Power Your Business With Bitcoin

From managing liquidity in digital assets to unlocking yield and driving growth, we deliver tailored strategies you can trust. Supporting businesses like yours since 2016.

Put Your Digital Assets to Work

Our tools allow you to build and leverage your digital assets as private reserves, giving you the freedom to use your wealth without giving up long-term growth. With SALT, you can:

Keep Your Crypto, Access Liquidity

No need to sell your crypto during downturns. Our solution offers liquidity options to keep your business running.

Protect Against Market Volatility

Navigate crypto market fluctuations with confidence. Smooth out volatility and maintain your position for long-term growth.

Optimize Your Crypto Holdings

Leverage your assets without the risks of market timing. Maximize growth potential while minimizing exposure to downturns.

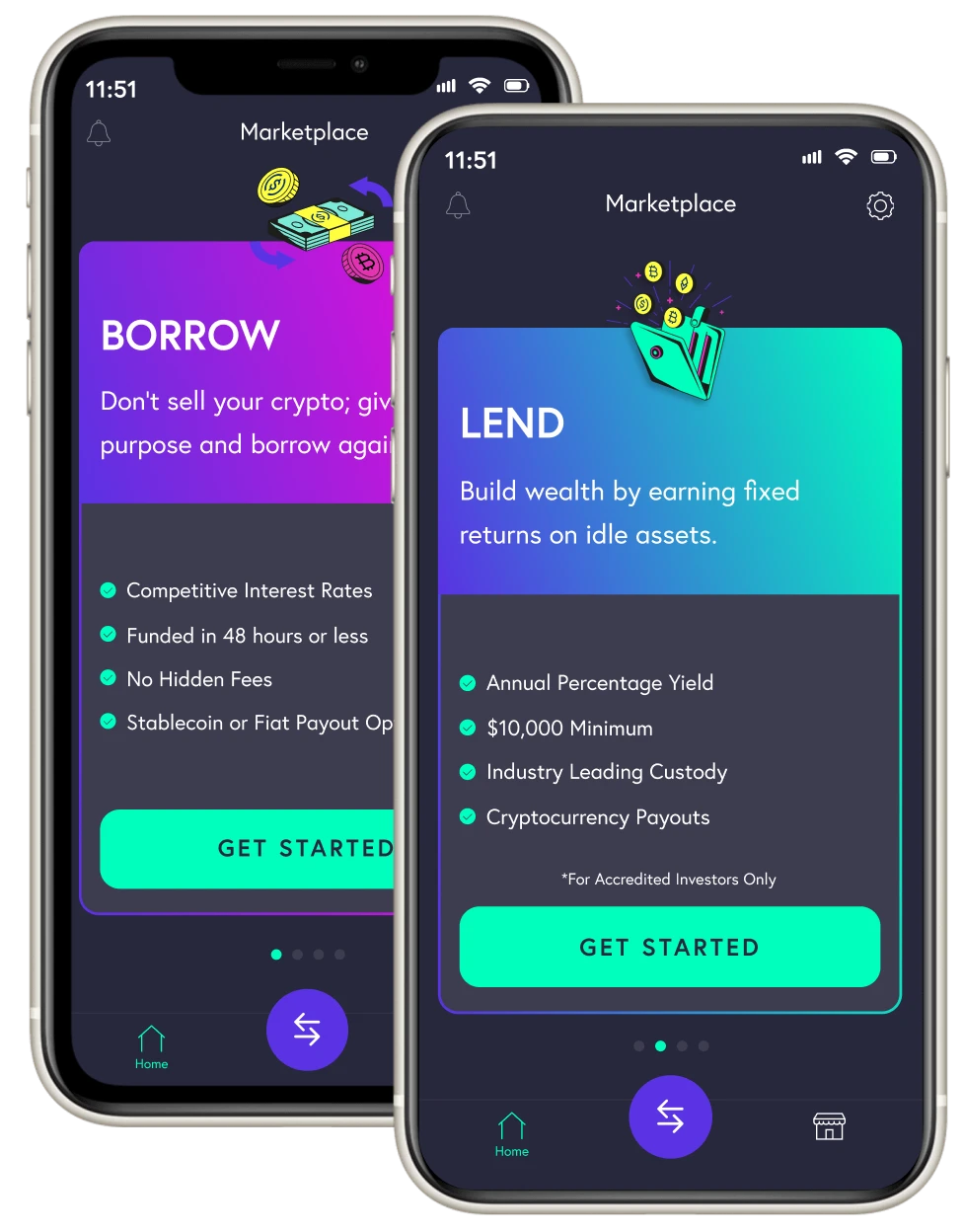

BORROW

Bitcoin-Backed Loans Made Easy For Businesses That Want to HODL

No matter your business goals, a bitcoin-backed loan can fuel your ambitions and make new opportunities possible:

Launch or Scale Your Operations

Build or expand your operations with the capital you need.

Fund Your Start-Up or Business

Fuel growth, innovation, and success from day one.

Cover Operational Expenses

Pay for electricity, equipment maintenance, or office setup costs without delay.

BORROW Low with Market Rates from: 8.95% - 14.45% APR*

*Available rates and terms are subject to change and may vary based on loan amount, qualifications, jurisdiction, and collateral profile. Other terms, conditions, and restrictions may apply.

What Happy BORROWers Say:

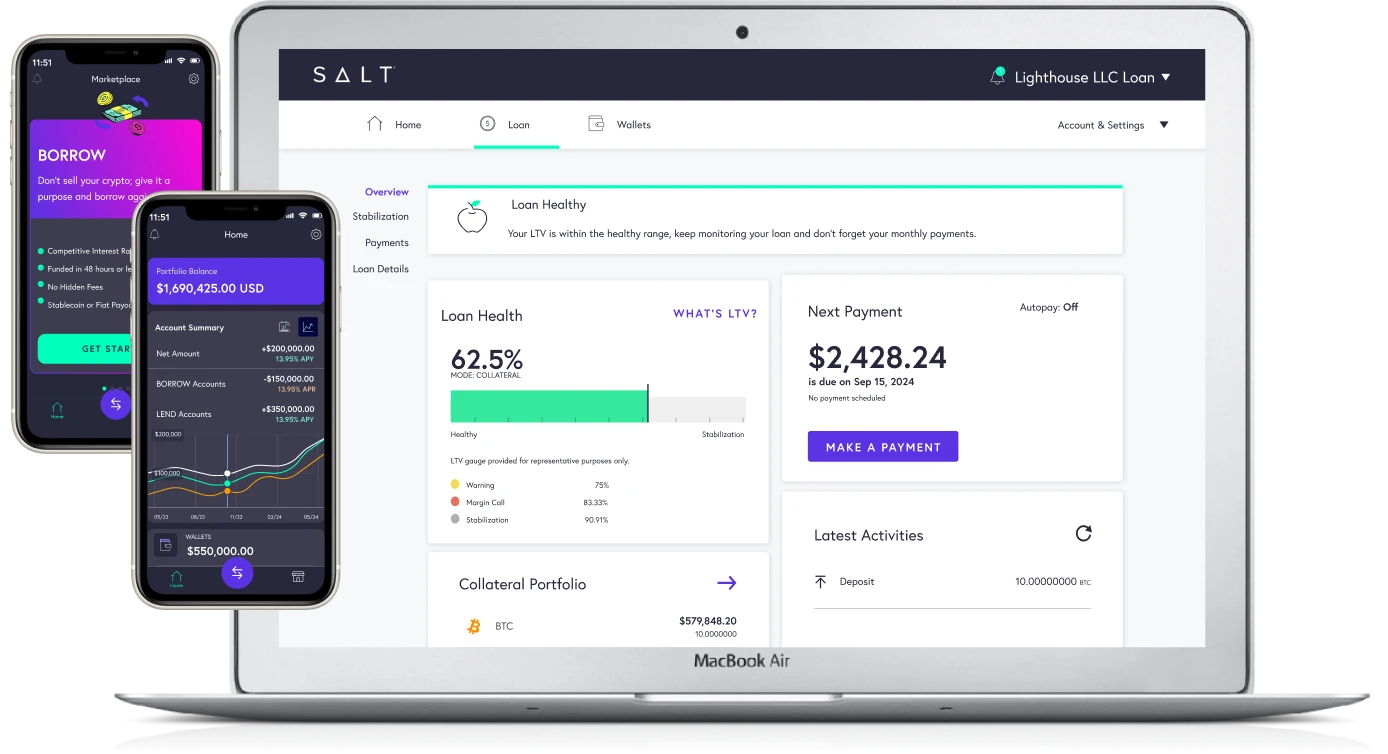

Bitcoin Loans For Businesses: Fast, Easy, Secure

Get Liquidity

Access cash within 1-2 business days to seize opportunities or cover expenses—all while preserving the growth potential of your Bitcoin investment.

Flexible Terms

Tailored financing options that adapt to your business goals and cash flow needs.

High Security

Enjoy peace of mind with your assets secured by industry-leading protection.

New! Introducing SALT Shield

How SALT BORROW Works:

- Quick Sign Up: Create your account in less than a minute.

- Easy Application: Apply for a loan with no credit check required.

- Speedy Funding: Get your funds within 24-28 business hours.

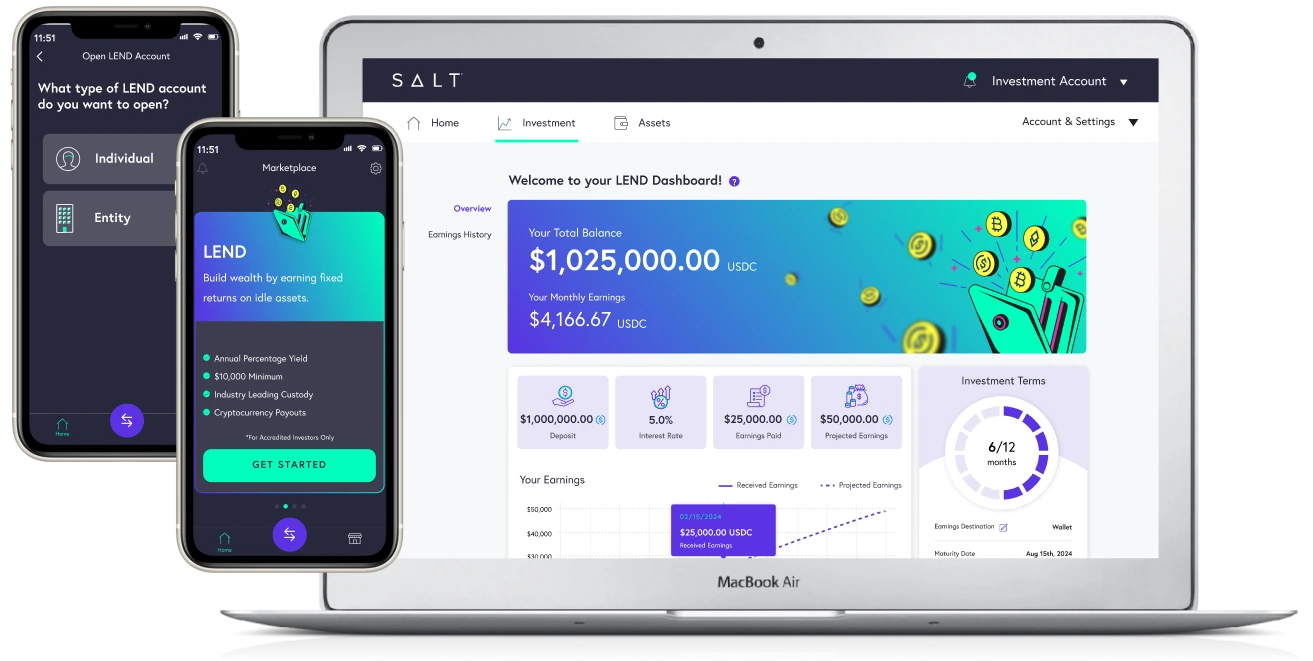

Earn Attractive Yields on Your Hard-Earned Digital Assets with SALT LEND

Put your digital assets to work by lending them in exchange for attractive Annual Percentage Yields (APY). Whether you’re holding Bitcoin, Ethereum, USDC, or other stablecoins, our SALT LEND program enables businesses to earn passive income while maintaining full control over your assets. Only $10,000 minimum required.

LEND

Current Market Rates

APY

APY

APY

What Happy LENDers Say:

Don't Let Your Digital Assets Sit Idle

Earn up to 10% APY

Grow your crypto holdings with competitive interest rates, increasing your asset value over time.

Predictable Income

Enjoy consistent, reliable returns from Bitcoin, Ethereum, and stablecoins—making it easier to plan and budget.

Easy Management

Simplify the management of your crypto investments with an intuitive web and mobile app platforms, saving time and effort.

How SALT LEND Works:

- Complete the Questionnaire: Provide your details to get started.

- Get Accreditation: Wait for approval before moving forward.

- Make Your Deposit: Fund your account with your digital assets.

- Select Investment Terms: Choose the terms that best fit your goals.

- Start Earning Yield: Watch your digital assets work for you!

Ready to Get Started with SALT BORROW OR LEND?

Create your FREE account to explore the SALTy tools you need to take control of your financial future.

Bitcoin-Backed Business Loan Questions Answered!

We understand the importance of transparency, and we're here to provide it.

How does SALT’s Treasury Management Solution help businesses manage crypto volatility?

Stabilization by SALT is designed to protect your business from market fluctuations, maintain liquidity, and preserve your assets for long-term growth. By leveraging your bitcoin holdings as collateral for a loan, you can smooth out volatility and stay financially stable, even in unpredictable markets.

Why should businesses consider holding cryptocurrencies in their treasuries?

Holding cryptocurrencies in business treasuries provides several strategic advantages:

- Liquidity: Digital assets enable quick and efficient transactions, ensuring businesses can access funds when needed.

- Economic Hedge: Cryptocurrencies offer a safeguard against economic instability and serve as a potential protection against inflation.

- Innovative Financial Strategy: Companies are increasingly leveraging crypto treasuries as part of forward-thinking financial management to optimize growth and resilience.

How can I maintain liquidity for my business without liquidating my crypto assets?

SALT allows you to borrow against your digital assets, providing immediate cash flow to cover operational expenses, fund expansion, or seize time-sensitive opportunities. This solution ensures that you can maintain financial flexibility while keeping your crypto investments in place for long-term growth, without the need to sell or time the market.

Is my collateral safe with SALT?

Yes, SALT has been a preferred choice for customer’s with Bitcoin and digital-asset collateral since 2016. We’ve never lost a client’s collateral. We prioritize the security of your assets with industry-leading protections, so you can have peace of mind knowing your collateral is safeguarded throughout the loan term.

What are the benefits of a Bitcoin-backed business loan?

- Immediate Liquidity: Access funds within 1-2 business days to fuel growth, cover expenses, or expand operations.

- Flexible Terms: Choose a loan amount and repayment plan tailored to your business needs.

- Asset Retention: Keep your crypto investments intact while unlocking their value.

What’s the minimum amount required to start earning with SALT LEND?

You can start earning attractive yields on your digital assets with as little as $10,000. Deposit your Bitcoin, Ethereum, or stablecoins and watch your crypto grow through competitive APY rates.

Once approved, you can access cash within 1-2 business days, ensuring you have the liquidity you need for your business to run smoothly.

What happens if the value of my collateral decreases during the loan term?

If market volatility affects your collateral’s value, we’ll work with you to manage your loan terms. Options include adding collateral, partial repayment, or adjusting the loan-to-value ratio.

Can I use SALT’s solutions if my business is a startup?

Absolutely! Whether you’re launching or scaling, our Bitcoin-backed loans provide the capital you need to fuel growth and innovation from day one.

How does SALT protect my assets?

- Proven Track Record: Supporting businesses since 2016 with a flawless reputation.

- Industry-Leading Security: Your assets are always safeguarded.

- Tailored Solutions: Flexible terms to meet your unique goals.

- Fast Liquidity: Access cash quickly without selling your assets.

Still Have Questions? No Worries! Contact Us

By Direct Email

[email protected]

Office Hours

Monday – Friday | 9AM – 5PM (MST)