The history of Bitcoin-backed lending has been turbulent, shaped by the boom and bust of early players in the space. A handful of companies captured the attention of borrowers, through unsustainable borrow and yield rates as well as the promise of being safer than a bank. They all eventually succumbed to risky collateral management practices and a lack of transparency, leading to significant losses for customers. Others exploded onto the scene and then wilted under the pressure to comply with US regulations. These failures highlight the need for a better approach—one that prioritizes security, transparency, regulatory compliance and customer protection, above all else.

As the original Bitcoin-backed lender since 2016, we’ve encountered and overcome our own challenges along the way, we’re still here, standing tall and proud of all we’ve accomplished so far. On top of being a Licensed Money Services Business (MSB) registered with FinCEN and fully compliant with BSA regulations, we’ve partnered with premier capital and custody partners like BitGo to build the premier financial services platform for Bitcoin holders. SALT is committed to building a better and safer future for Bitcoin-backed lending – and we’re not slowing down.

By leveraging innovative custody solutions and emphasizing borrower security, we offer a regulatory-compliant and fine-tuned model that keeps your Bitcoin safe while allowing you to access liquidity and (Saylor’s Rule #20) never sell. Whether you’re a seasoned Bitcoin hodler or new to the wild world of crypto-backed loans, our market-tested and proven approach ensures that your assets are protected and your ownership is secure for the long term.

The SALT Difference: Security, Transparency, and Innovation

- Security through Partnership with BitGo

- SALT’s Innovative features: Stabilization and beyond

- Why SALT? Longevity and Risk-Averse Management of Collateral

SALT’s model is built on a partnership with BitGo, a leader in digital asset security and financial services. Through this collaboration, SALT ensures that your Bitcoin is held in one of the most trusted custody solutions available today. BitGo’s multi-signature wallet technology and cold storage capabilities safeguard your assets against operational and external threats, ensuring that your collateral is secure.

BitGo has been at the forefront of crypto security since its founding in 2013. Today, BitGo Trust Company provides fully regulated, qualified custody, giving SALT the ability to offer a secure, compliant solution for Bitcoin-backed lending. By integrating BitGo’s custody infrastructure, SALT reduces the risks of loss or theft and ensures that borrowers’ assets are always protected.

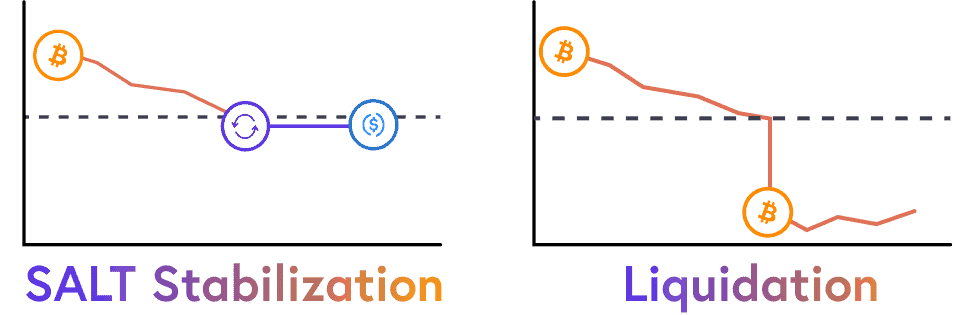

One of the key issues in Bitcoin-backed lending has been the forced selling of collateral during market downturns. Historically, due to the nature of the 24/7 Bitcoin marketplace, we see a slow grinding price decline followed by a steep price decline during periods of low liquidity. The sale of collateral during a market downturn can lead to a significant loss in the amount of collateral used to back the loan, as well as a taxable event for the customer.

SALT pioneered a solution that can significantly reduce the amount of collateral lost during a market downturn. SALT’s Stabilization product offers customers the flexibility to decide when to respond to a margin call by converting the Bitcoin held as collateral to stablecoin when certain loan-to-value thresholds are reached. The customer can then decide their next move, empowering them with control during market fluctuations. In a scenario where the market recovers 20% prior to conversion, customers that decide to convert the stablecoin back into BTC see a savings of 78% in the amount of collateral versus the traditional liquidation offering used by others in the space.

But the innovation doesn’t stop there. Every Bitcoiner’s investment thesis typically revolves around the belief that Bitcoin will significantly increase in value over time, and we are currently developing further pioneering solutions that seek to eliminate the risk of the sale of collateral due to temporary drops in Bitcoin’s price. Stay tuned!

We understand that your Bitcoin is more than just an asset—it’s part of your long-term financial plan. That’s why SALT employs a risk-averse management strategy that prioritizes security and stability. We do not engage in high-risk practices such as re-lending your Bitcoin to third parties or investing in speculative ventures. Instead, we focus on protecting your collateral while making it simple and straightforward to engage with our products, our mobile-friendly tools, and our experienced support team.

SALT offers some of the most competitive interest rates in the Bitcoin-backed lending space, rivaling even traditional financial institutions, because we’ve been providing Bitcoin backed loans for 8 years now and over that time we’ve built trusted relationships with multiple capital providers.

SALT has immense jurisdictional coverage in the US and abroad, meaning we can originate, fund, and service loans in nearly all 50 US states, under the jurisdiction of the Treasury Department. As pioneers of this space, we’ve developed several winning tools, strategies, and partnerships that allow us to offer our customers the most protection while providing the best rates and terms. For a more comprehensive look at how we stack up to others like LEDN, Figure, and Unchained, see here.

SALT’s approach to responsible lending has led to sustained growth year over year. Q3 2024 marked our best quarter to date for loan originations, highlighting the trust borrowers place in our model. As we continue to grow, our focus remains on providing the safest, most transparent Bitcoin-backed lending solution in the market.

SALT’s approach to responsible lending has led to sustained growth year over year. Q3 2024 marked our best quarter to date for loan originations, highlighting the trust borrowers place in our model. As we continue to grow, our focus remains on providing the safest, most transparent Bitcoin-backed lending solution in the market.

A Vision for the Future of Bitcoin-Backed Lending

The future of Bitcoin-backed lending lies in secure, transparent, and borrower-friendly practices. At SALT, we’re still leading the charge with innovative solutions that protect borrowers from market volatility, distribute risk through trusted partners like BitGo, and ensure that your Bitcoin remains under your control.

In an industry where trust is paramount, SALT is paving the way for a safer, more secure method of unlocking the value of your Bitcoin without compromising security or transparency. As the industry evolves, SALT remains committed to being a leader in responsible, risk-averse lending practices that protect borrower collateral while offering the best tools and rates, so that Bitcoin as “pristine collateral” can benefit more hodlers. We’re a group of Bitcoiners and our goal is to help other Bitcoiners find refuge from fiat debasement and preserve their wealth, yet still have a trusted partner they can lean on when life calls, so they (Saylor’s Rule #20 again) never have to sell!

And finally, what would this lengthy piece be without a bit of forward looking excitement to get pumped up about?! SALT has pioneered Lending as a Service tools which bring our simple secure Bitcoin backed lending experiences to 3rd parties who want to offer these services to their users, using industry standard REST APIs. For more information, click here.

About BitGo

BitGo provides secure, scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and institutions. Founded in 2013, BitGo pioneered multi-signature wallet technology and has since expanded to offer a full suite of services, including regulated cold storage and digital asset liquidity solutions.

Today, BitGo safeguards over 800 digital tokens across a wide variety of blockchains, serving more than 1,500 institutional clients globally. As SALT’s primary capital and custody partner, BitGo plays a critical role in ensuring the safety and security of our borrowers’ collateral.