Choosing the right refinancing partner is crucial, but…

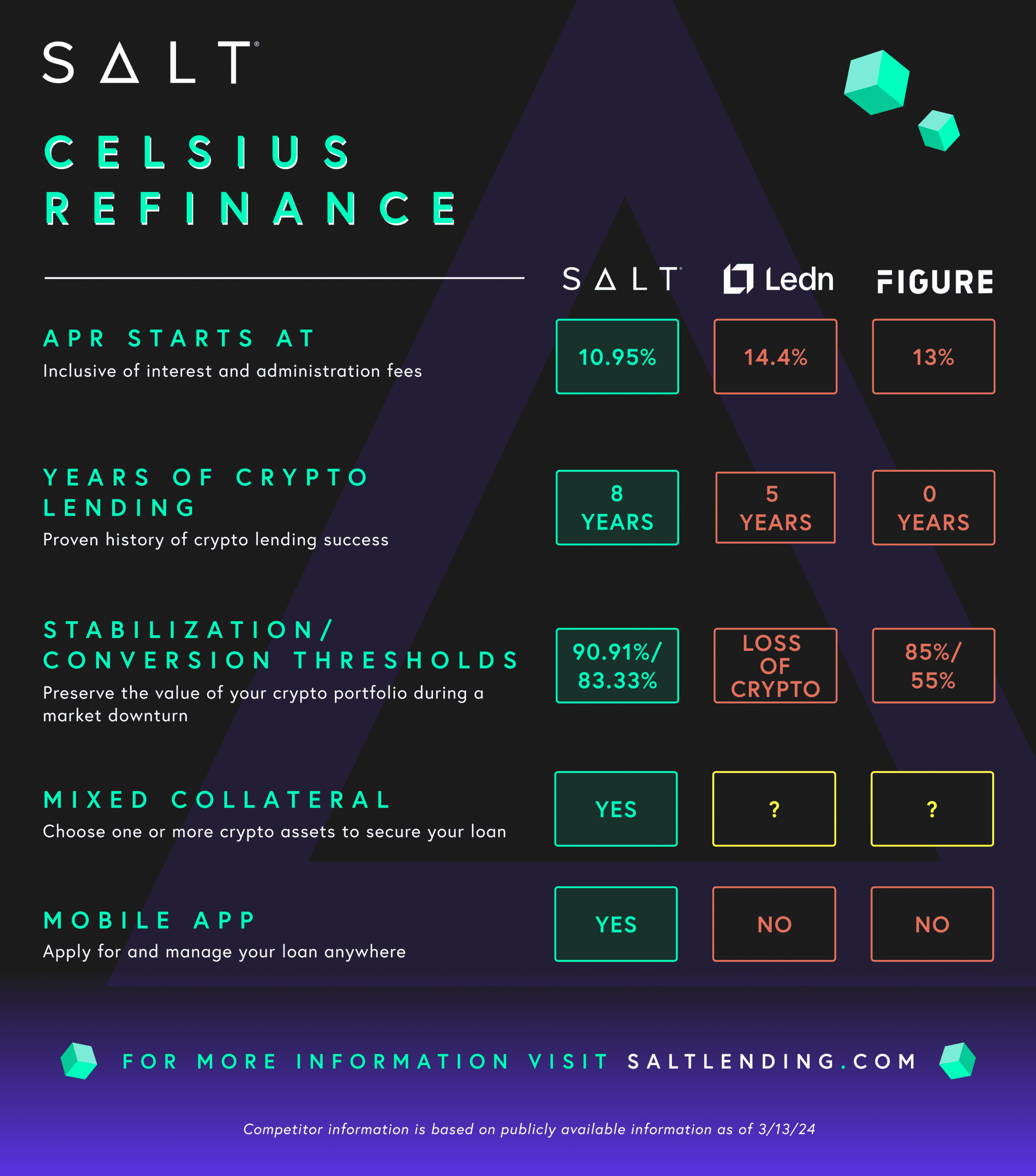

SALT is the premier option. We’re obviously biased (maybe a little SALTy), but this comparison graphic succinctly illustrates why SALT stands above the other options for Celsius creditors. It showcases our exclusive offerings, such as a mobile application, multi-collateral loans, extensive industry experience, and a comprehensive suite of loan options.

While we could have just shared the comparison on Twitter (I’m never calling it X) or via email, we felt it was necessary to clarify a few items that our competitors have positioned as reasons you shouldn’t choose SALT or why their offerings are similar. This blog aims to clarify the often misunderstood “Custody Loans” and highlight the distinct advantages of SALT’s Stabilization feature, ensuring you’re well-informed to make the best decision for your financial future.

Custody Loans Demystified:

The term “Custody Loans,” as used by Figure and Ledn, might imply a level of security and control not entirely present. Unlike an actual key-sharing arrangement where the borrower retains a key in a multi-signature wallet with the lender and custodian, their custody loans involve transferring your assets to a custodian without the borrower or the lender maintaining direct control.

SALT’s multifaceted approach to funding, including using arrangements outlined above with custodians like BitGo and innovative methods like our SAFE process, ensures optimal capital sourcing without needing distinct product categorizations or unnecessary premiums. This maintains the integrity and security of your assets while never hypothecating.

Stabilization, Imitation (kind of) is the Highest Form of Flattery:

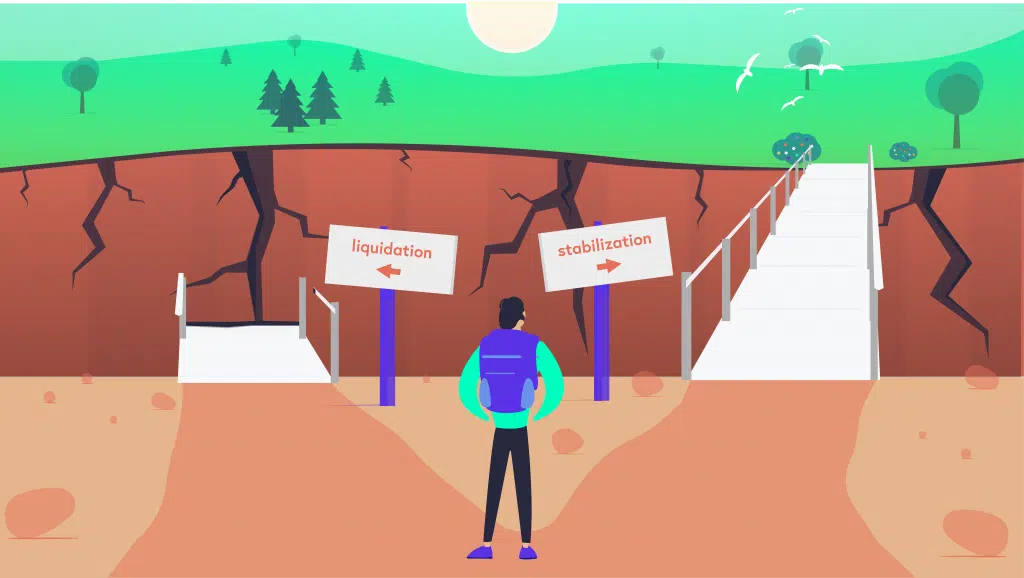

SALT pioneered the Stabilization feature in 2020, allowing borrowers more flexibility during margin calls by protecting the US dollar value of the borrower’s loan instead of liquidating to cure. Since releasing the feature, we have preserved nearly $60,000,000 worth of wealth for our customers! We plan to provide additional customization for Stabilizations in the future, too.

While Figure has plans to introduce a similar feature, SALT’s Stabilization is activated at a 90.91% LTV, offering more leeway than Figure’s 85% trigger. Post-stabilization, SALT requires borrowers to lower their LTV to just 83.33%, compared to Figure’s 55%, to convert your assets back to BTC or ETH, showcasing SALT’s commitment to providing a borrower-friendly environment. This approach reflects our deep understanding and expertise in crypto-backed lending, honed over eight years of innovation.

Choose Excellence, Choose SALT:

By opting for SALT Lending, you leverage a platform that’s not just a leader in crypto-backed loans but also a pioneer in borrower-focused features. With SALT, you get competitive rates, a rich array of services, next-level customer support, and a partner committed to your financial success.

Book a call with our Sales Team TODAY to use SALT for refinancing your Celsius loan