Rest Easy with SALT Stabilization

Protect Your Portfolio in Any Market

This proprietary feature safeguards your crypto assets during market downturns, preserving their value. With our innovative solution, you gain the flexibility to re-enter the market when the timing is right for you.

The Benefits of Stabilization

Preserve Wealth

Proactively preserving collateral value, converting assets to US dollar stablecoins, like USDC, to protect them during volatile market conditions.

Reduce Stress

Market crashes don’t have to lead to panic. SALT Stabilization gives you time to manage your loan and act when conditions improve.

Timing Control

Convert back to your original crypto mix after the market stabilizes to potentially increase your holdings and build long-term wealth.

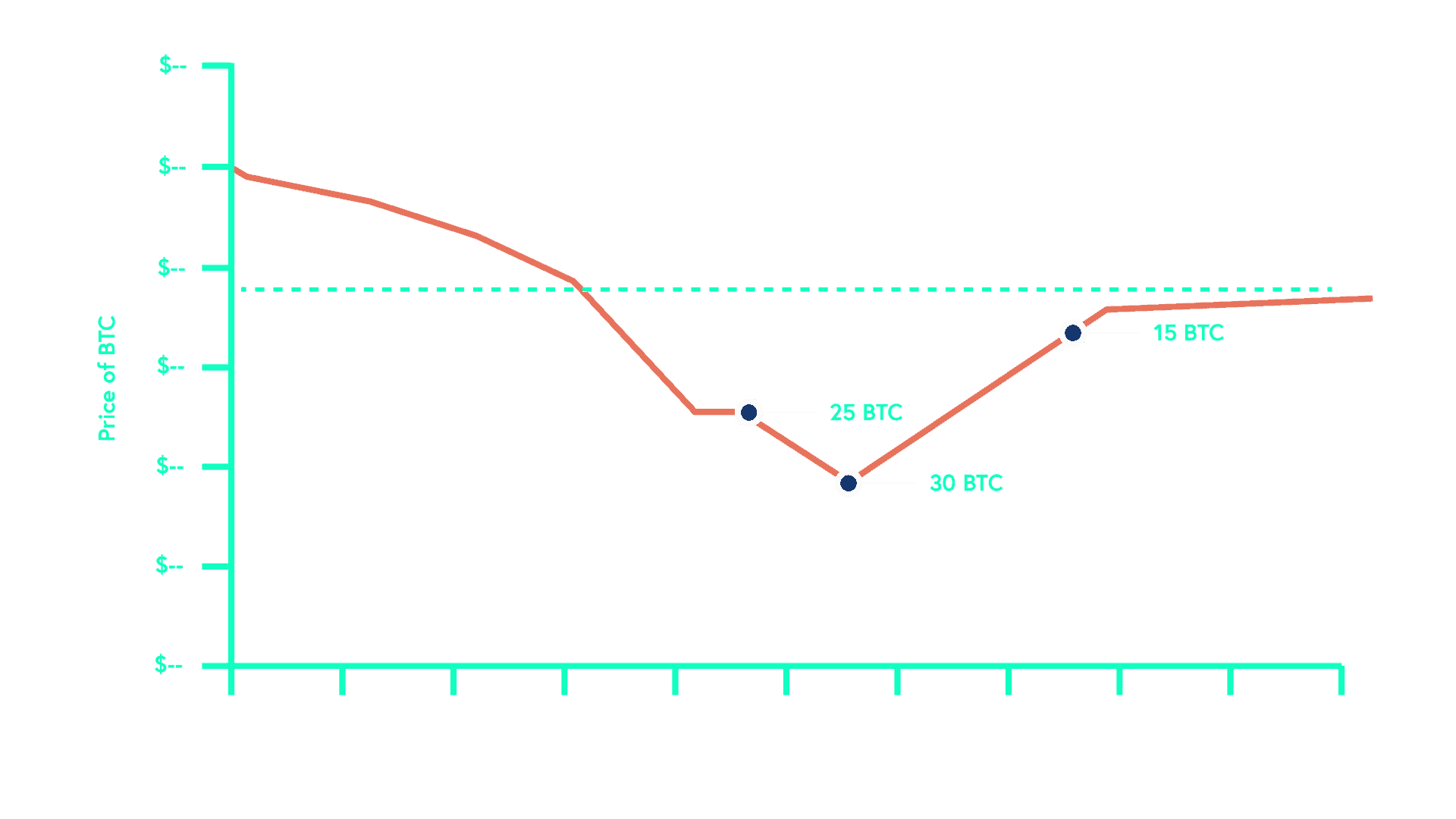

How does Stabilization work?

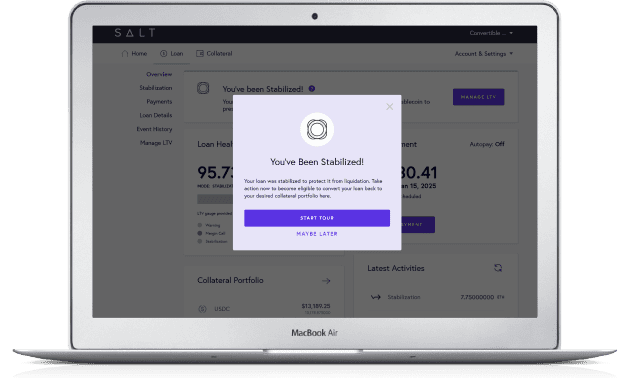

If the Market Declines: When your Loan-to-Value (LTV) ratio reaches 90.91%, the SALT Stabilization feature will automatically convert your portfolio to USDC, locking in its value.

Take Action to Re-Enter: Later on, once you bring your LTV down to 83.33% or below through a payment or collateral deposit, you’re free to re-enter the market and take advantage of opportunities when they arise.*

*Subject to market values at time of transaction. Transaction fees apply.

| Re-entry point #1 | 25 BTC |

| Re-entry point #2 | 30 BTC |

| Re-entry point #3 | 15 BTC |

| Competitor's Method | 4.2 BTC |

We Are the Only Lender Offering Portfolio Stabilization!

Stay Secure, Stay Confident: SALT Stabilization is the only solution that lets you preserve the value of your crypto portfolio during downturns, ensuring you stay protected with less worry.

Sign up

Based on 3 years of market data and volatility

Based on your loan terms and the number of days market volatility would have negatively impacted your loan-to-value ratio, liquidation of your portfolio was likely.

Estimates based on historical averages, individual results vary based on collateral type, loan terms, borrower maintenance, among other factors.

70% LTV

Loan term: 1 year

50% LTV

Loan term: 1 year

30% LTV

Loan term: 1 year

How SALT Stabilization Protects Your Crypto Portfolio

Have Questions? Contact Us

By Phone: +1 (720) 457-2288

Monday – Friday | 9AM – 5PM (MST)

By Direct Email

[email protected]