While the world’s fiat currencies suffer from inflation as governments print more money to manage the COVID-19 crisis, Bitcoin, by design, is becoming more deflationary with each block confirmation. This is because Bitcoin creator Satoshi Nakamoto intended for Bitcoin to be the antithesis of government-controlled fiat currencies: “The root problem with conventional currency is all the trust that’s required to make it work,” wrote Satoshi in a post on the P2P Foundation Forum, “The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” In the post, dated February 11, 2009, Satoshi announces the creation of Bitcoin (along with a link to the earlier published white paper) and details its characteristics that make it anything but conventional. Among these characteristics is the fact that “everything is based on crypto proof instead of trust.”

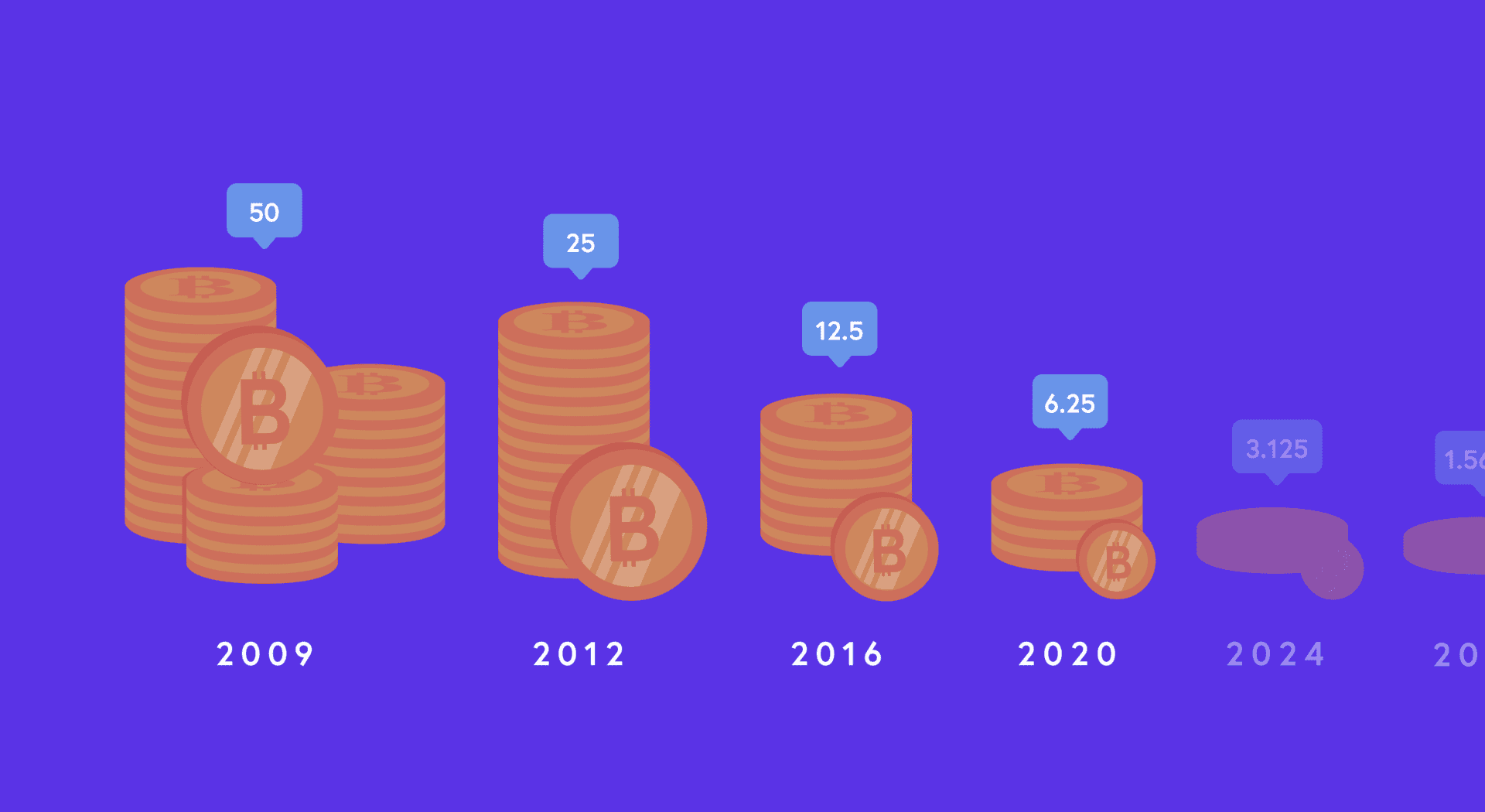

In creating Bitcoin as a decentralized, trustless system, Satoshi ensured that it could not fall victim to the “breaches of trust” and inflation experienced throughout the history of fiat currencies. Unlike fiat currencies that are controlled and manipulated by governments and central authorities, Bitcoin follows a strict set of rules that have been embedded into its codebase or “monetary policy” since its inception. These rules include a hard supply limit of 21 million coins, the last of which will be mined around the year 2140. Currently, more than 87 percent of the 21 million bitcoin have been mined, meaning there are approximately 3 million remaining coins to be mined over the course of the next 120 years. The speed at which new bitcoin is mined and distributed is controlled by 30 precoded “halving” or “halvening” events (our Twitter followers prefer “halving”, so we’ll go with that from now on) that will take place every 210,000 blocks or about every four years until the last bitcoin is mined. In 2008 the block reward for miners was 50 newly minted bitcoin for each validated block. Following the first halving event in 2012, the block reward reduced by 50 percent to 25 bitcoin per validated block and then reduced by another 50 percent to 12.5 bitcoin following the second halving event in 2016. 2020 marks the year for the third halving event in which the block reward will be reduced to 6.25 bitcoin per validated block.

While we don’t know the exact date of the halving event (more on this below), we know it is fast approaching and is set to occur sometime this month. There’s been a lot of anticipatory chatter about the halving as people question and speculate on how it will (or will not) impact everything from the price of bitcoin to profitability and participation of miners in the network.

We’ve compiled what we consider to be the best available resources for understanding the Bitcoin 2020 Halving event and answering some of the most common questions around it.

When will the halving occur?

The answer to this question is contingent on the speed at which new blocks are created. Given the average block time is around 10 minutes and a halving event takes place every 210,000 blocks, the halving is estimated to occur on or around May 11. While there are various countdown resources that estimate within a day of one another, our favorites are the Bitcoin Halving Countdown from CoinMarketCap and the Bitcoin Clock, which “uses data from BTC.com to get the average block time for the past two months. It then uses this block time (currently 10.3125 minutes between blocks as of March 25, 2020) to estimate the halving date.”

Tell me more about the halving. What is it exactly? What is the intention behind it?

Whether you’re new to crypto or you’ve been in the game for years, we can all use a bit of a refresher when it comes to the halving event. If you’re new to crypto, we recommend starting with this video from We Use Coins regarding the need for Bitcoin and this video from CryptoCasey, which provides a straightforward explanation of blockchain technology, mining, and the upcoming bitcoin halving event. For a more humorous take on the benefits of “the currency of the future,” check out this video from Cameralla Comedy.

Running short on time? Try this episode of the 4-Minute Crypto Show, which offers a speedy, yet thorough explanation of halving events.

If you’re already familiar with the crypto basics and want more detail on the halving, this article from CoinDesk is an excellent resource. Not only does it include an illustrative explainer video that breaks down and simplifies the process, but the article also dives into:

- the economic reasoning behind Satoshi’s decision to build the halving events into Bitcoin’s code

- how Bitcoin’s monetary policy differs from that of modern financial systems where central banks control the money supply

- the email in which Satoshi Nakamoto shares his thoughts on Bitcoin’s monetary policy and how it may play out in the future

- how the halving event will impact miners

- the history of bitcoin halving events and theories around how the 2020 event will impact the price of the asset

For additional info on previous halving events and miners’ roles in the network, Michael Sweeney from The Block provides a solid explanation in his analysis, “The bitcoin halving: what it is and why it matters.”

Interested in learning more about the economics behind Bitcoin’s monetary policy? Take a look at this article from The Block’s Mike Orcutt or this guide from Block Geeks that provides a crash course on supply and demand, inflation, deflation, and market cap as it relates to bitcoin, as well as how incentivization for miners fits into the equation. Or if you really want to get into it, Bitcoin Magazine’s Peter C. Earle explains why the 2020 halving is particularly important. He calls out the difference between the old and modern definitions of inflation, noting that in the context of the modern definition which refers to “an increase in general price levels within an economy,” the fact that “with increasing value one bitcoin buys more over time, it is indisputably deflationary.”

“What’s noteworthy about this point, Earle writes, “is that, upon this particular halving, Bitcoin ‘inflating’ at a roughly 1.8 percent rate annually will nominally — and by then, quite possibly in real terms — be ‘inflating’ at a rate lower than both the Federal Reserve target of 2 percent per year and current, CPI-based estimates of real U.S. inflation of 1.9 percent annually.”

Tell me more about the miners. How will it impact who is currently mining and who will continue to profit? Will the halving result in mining eventually becoming monopolized?

Andreas Antonopoulos tackles these questions in this short video clip and notes that we don’t need to be concerned about the monopolization of mining because the amount of profit a miner generates is not contingent on the size of their mining facility but on the smoothness of their mining operation. So while there are multiple factors that play into whether a mining operation is profitable, larger operations do not necessarily have an advantage over smaller ones. Rather, it’s all about efficiency. “Halving will increase competition in mining,” he says, and in general it will be the least efficient miners that become less profitable.

Similarly, in an interview with Anthony Pompliano the CEO of Blockware Solutions Matt D’Souza states, “The efficient miner should not fear the halving, they should welcome it.” Why? D’Souza notes that “once we go through halving the miners’ revenue is going to get slashed in half” and we’re going to experience what he considers to be “a healthy cleanse of the network.” He predicts that if the bitcoin price is still at $8k or lower going into the halving, we may experience “extreme miner capitulation” where we may see up to 40 percent of the network shutting off due to high energy costs and reliance on outdated mining equipment. He notes that as these inefficient miners begin to pull out of the network following the halving, there will be an adjustment period from May to July as the network undergoes these changes. At that point, difficulty will kick in and margins will improve for those miners who are still in the game. “Mining is about survivability,” says D’Souza, “You just need to survive. If you survive, difficulty will adjust in the future and it’s going to improve your margins because the people that are inefficient… their bitcoin is going to go to you.”

What happens to miners once all of the bitcoin has been mined and there are no more block rewards?

After the final halving event takes place and the 21 millionth bitcoin is mined sometime in 2140 miners will no longer receive block rewards, but they will still collect transaction fees just as they do currently. While we don’t know for sure how miners will react once we reach this point, according to Adam Barone in his article published on Investopedia, “Even when the last bitcoin has been produced, miners will likely continue to actively and competitively participate and validate new transactions. The reason is that every bitcoin transaction has a small transaction fee attached to it. These fees, while today representing a few hundred dollars per block, could potentially rise to many thousands of dollars or more per block as the number of transactions on the blockchain grows and as the price of a bitcoin rises. Ultimately, it will function like a closed economy where transaction fees are assessed much like taxes.”

What about the bitcoin price? How will it be impacted by the halving event?

The short answer is that there is no shortage of predictions.*

To quote Antonopoulos regarding his thoughts on price predictions: “I think it’s mostly irresponsible to make predictions about price. It’s the same as astrology and reading tea leaves.” While we agree with him on this sentiment, many people in the cryptosphere have openly made predictions about what will happen to the price of bitcoin following the 2020 halving. So, if you’re one for speculation or you just find it fun to read about people’s theories and want to be aware of what some of the most well-known people in the industry are saying, here are a few links for you to check out:

- Kitco News (interview): Anthony Pompliano says get ready for the bitcoin halving and price escalation to $100k

- Crypto New Alerts (podcast): 182: Bitcoin Price Is Likely to Plunge to $1K, Says Silk Road Founder | BTC Halving 2020 Countdown (this is the Medium Post referenced by this podcast: Bitcoin by Ross #9: A Strong Signal for Lower Prices)

- CoinDesk (article): How Financial Models Could Move Bitcoin’s Price After the Halving

- Forbes (article): Binance CEO Makes Rare Price Prediction — Says This Is When To Buy Bitcoin

- CoinDesk (podcast): Bitcoin Halving 2020: How Miners Expect the Crypto Markets to React

How can I watch the halving event?

For the previous halvings, it was fairly common for people to throw watch parties to celebrate the halving event. Now with current social distancing measures in place, in-person parties are being replaced by live streams. Our pick for how to watch and celebrate the 2020 Halving is Bitcoin Magazine’s 21-hour Live Stream for which they’ll be sharing updates across their social channels regarding exact timing, but you can track their countdown here.

*This content is meant to educate and inform but should not be taken as financial or investment advice. Trading and investing in cryptocurrencies (also called digital or virtual currencies, cryptoassets, altcoins and so on) involves substantial risk of loss and is not suitable for every investor.