to choose more favorable market conditions.

Additionally, by leveraging their mining rewards for additional loan capital, they avoid the need to sell their precious Bitcoin holdings altogether. This approach not only ensures smoother financial management but also positions miners to benefit from the potential growth of their crypto assets over time. In the ever-volatile crypto market, having the flexibility to sell when the market is favorable becomes a strategic advantage for miners looking to maximize their returns. And thus, you can see SALT lending has helped:

- Mining companies facing the challenge of aligning their energy costs with crypto rewards can use SALT to access cash without selling crypto holdings.

- Individuals can leverage their crypto assets to fund significant life events like home purchases, education expenses, or vacations, all while keeping their crypto investments intact.

SALT ensures complete security and control for miners

SALT offers a comprehensive suite of features tailor-made to appeal to miners, enhancing their lending experience and overall financial security.

First and foremost, the Stabilization Feature is a safety net, automatically converting the entire crypto portfolio to USDC in the event of a market downturn, thus safeguarding the value of their assets.

Additionally, SALT’s collaboration with Luxor not only reduces pool fees but also enables miners to accumulate more Bitcoin in their SALT wallet, aligning perfectly with their long-term crypto holding strategy.

The partnership with Fireblocks, a trusted custody management platform, bolsters security, assuring miners that their assets are held with the utmost care. SALT’s commitment to cyber insurance further underlines their dedication to safeguarding crypto assets.

With a custody-agnostic approach, SALT optimizes risk distribution, security, and loan funding, all while expanding wealth preservation options.

Miners can trust SALT to provide reliable access to their assets, thanks to a robust custody process and multi-user authorization, ensuring peace of mind in their crypto lending journey.

Stay Long, Stay Liquid with SALT

For cryptocurrency enthusiasts and miners, the mantra “stay long, stay liquid” has never been more relevant. Believers in the long-term potential of digital assets understand the importance of holding onto their investments while still having access to the liquidity needed for everyday expenses and business operations.

SALT lending’s approach to crypto-backed loans has proven worthwhile for miners and crypto enthusiasts who want to achieve this delicate balance. By becoming your own lender through SALT, you can navigate the intricate landscape of cryptocurrency with confidence.

You can access liquidity in 4 easy steps with SALT Lending:

- Create your SALT account and undergo identity verification.

- Tailor your loan to your specific needs by choosing your borrowing preferences and submitting your loan application.

- Transfer your crypto collateral to your designated SALT wallet.

- Upon approval, access stablecoin funds directly deposited into your account.