When you apply for a traditional loan, the lender uses your credit score, as reported by third-party credit agencies, to determine your credit worthiness or financial “reputation.” The higher your credit score, the lower the risk. To offset your credit score or in some cases even completely remove it from the equation, you can apply for an asset-backed loan. With this type of loan, you can offer up your assets — anything from your house or car to your stock portfolio — as collateral to act as “insurance” for the lender. In asset-backed lending, borrowers typically secure loans for an amount that’s less than the total value of the collateral.

The measurement of the balance of the loan relative to the value of the collateral asset is represented as loan-to-value or LTV. For example, you may have a loan for $320,000 for a home that is valued at $400,000, in which case your loan is 80% of the total value of the home.

As an asset-backed lender, one of the things that makes SALT unique is that we don’t even look at your credit score. With a SALT loan when you have collateral — whether you’re unbanked, haven’t accumulated credit, or have poor credit — you can still get a loan. Instead, SALT uses loan-to-value of your collateral to assign risk. As LTV is a measure of risk, the lower the LTV, the lower the risk for the lender (and therefore the lower the interest rate for the borrower).

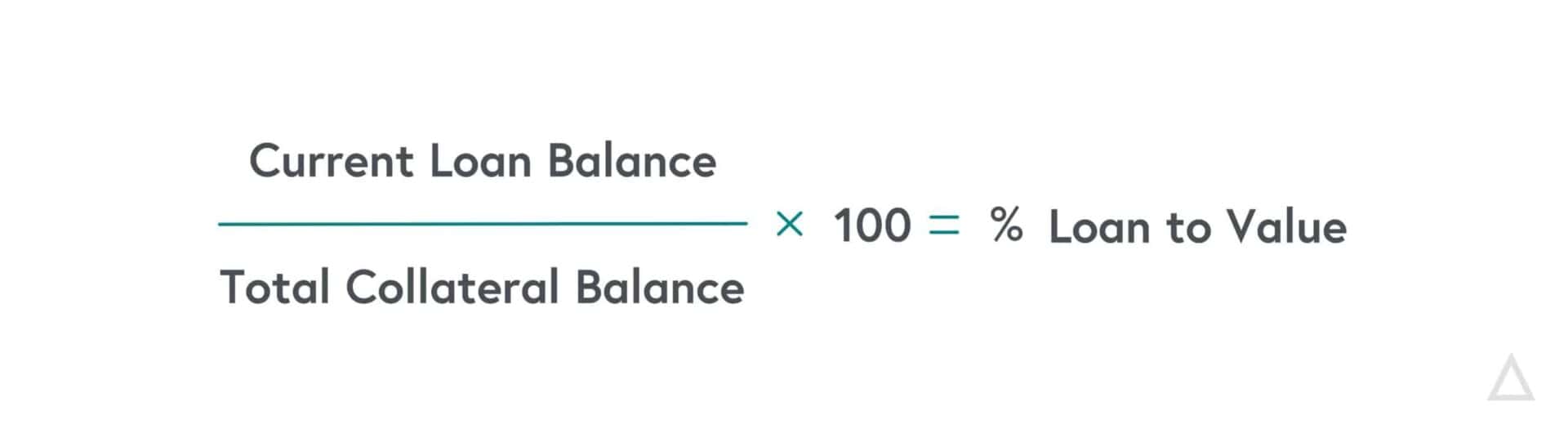

How is LTV calculated?

Good question.

LTV is calculated as the loan amount in USD divided by the value of the collateral in USD, expressed as a percentage.

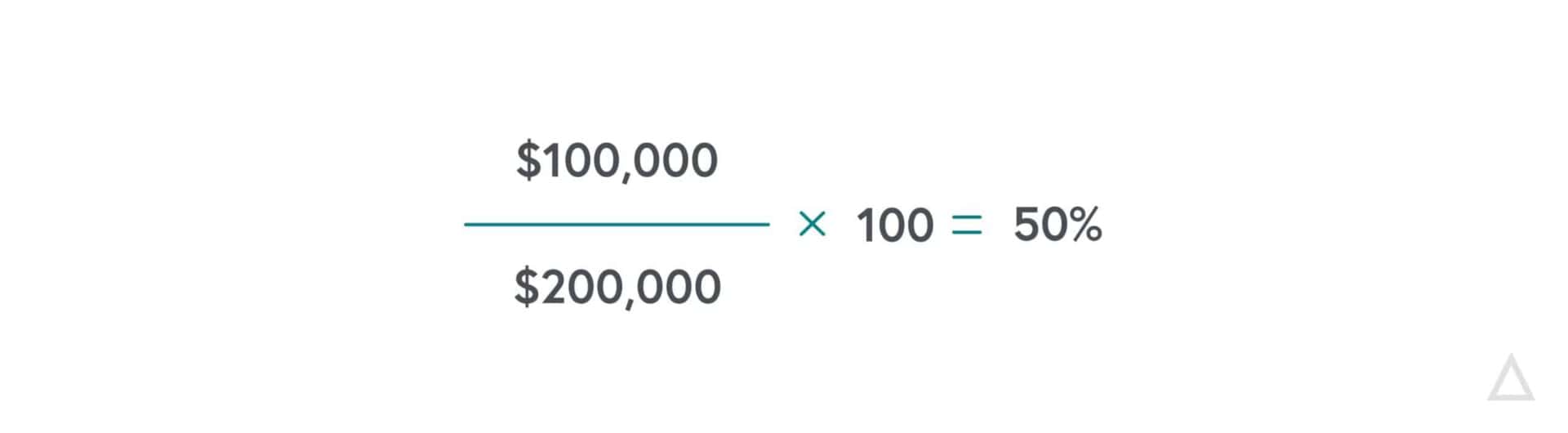

As an example, if you have a current loan balance of $100,000 and your total collateral asset balance is $200,000, you have an LTV of 50%. To make things easier, we’ve added an LTV Helper to the borrower portal that illustrates exactly how the LTV is calculated. See below.

Understanding LTV and how it’s calculated is essential to making an informed decision about your loan terms. Liquidation events benefit no one, which is why we provide the tools like our automated notification system to help you avoid them. Before you apply for a loan, you should ask yourself:

- How much do I need?

- How much total crypto do I have?

- Am I prepared to deposit more crypto if necessary to lower my LTV?

Once you answer these questions, you can choose the LTV that’s right for you.

Starting LTV

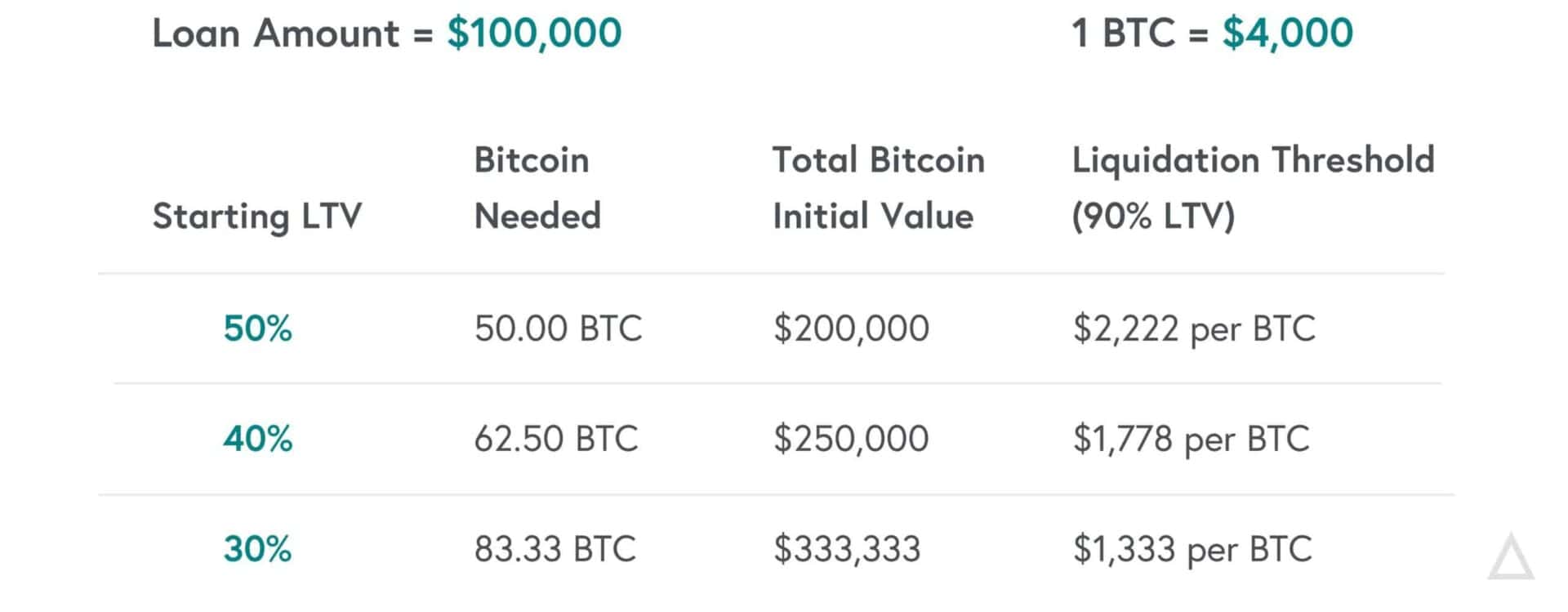

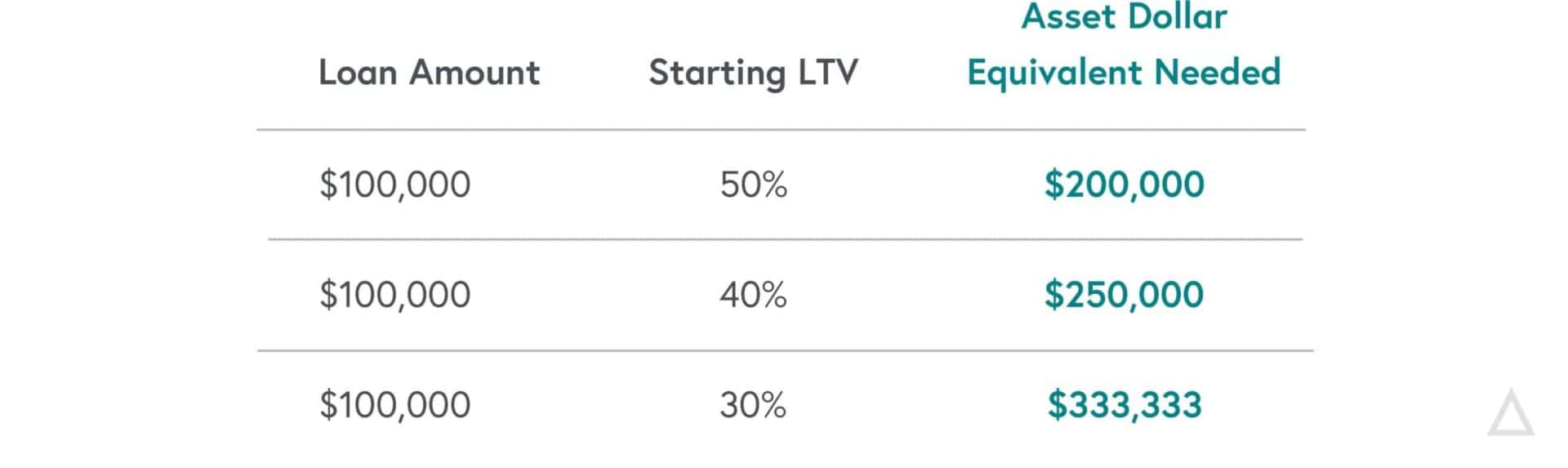

When you are taking out a loan against your crypto assets with SALT, you presently have 3 options for your starting LTV; 30%, 40% and 50%. The starting LTV will determine approximately how much (in terms of dollars) of the crypto asset you will need for that loan.

From the example above, for a $100,000 loan, you would need $200,000 in Bitcoin, Ether, Doge, or Litecoin to secure the 50% LTV loan option. For a 40% LTV, it would be $250,000 and for 30% LTV, it would be approximately $333,333.

Using LTV as a measure of risk, the 30% LTV option is the lowest risk.

Why is a lower LTV seen as less risk?

As the LTV goes up, the value of the underlying asset goes down. In the case of a crypto asset-backed loan, the value of Bitcoin, Ether, Litecoin, or Doge is trending down.

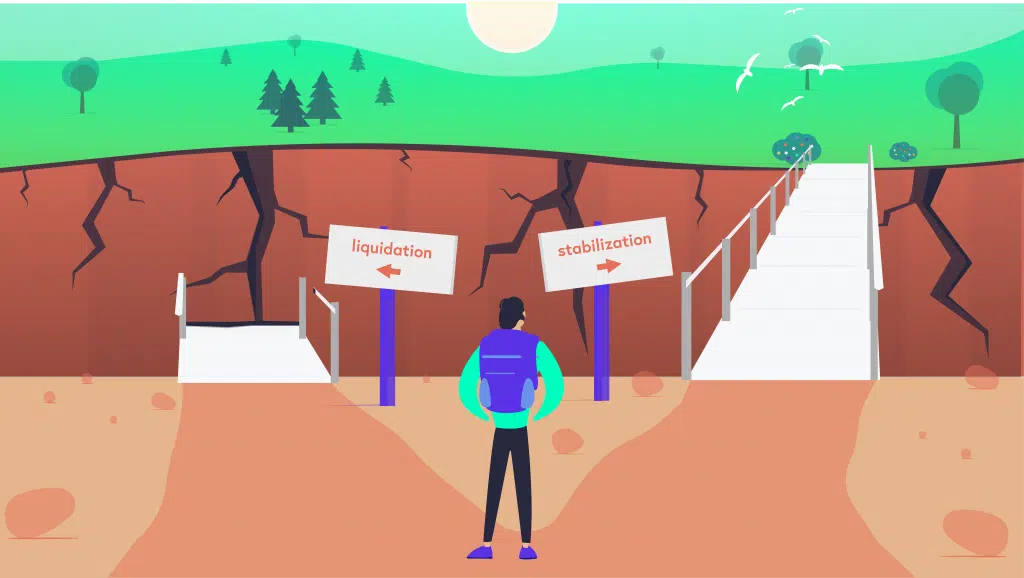

If the price of the crypto asset falls too low, the LTV will continue to increase. As it approaches 100%, there is a threshold where the collateralized asset will be sold to pay back the loan. This is known as the liquidation threshold. This threshold can vary from business to business and loan to loan.

For our example, let’s say the liquidation threshold is set to a 90% LTV.

When the LTV ratio reaches 90%, the crypto asset will be sold to reduce the LTV back down.

Timeout. Liquidations!?!

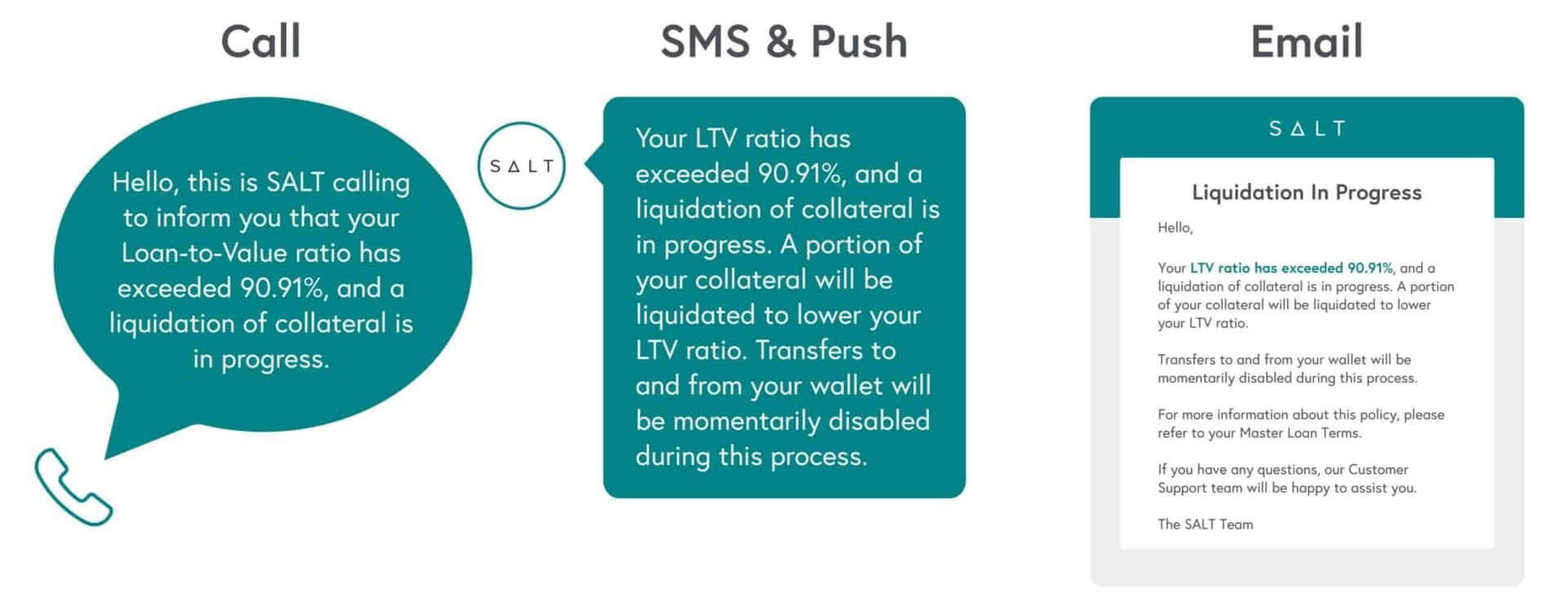

At SALT, we pride ourselves in having a robust notification system that relays important account activity to borrowers via our portal, text, phone calls, and emails. We give you control of how you want to be notified about each activity. You can be notified of everything from deposits and withdrawals to LTV warning thresholds.

As a borrower, you always have the option to transfer more collateral at any time.

Back to LTVs.

Why does this matter?

As you might be aware, the price of Bitcoin (or any crypto asset) can move up and down. As the price moves up, your LTV goes down. As the price moves down, your LTV goes up.

To build on our earlier example of a $100,000 loan with a 50% LTV, let’s use Bitcoin as the underlying crypto asset. In this example, let’s use $4,000 as the US dollar price of 1 Bitcoin.

Loan Amount = $100,000

Starting LTV = 50%

Price of 1 Bitcoin = $4,000

Doing the math $200,000/$4,000, you would need approximately 50.00 BTC to get a $100,000 loan with a 50% starting LTV.

Bringing it all together!

From above, assuming the liquidation threshold is set at 90% LTV, the price of 1 Bitcoin would need to go all the way down to approximately $2,222 to raise the LTV up to the liquidation threshold of 90% LTV.

A $100,000 loan with a starting LTV of 40%, would require 62.50 BTC at a price of $4,000 per Bitcoin. However, the 90% liquidation threshold would not be reached until the price of 1 Bitcoin went down to approximately $1,778.

Repeating the example with a 30% LTV, you would need 83.33 BTC at a price of $4,000 per Bitcoin and would reach the 90% liquidation threshold when the price of 1 Bitcoin was approximately $1,333.