Until recently SALT Lending has been operating in 15 U.S. jurisdictions, as well as New Zealand and the United Kingdom. Our active pursuit of additional opportunities to enable our members has paid off. We are proud to announce the addition of 20 new jurisdictions in the United States in which we can expand our operation for a total of 35. Effectively we’ve broadened our reach by 60%. As our growth continues, we anticipate making additional announcements about where we will be operating. For today, we are pleased to service an abundance of new member applications.

Our operational intent in new jurisdictions available for both businesses and individuals includes a total of 13 U.S. states. Previously SALT was present in 5 U.S. states including Alabama, Alaska, Colorado, Georgia, and Kentucky. SALT is now set up in an additional 9 U.S. jurisdictions which include Connecticut, District of Columbia, Florida, Illinois, Kansas, New Hampshire, North Carolina, Ohio, and Oklahoma. Alabama has joined the list of business-only jurisdictions.

SALT’s operations focused solely on business loans will also expand. Previously SALT’s business-only loan operations included Delaware, Kansas, Mississippi, Missouri, New Hampshire, New Mexico, North Carolina, South Carolina, Oklahoma, and Wyoming. Luckily four of these are areas that have moved to the list for both business and individual operations. These include: Kansas, New Hampshire, North Carolina, and Oklahoma. Business-only jurisdictions now include 22 areas. The newly added states are: Alabama, Idaho, Indiana, Iowa, Louisiana, Maine, Maryland, Michigan, Nebraska, Rhode Island, Tennessee, Texas, Vermont, Virginia, West Virginia, and Wisconsin.

We are currently engaging with members who previously submitted loan inquiries and reside in areas in which we did not previously operate. We wish to thank you for holding and waiting until this time and encourage you to submit your loan inquiries for our review.

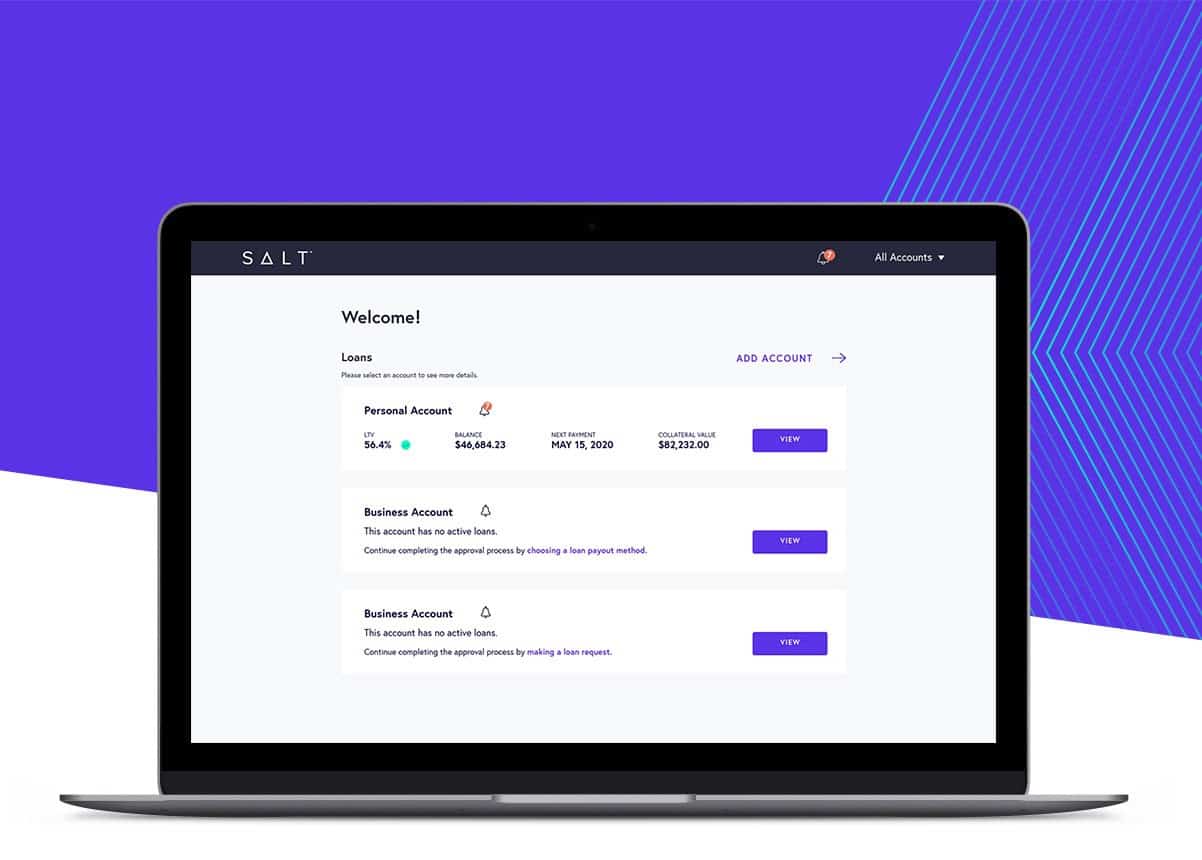

In the meantime, new member applications will be accepted at the upgraded member portal. Those with a previous membership that have not yet reestablished their account on the new platform are advised to do this as soon as they receive email confirmation that their account has been triggered. After this process has been completed, members will have the opportunity to check out minimum requirements in specific jurisdictions, use tools associated with the Proof of Access (POA) program and review their fresh new personalized dashboard for more membership detail.