The Original

Crypto-Backed Loan

- Starting from $5,000*

- Fixed Rates from 8.95% to 14.45% APR

- 12-month terms

- Borrow up to 70% LTV

- $0 prepayment fees

*Available rates and terms are subject to change and may vary based on loan amount, qualifications, jurisdiction, and collateral profile. Other terms, conditions, and restrictions may apply.

What is Stabilization?

We are the only lender that preserves the value of your crypto portfolio in a market downturn

Stabilization Happens

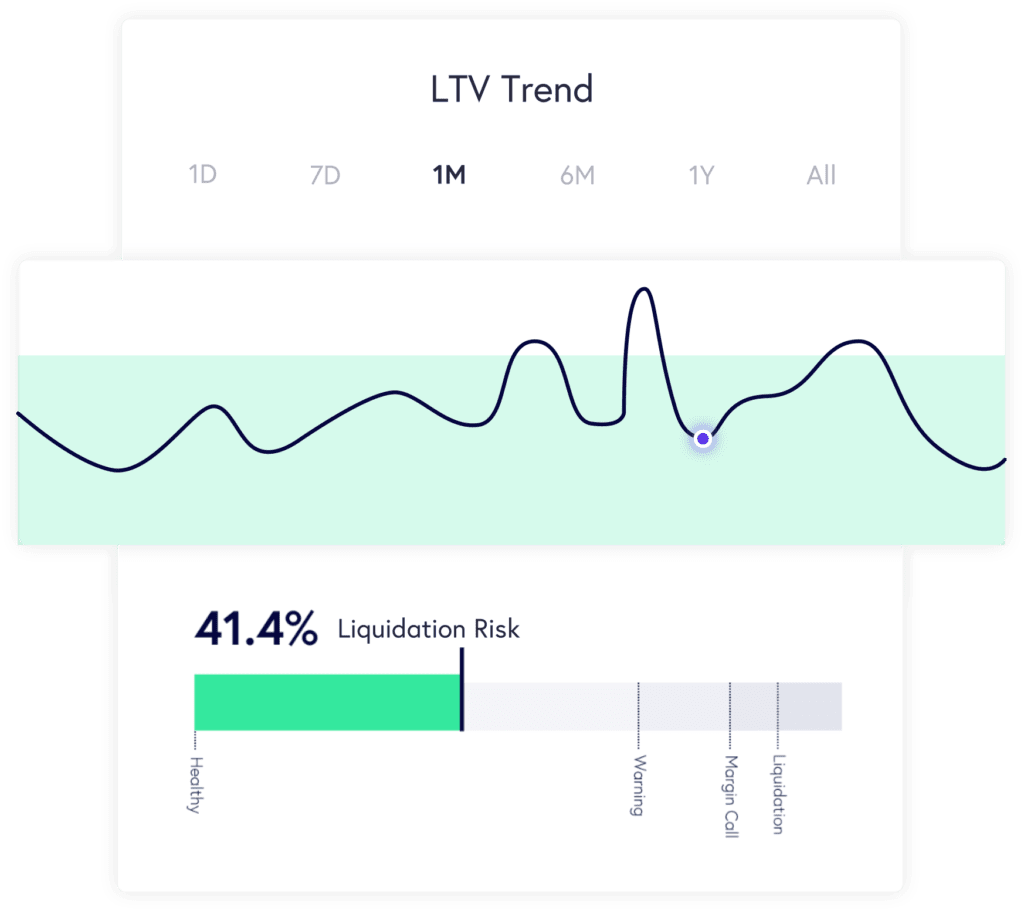

When your LTV surpasses the stabilization threshold of 90.91%, we will immediately convert your portfolio to stablecoin (USDC) to preserve its value and provide you with more options for managing your loan.

Manage Your Options

Want to convert back to your original portfolio mix when you think the timing is right? Simply lower your LTV below 83.33% by depositing more collateral or by paying down the balance of your loan.

Convert Back to Crypto

The new “Convert” section of your borrower experience will appear after restoring the health of your loan (LTV below 83.33%). You will have the option to convert your collateral back to its original mix or any other collateral mix we support.

Assets We Accept

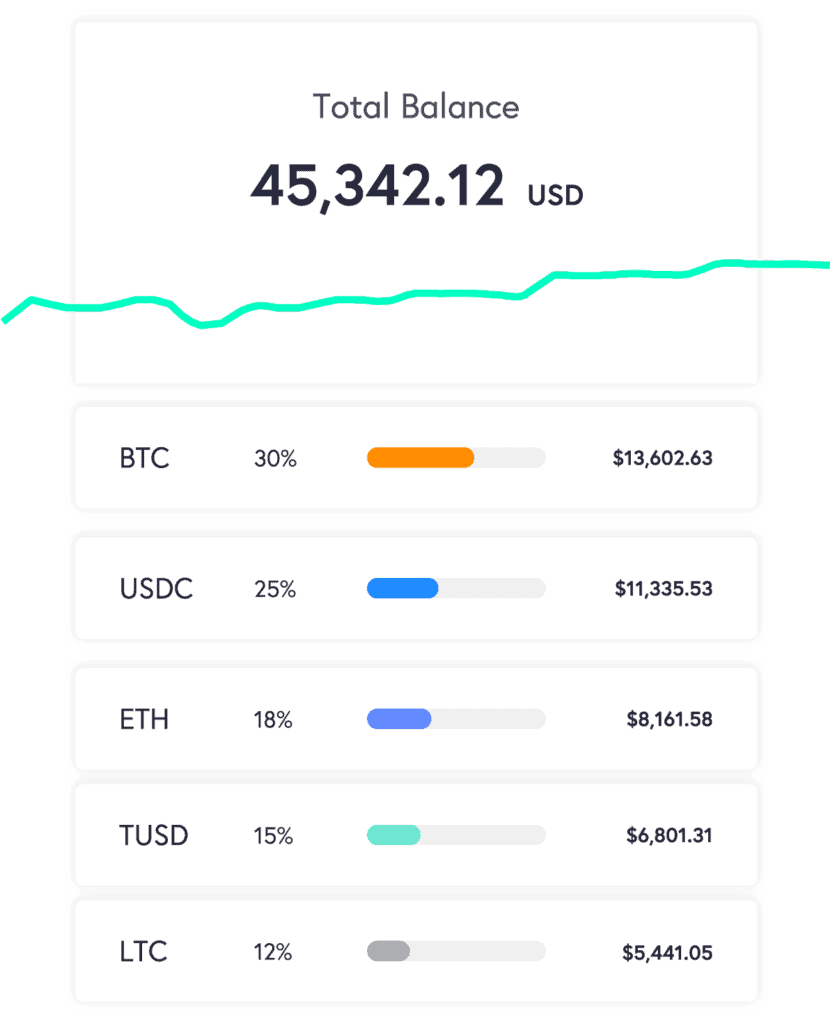

Do you hold several cryptocurrencies? Use a combination of them to get a loan and get funds in USD or Stablecoin.

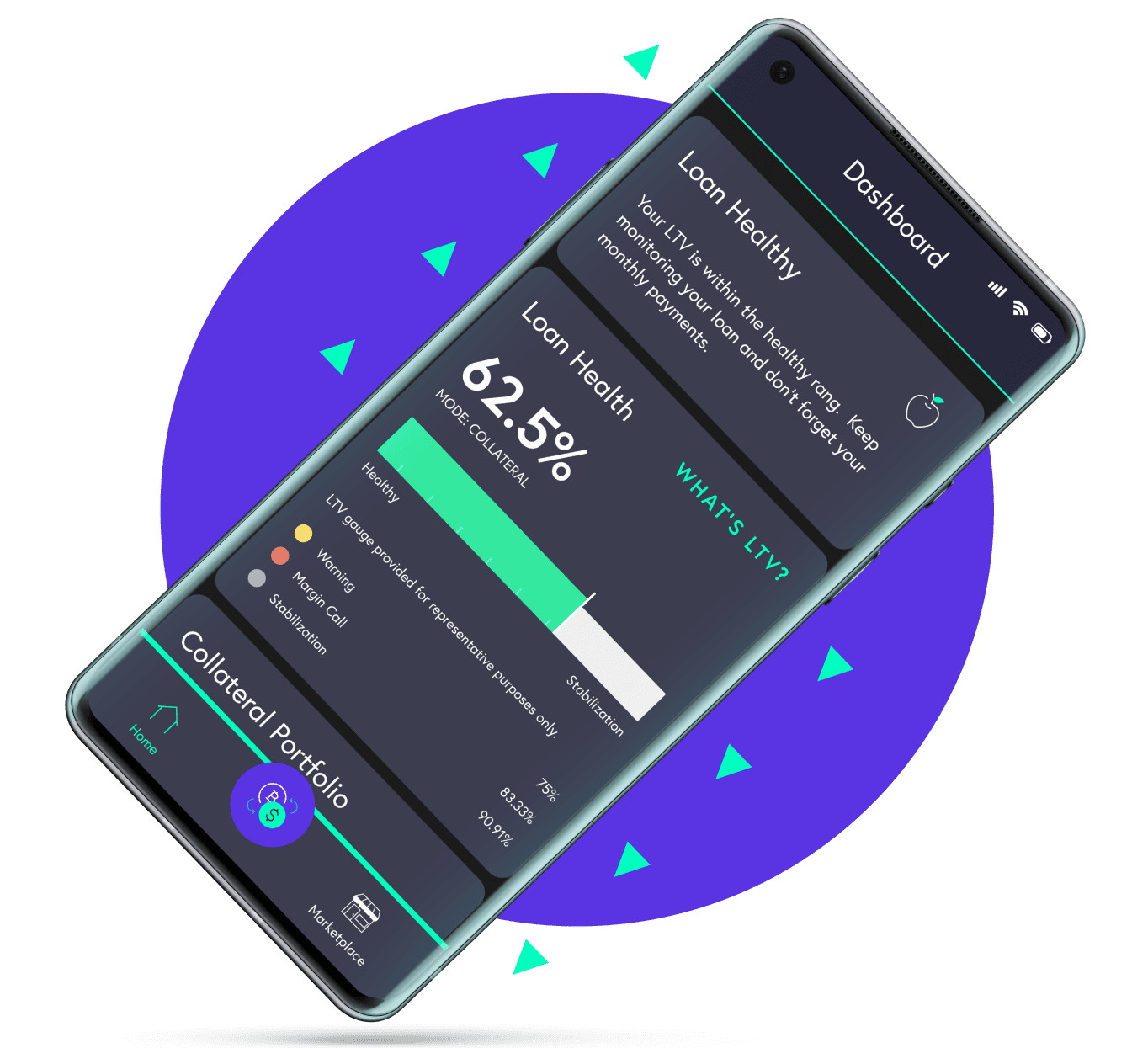

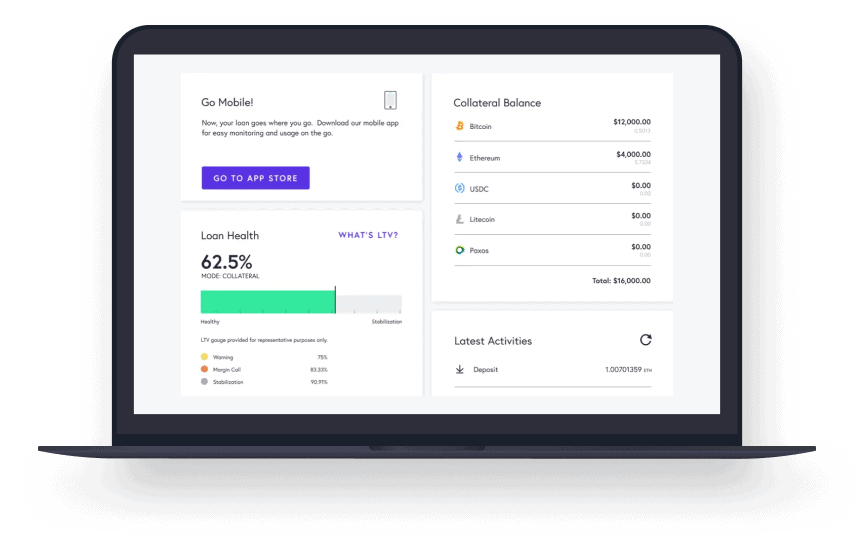

Monitor Your Loan Health

Our near real-time system reports your loan health (in Loan-to-Value ratio) through the life of your loan. We’ve created industry-leading tools, so you can stay informed and manage the risks or opportunities associated with your loan.

Your Portfolio, All in One Place

With our real-time pricing updates for cryptoassets, you can get an accurate view of your entire portfolio in one place.

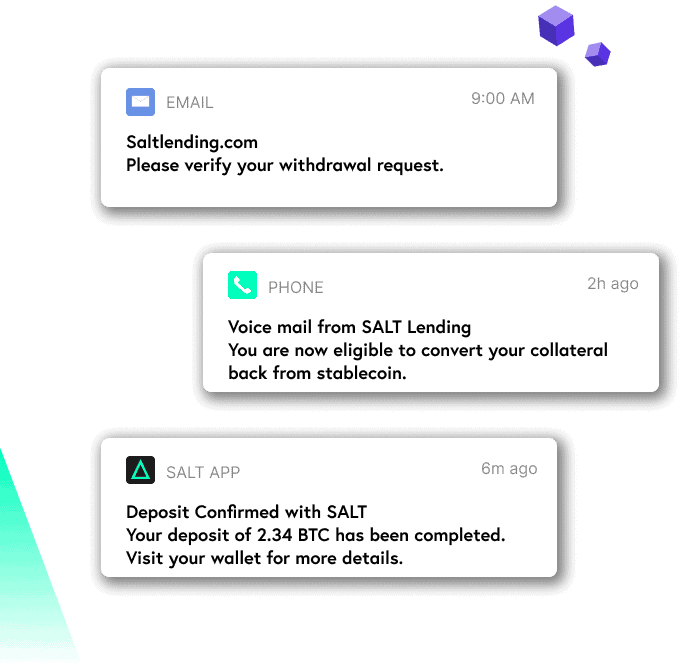

Notifications

We monitor your account, every moment of every day. Choose the notification triggers that work for you and get free, personalized account messages in real-time via:

- Phone Call

- Push Notifications

Security & Controls

How We Keep Your Crypto Safe

Fireblocks Partnership

We’ve partnered with Fireblocks– a trusted custody management platform that many top crypto companies rely on for the safe, secure transfer of collateral assets– and are excited about their approach to MPC technology primarily because it means enhanced security for you as well as faster transactions for both SALT and our customers.

Insurance

Similar to Fireblocks, SALT maintains Cyber Insurance, meaning the company will be covered in the event of cyber-related incidents (e.g. cyber breaches, cyber extortion, technology errors or failures, loss of data assets, etc.) as well as theft of crypto assets resulting from such incidents. Fireblocks’ eCrime Event coverage also covers assets in transit.

Custody Agnostic

We recently announced our new custody agnostic approach, which allows us to distribute risk, enhance security, reduce interest rates, fund loans more swiftly, and focus on expanding our suite of wealth preservation products.

Reliable Access to Assets

Our custody process and custody partners, like Fireblocks, require multi-user authorization, meaning that access to your assets never hinges on one individual.

We offer email support during normal business hours.

On average, customers have rated our service at 97% satisfaction.

On average, customers have rated our service at 97% satisfaction.

Don’t just take our word for it,

see what others are saying

"My SALT loans are helping me accomplish my mining goals. We utilized some of the cash flow to add mining equipment at a critical time. By taking out a loan with SALT, we're able to have our cake and eat it, too."

Bill L.

Loan Holder

"It’s extremely easy to apply for a loan. The platform is simple. It’s clean, and there’s not a lot of jargon to comb through, which makes it significantly easier to go through the loan process."

Justin P.

Loan Holder

"I am extremely pleased with the support I got. They put an extra effort in to help me get the answers I wanted. I can surely work with a company with such great client service."

Reginald H.

Platform User