There are a lot of loan offerings out there for blockchain assets, but none of them are quite like SALT.

Let us tell you why.

At SALT our guiding principle is to put you first — and that means offering more than just Blockchain-Backed Loans™. We strive to offer the highest level of service and security because we’re committed not only to helping you make the most of your digital assets, but to helping you keep them safe.

Here are a few ways we’re staying true to that commitment through our offerings.

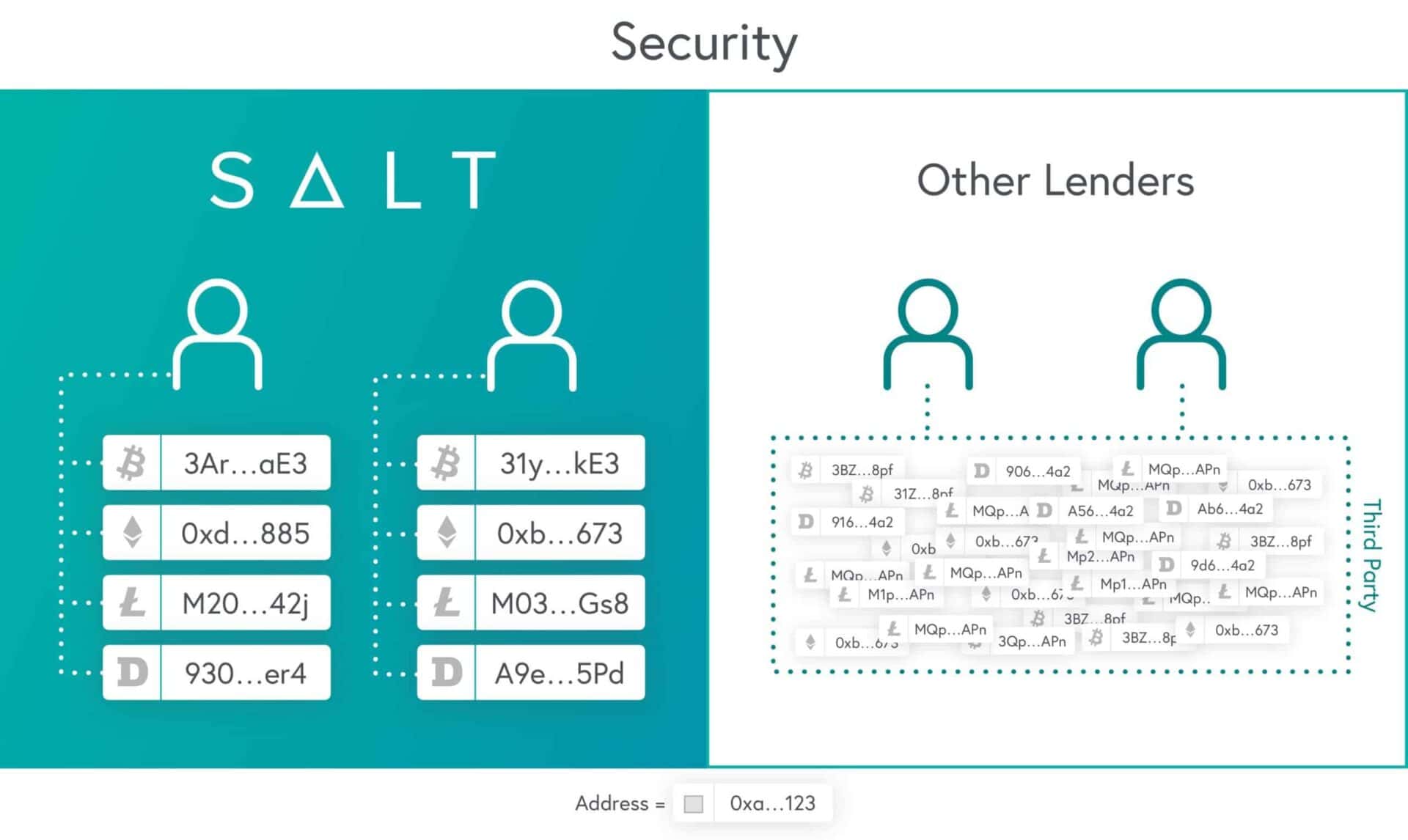

Security is imperative when it comes to maintaining safe custody of your assets and it’s a top priority at SALT. Here are just a few features we have developed to ensure the safety of you and your assets:

· Offline storage and generation of all platform wallet keys — plus, our key management controls are CryptoCurrency Security Standards (CCSS) compliant

· Multi-signature wallet protection — requires multiple independent signers to access funds

· Multi-factor enrollment required and user passwords protected by SHA256

· TLS (SSL) protection for all website traffic with industry-standard RSA 2018 encryption

· Ongoing third-party penetration testing and platform assessment

· Multiple layers of network and application firewalling

Aside from the above, one of the features that sets us apart from other lenders is that we don’t commingle your assets. Instead we create a unique multi-signature wallet for each of you, as well as for each individual collateral type you put onto the SALT platform — an added layer of security given your assets are never pooled with the rest of the user base.

What better way to track your assets than to know exactly where they stand?

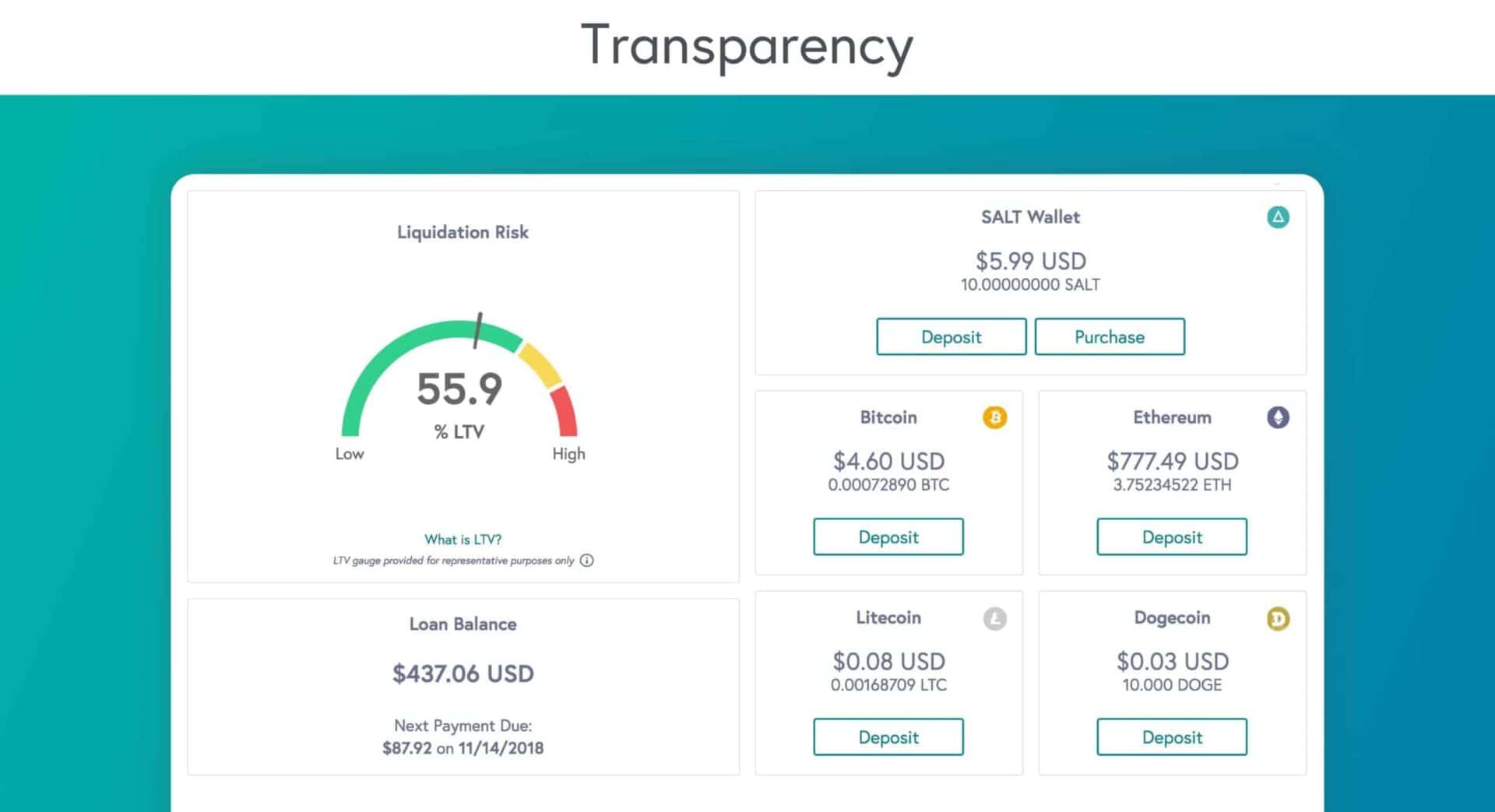

At SALT, we believe in transparency, which is why we’ve built technology that enables us to track the values of multiple collateral types from multiple exchanges by calculating the volume weighted average. With the ability to pull this data in near-real time, we can provide the most stable as possible price of your collateral to protect it in the event of an exchange experiencing issues. Because of this technology, we’ve also been able to develop a near real-time Loan-to-Value (LTV) monitoring system. These capabilities combined allow us to provide you with the information necessary for you to simultaneously track your loan health and portfolio value at any time. Even when you aren’t tracking these items on your own, our automated notification system helps keep you up-to-date via phone, text and email so you’re alerted if and when your collateral declines in value.

Additionally, as mentioned previously, we refrain from commingling your assets — a major benefit given you can rest assured that your assets aren’t being mixed in with anyone else’s and that they’re verifiable independent of the SALT platform.

We want to help you maximize the potential of your blockchain assets and work with you to accomplish your goals. Not only do we offer a quick, simple process for securing a loan, but we’re able to deposit funds into your account as quickly as you’re able to complete the loan process. Simply customize your loan options, apply for a loan, and then transfer your chosen collateral types to the SALT platform, and once your application is approved, we’ll drop the requested funds into your bank account.

Aside from a fast turnaround time and ease of use, there are a few other points to keep in mind about how we do (and don’t do) business.

We DO:

· Currently offer 4 collateral types — Bitcoin, Ethereum, Litecoin, and Dogecoin

· Offer the option to combine collateral types to secure a loan

· Offer flexible loan terms with a variety of APR and loan term duration options

· Lend in multiple jurisdictions around the world, with more expansions coming soon

· Help you secure the best loan terms for you depending on your location and needs

We DON’T:

· Charge origination fees

· Charge prepayment fees

· Run credit checks

· Commingle your assets

Navigating the lending landscape — whether it be in the traditional or blockchain sense — can be tricky and confusing, which is why we connect you with a dedicated professional throughout your entire journey with us.

Sign up – once you become a SALT member, we provide you with direct access to experts who can answer your questions and guide you through our platform and offerings — with offices in the Philippines, Mauritius, and Denver, we offer global support that you can either access online 24/7 or via phone during business hours

Borrow – once you become a SALT borrower, we assign a dedicated lending associate to each customer to guide them through the underwriting process; once the loan is funded we assign a Member Success Advocate to be your primary point of contact regarding your relationship with us

Once you sign up, we provide you with access to 24/7 online support followed by access to seasoned lending professionals and a dedicated underwriter throughout your entire journey with us from membership to borrowing. Whether you want to speak with someone via phone during business hours or access online support at any point in the week, you can take comfort in knowing there’s a person who’s dedicated to answering your questions quickly and personably.

At SALT, we operate with a customer-first mindset because you’re the reason we come to work each day. As we seek to add new collateral types, platform features, and lendable jurisdictions, we remain focused — focused on our vision, our contribution to the advancement of blockchain technology, and most importantly on our commitment to helping you unleash the power of your blockchain assets.

To stay in the loop about what’s new at SALT, follow us on Twitter, Facebook, LinkedIn or Telegram.

Sign up to receive updates and announcements from SALT.