Ever considered getting a crypto loan? Maybe you’re wondering about the ins and outs of borrowing against your crypto and how it works? Perhaps you own cryptocurrencies like Bitcoin, Ethereum, Litecoin, or other digital assets and want some liquidity? If you’re toying with the idea of getting a crypto loan and want to thoroughly assess its pros and cons, you’ve come to the right place. Here, we’ll explore how you can borrow against your crypto and whether it’s the right option for you.

The thing is, acquiring liquidity from your cryptocurrency has become remarkably straightforward. By using your crypto assets as collateral, you can easily obtain a loan amounting up to 70% of their value. Select lenders even extend loans of up to 90% of your crypto holdings, providing you with a variety of flexible borrowing options to meet your specific risk profile and financial needs.

Borrowing against your crypto assets is a great option when you need a loan but don’t want to sell your cryptocurrencies. It works similar to how you’d use your car, house, or stock as collateral for a loan. You can pay back the loan in regular installments, and if you make the payments on time, you get to keep your crypto assets. Here’s a simple overview of how borrowing against crypto works and all the essential information you need to know:

What Is A Crypto Loan

A crypto loan, as the name suggests, is a secured personal loan backed by your crypto assets. If you own cryptocurrencies such as Bitcoin, Ether, Bitcoin Cash, Litecoin, SALT, USDC, TUSD, and/or USDP, you can use them as collateral for the loan.

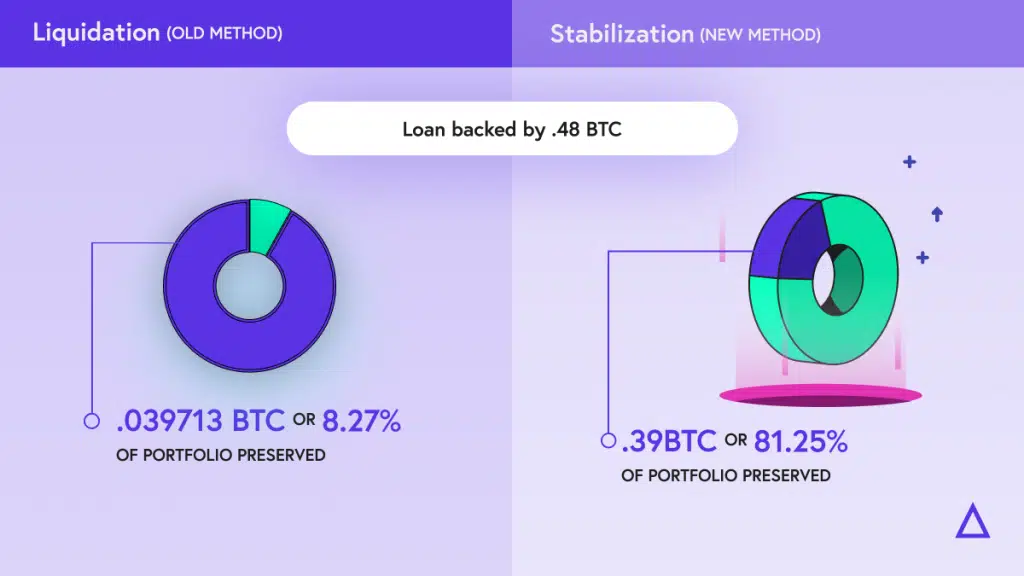

Here’s how it works: If you make timely repayments, your crypto assets will be returned to you at the end of the loan term, which can range from a 12 months to 60 months. However, if you fail to make payments and default on the loan, the lender has the right to liquidate your assets to recover the remaining amount owed.

Different lenders have their own terms, interest rates, and requirements, so it’s essential to review the agreement thoroughly before applying for a crypto-backed loan.

The loan amount you can be approved for usually depends on a percentage of the value of the crypto you pledge as collateral. The specific percentage varies by lender, but typically you can borrow between 20% to 70% of your crypto’s value. If the value of your holdings decreases during the loan period, you might need to provide additional collateral. Compared to other financing options like personal loans and credit cards, crypto loans generally offer lower interest rates. For example, some crypto loan lenders, such as SALT lending offer rates starting from APRs from 0.95%*

Types of Crypto Loans

There are two primary types of crypto loans: Centralized Finance (CeFi) and Decentralized Finance (DeFi). A CeFi loan involves entrusting your crypto asset to the lender during the repayment period, and they return control to you upon completing the payment. This is the more common type of crypto loan.

On the other hand, a DeFi loan relies on smart contracts to enforce the loan terms and conditions, allowing you to retain control of your crypto assets.

However, if you default on the loan, the lender may take automatic actions against your crypto holdings. DeFi loans typically come with higher interest rates compared to CeFi crypto loans and the well documented smart contract risk. Both loan types offer the advantage of borrowing against your crypto holdings without needing to sell them, and they accept various types of cryptocurrencies as collateral.

How To Borrow Against Crypto

Wondering how borrowing against crypto works? It’s simple. First, you need to own some cryptocurrencies and find a lender willing to accept your crypto assets as collateral. Cryptocurrencies are digital currencies with a fixed FIAT value at any given time, and their value can fluctuate based on various factors, with some, like Bitcoin, being more stable than others.

To get started, acquire cryptocurrencies through an exchange or mining. You can buy crypto using FIAT money and store it in a digital wallet. Once you have your crypto asset, search for lenders offering crypto loans. Carefully review the terms and conditions, paying close attention to loan limits, interest rates, repayment terms, late payment penalties, and other essential details.

To secure a crypto loan, you’ll need to possess a cryptocurrency that is accepted by your chosen lender. Before applying, it’s essential to verify this with your lender to ensure compatibility. While each lender may have its unique application process, you can generally follow these steps:

- Create an account with your preferred lender.

- Verify your crypto holdings and identity.

- Select your desired loan amount, considering your collateral and preferred repayment term.

- Submit your loan application.

Crypto lenders typically offer fast turnaround times, with some providing immediate responses and funding within 24 hours.

Depending on the lender, you may be eligible to borrow anything from 25% to 70% of your crypto holdings. If you meet the lending requirements, create an account, verify your crypto asset, specify the loan amount and terms, and submit your application. The loan is typically disbursed on the same day. You can then repay the loan in monthly installments, with your crypto asset serving as collateral.

It’s crucial to stick to the loan terms to keep your crypto assets safe. If you default or fail to comply with the lending agreement, the lender may liquidate your asset. However, making timely payments and clearing the debt ensures the safety of your crypto holdings. Before submitting your application, it’s wise to reach out to the lender to clarify any unclear terms. Most lenders allow borrowers to complete the loan application online and do not require credit checks.

What can I use a Crypto loan for?

A crypto loan offers versatile use for nearly any legal personal expense, such as debt repayment, making a large purchase, dream holiday expenses, buying a new car or home repairs. You can also use a crypto loan to re-invest or trade your cryptocurrencies. However, certain lenders may impose limitations on using the funds for business purposes, down payments, or higher education expenses. SALT offers both Business and Personal loans with terms ranging from 12 to 60 months.

Crypto Loans Pros and Cons

When researching how to borrow against crypto, weigh the pros and cons. Crypto loans have many advantages compared to other secured loans. However, borrowing against your cryptoassets also involves risks. For most borrowers, the pros outweigh the cons, especially if you repay the loan according to the lending terms. You can also use crypto loans as you wish, without any restrictions from the lender. Here are some of the pros and cons of borrowing against your cryptoassets.

Pros

- Low-Interest Rates: Crypto loans tend to feature lower interest rates than other secured loan products. Lower rates make the debt more manageable.

- Based on Asset Value: The loan you receive is based on a predetermined percentage of your cryptoassets. You’ll gain access to more margin if the assets grow.

- Multiple Loan Currencies: Looking for how to borrow against Bitcoin? You’ll soon realize lenders accept several other cryptocurrencies, including ETH, BCH, LTC and USDT among others..

- No Credit Checks: Because the cryptoassets act as collateral/security, you don’t need to have an excellent credit score. You can apply for crypto loans with bad credit.

- Fast Funding: Leading lenders release the funds on the same day of your application if you’re eligible. No tax returns, income statements, or financial documents are necessary.

- Manage Taxes: You can borrow against crypto to potentially better manage taxable events associated with selling your crypto.

Cons

- Price Drops: If the current value of your cryptocurrency drops, you’ll need additional crypto to cover the loan.

- Potential Liquidation: The lender may initiate partial liquidation of your crypto asset if you fail to make payment or default.

- Less Oversight: Crypto lenders tend to have less oversight than banks and traditional lenders, so you must be cautious when taking a loan.

- Limited Access: You may not have access to your cryptocurrencies during the term of a CeFi loan.

Crypto-Backed Loans from SALT Lending

Choosing a trustworthy lender can guarantee reasonable and transparent terms if you’re looking to take a crypto-backed loan. So, spend time researching how to borrow against crypto and find the best lenders and terms. SALT Lending offers loans starting from $1,000 with APRs from 0.95% and loan terms ranging from 12 to 60 months. You’ll also pay $0 prepayment/origination fees and can borrow against Bitcoin, Ether, Bitcoin Cash, Litecoin, SALT, USDC, TUSD, and/or USDP.

Sign up today to learn more about SALT Lending crypto-backed loans and how you can qualify.