How are crypto loans taxed?

This is a guest post from our Authorized Partner at CoinLedger.

This post is for informational purposes only and is not a substitute for professional legal and tax advice.

Taking out a cryptocurrency loan (a loan secured by crypto assets like Bitcoin and Ether) can help you save thousands of dollars on your tax return.

While selling your cryptocurrency is a taxable event, taking out a crypto-backed loan is typically tax-free.

In this guide, we’ll break down everything you need to know about how crypto loans are taxed. By the time you’re finished reading, you’ll understand why taking out a crypto-backed loan can be a fantastic strategy for tax savings.

The basics of cryptocurrency taxation

Before we jump into the tax implications of cryptocurrency loans, let’s briefly review the basics of how crypto is taxed.

In the United States, cryptocurrency is subject to capital gains and ordinary income tax.

Capital gains tax: When you dispose of crypto, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally acquired it. Examples of disposals include selling your crypto, crypto-to-crypto trades, and using your crypto to make a purchase.

Ordinary income tax: When you earn cryptocurrency, you’ll recognize ordinary income based on the fair market value of your crypto at the time of receipt. Examples of earning cryptocurrency include staking rewards, mining rewards, airdrop rewards and receiving crypto as part or all of your paycheck.

Looking to estimate your crypto tax bill? Check out CoinLedger’s free crypto tax calculator.

What are the tax advantages of cryptocurrency loans?

Often, investors in need of fiat currency will sell off some of their existing crypto holdings. However, it’s important to note that “disposing” of your cryptocurrency has tax implications.

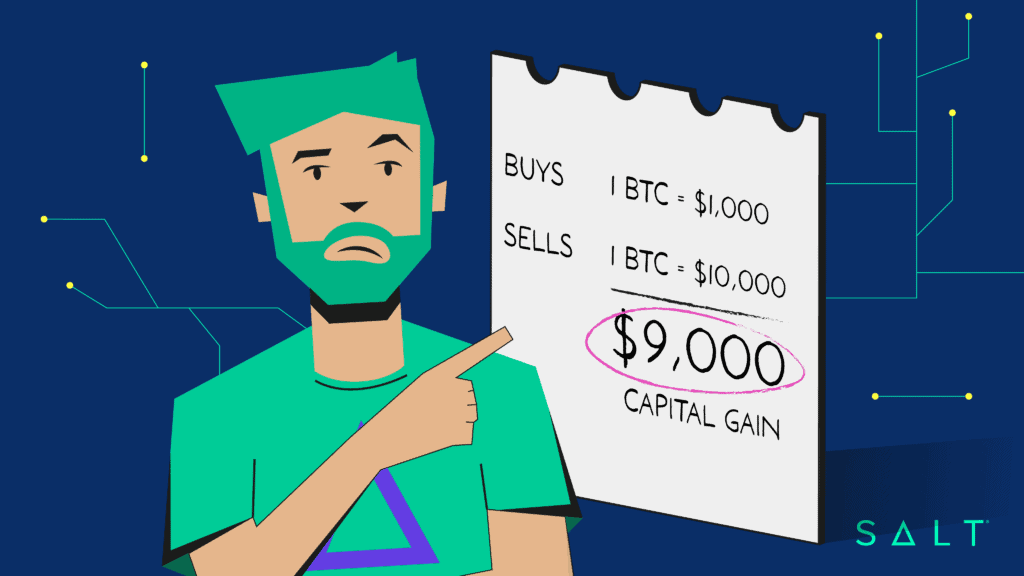

As previously mentioned, if you sell or trade your crypto assets, you’ll incur a capital gain or loss depending on how the value of your assets have changed since you purchased or acquired them.

- Charlie buys $1,000 of Bitcoin.

- Years later, Charlie sells his BTC for $10,000.

- Charlie incurs $9,000 of capital gain.

How crypto loans can help you save money…

Unlike disposals, loans from centralized entities like SALT Lending are considered non-taxable because rather than spending your Bitcoin or other crypto assets, you’re using them as collateral to secure a cash or stablecoin loan. It’s similar to getting a loan against your car, house, or 401K in that you’re borrowing against assets you already own

Plus, if you’re long on crypto, meaning you believe the value of your assets will appreciate over time, a crypto-backed loan is an excellent way to get value out of your crypto assets right now without having to sell them or lose out on potential gains. By collateralizing your crypto with SALT, you can get cash in 48 hours or less and get your assets back as soon as you’ve paid off your loan in full.

How are DeFi loans taxed?

Unfortunately, many of the tax advantages of crypto loans don’t apply to the DeFi space.

Many DeFi lenders use crypto-to-crypto swaps to facilitate loans. In the past, the IRS has classified these types of transactions as disposal events subject to capital gains tax. As a result, it’s reasonable to assume that taking out a DeFi loan will be considered taxable in some situations.

In addition, DeFi lenders often automatically liquidate your holdings if their value falls below a certain threshold. Even if you don’t receive the proceeds of the liquidation, you’ll still be subject to capital gains tax.

Can I deduct interest payments from my taxes?

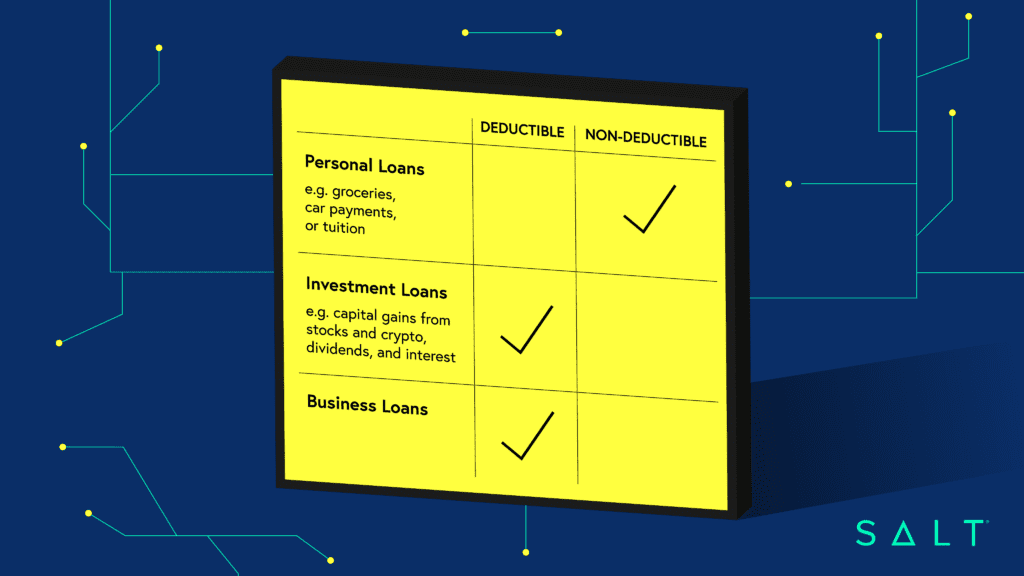

The interest payments on your cryptocurrency loans may be tax deductible in some scenarios.

Personal Loans: Non-Deductible

When you take out loans for personal reasons — such as for groceries, car payments, or tuition — your interest payments are considered non-deductible.

Investment Loans: Deductible

Loans taken out for investment purposes can be tax-deductible. If you took out a loan and re-allocated your funds to other investments, you can deduct your interest payments up to your net investment income for the year. This includes your total income from investments including capital gains from stocks and crypto, dividends, and interest.

Business Loans: Deductible

If you take out a loan as a business entity, you can deduct the cost of interest payments as a business expense.

How are liquidations taxed?

SALT Lending takes steps to ensure that its customers’ funds are protected from total liquidation even in the case of a severe market downturn. If the value of your cryptocurrency begins to collapse, SALT Stabilization will convert your entire collateral portfolio to stablecoin to protect the value of your holdings.

It’s important to remember that converting cryptocurrency to stablecoin is considered a crypto-to-crypto trade subject to capital gains tax based on how the price of your collateral has changed since you originally received it.

In conclusion

While cryptocurrency disposals can lead to an expensive tax bill, crypto-backed loans are tax-free. That’s part of the reason thousands of investors use SALT Lending to take out loans against their Bitcoin, Ether, Litecoin, Bitcoin Cash , and other cryptocurrencies.

Take the Guesswork Out Of Crypto Taxes

Cryptocurrency tax reporting is a challenge for investors all over the world. By taking the right steps to track your transactions and legally reduce your tax liability, you can save yourself thousands of dollars as well as hours of stress during the tax season.

Whether it’s tracking your capital gains from buys, sells, or NFT mints, CoinLedger makes the process of doing your crypto taxes simple. Visit CoinLedger.io to learn more about how you can manage your crypto taxes in one place, and even import your tax filing information into TurboTax and other leading tax software platforms.

Sign up now for a free preview of your capital gains and losses!

For a limited time only, any SALT Lending customer can get 20% off of their next CoinLedger tax report with the discount code SALTLEND.