As the financial world continues to evolve, Bitcoin has emerged as a groundbreaking asset. It’s no longer just a digital currency; it’s a new paradigm for financial resilience, offering unique opportunities for institutions and individuals alike. Traditional reserves, consisting of commodities like oil, gold, or food, are increasingly being complemented or even replaced by Bitcoin, a digital asset with unique features that can provide long-term value.

SALT Lending: Bridging Bitcoin and Traditional Finance

Before diving into the broader concept of a Strategic Bitcoin Reserve, let’s briefly highlight the role of SALT Lending, an innovative company that is paving the way for Bitcoin to be used as a traditional financial tool.

The Role of SALT Lending: Unlocking the Potential of Bitcoin Reserves

While Bitcoin offers incredible potential as a reserve asset, it also comes with challenges, notably its volatility and the inability to tap into its liquidity without selling. This is where SALT Lending steps in.

SALT Lending is revolutionizing the way Bitcoin holders interact with their digital assets. By using Bitcoin as collateral, institutions and individuals can unlock liquidity without needing to sell their holdings. This model offers the perfect solution for those who wish to capitalize on the value of their Bitcoin without sacrificing long-term ownership.

SALT’s lending platform allows users to access cash loans against their Bitcoin reserves, providing them with the liquidity they need to operate in the traditional financial system, while still retaining ownership of their Bitcoin. It’s an innovative financial solution that connects the worlds of traditional finance and decentralized assets, allowing for greater financial flexibility and long-term strategic planning.

Bitcoin Reserves: A Modern Financial Evolution

The concept of reserve currency isn’t new, but Bitcoin is reshaping this traditional notion. Across the globe, forward-thinking companies, financial institutions, and even entire nations are incorporating Bitcoin into their reserve assets. This evolution is not just about diversification—it’s about adopting a proactive approach to long-term financial stability in a world where the conventional economic systems are increasingly volatile.

By leveraging Bitcoin as a reserve asset, companies and institutions can build financial resilience in the face of rising inflation, currency devaluation, and market instability. The value of Bitcoin lies not just in its scarcity but in its ability to function independently of traditional financial systems, creating a unique buffer against systemic risks.

Incorporating Bitcoin reserves is about more than just hedging against risk — it’s a strategic move to position oneself at the cutting edge of the financial evolution, ensuring long-term growth while navigating an increasingly complex global economy.

Why Bitcoin in Strategic Reserves?

Bitcoin’s appeal as a reserve asset is grounded in several unique attributes:

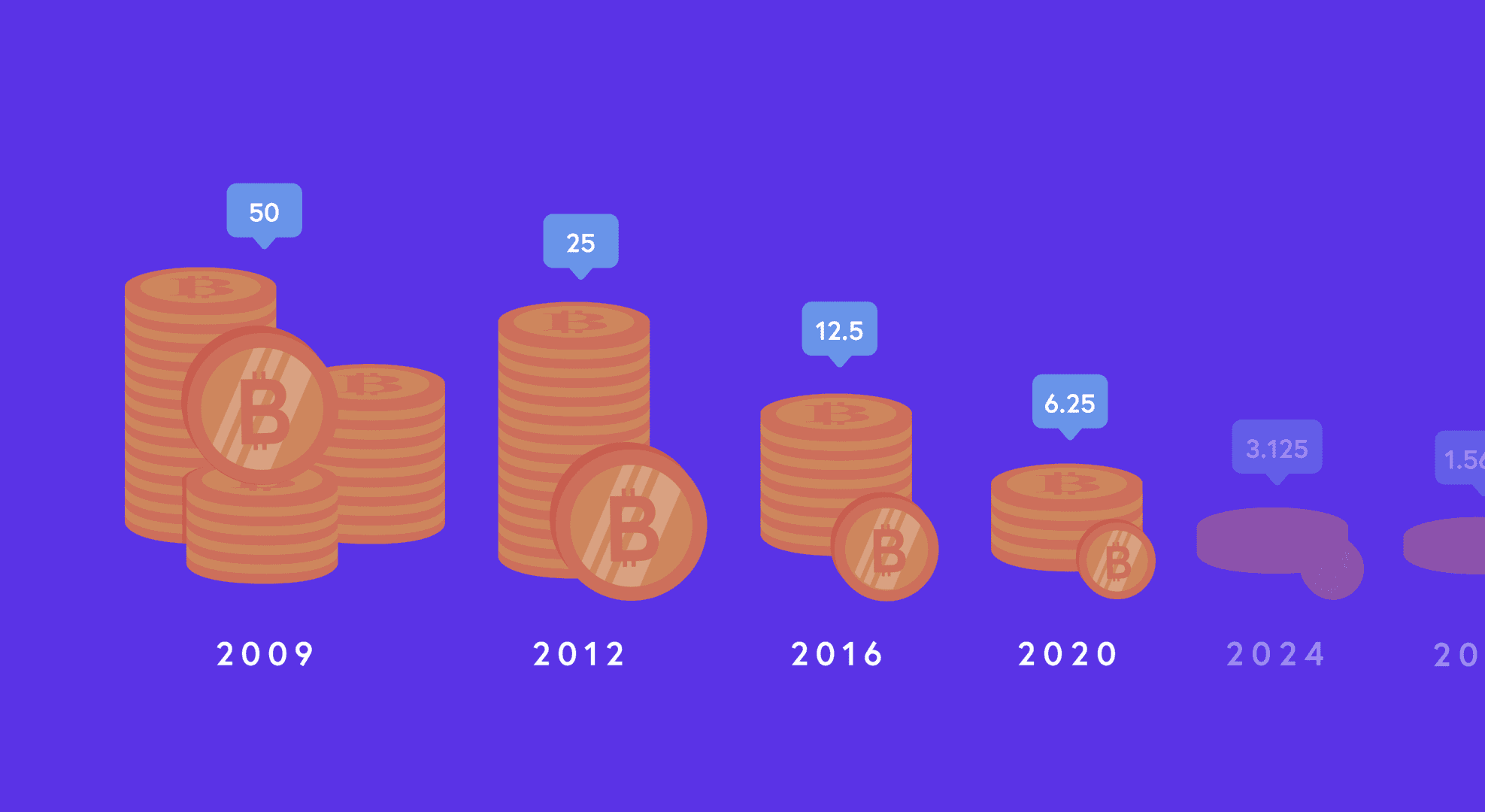

- Scarcity: With a maximum supply of 21 million coins, Bitcoin’s finite nature creates scarcity, an asset feature akin to precious metals like gold.

- Decentralization: Bitcoin operates outside traditional financial systems, providing immunity from manipulation and centralized control.

- Portability: Unlike physical assets, Bitcoin is easy to store and transfer, making it an ideal option for global reserves.

- Proven Growth: Over the past decade, Bitcoin has consistently appreciated, establishing itself as one of the most reliable growth assets.

While traditional reserves have long served to hedge against inflation and financial instability, Bitcoin’s characteristics offer a new dimension of stability and potential appreciation.

Bitcoin Volatility: Navigating Risks with Strategy

Bitcoin’s inherent volatility has been a point of contention for many traditional investors, but in reality, it’s this volatility that creates opportunity for those who are equipped with the right strategy. The fluctuations in Bitcoin’s price can be leveraged to unlock value, especially when institutions and businesses take a long-term view.

Rather than viewing Bitcoin’s price fluctuations as a risk, savvy institutions are seeing them as a chance to maximize value by using strategies that allow for flexibility and protection. SALT Lending, for example, offers a method to mitigate risk by providing liquidity without the need to liquidate Bitcoin holdings during downturns. This allows institutions to avoid panic selling and take advantage of potential future price surges.

By strategically utilizing Bitcoin as collateral, institutions can maintain liquidity while mitigating the risk of selling at the wrong moment. This approach ensures that their Bitcoin reserves are protected, while still enabling them to leverage the asset for growth.

The Bitcoin Act of 2024: The Path to Official Bitcoin Reserves

A pivotal development in the push to incorporate Bitcoin into national reserves is Senator Cynthia Lummis’ Bitcoin Act of 2024. This bill outlines the framework for the U.S. government to start accumulating Bitcoin in reserves, potentially acquiring up to 1,000,000 BTC over the next five years. The bill proposes that these holdings be stored in a decentralized manner across the country, ensuring security while providing transparency through regular audits.

Key provisions of the Act include:

- Minimum Holding Period: The Bitcoin cannot be sold or liquidated for 20 years, except for retiring federal debt.

- Audit & Transparency: Regular third-party audits to ensure full transparency, including detailed reports on how Bitcoin forks or airdrops are handled.

- State Involvement: U.S. states are invited to participate, enabling decentralized management and enhancing the resilience of local economies.

These provisions aim to build a stable, long-term financial buffer for the country, positioning Bitcoin as a hedge against inflation, national debt, and the vulnerabilities of fiat currencies.

Applications: How Bitcoin Reserves Can Shape the Future

Strategic Bitcoin reserves can serve as a valuable tool for institutions or nations grappling with the pressures of inflation and rising national debt. The U.S. national debt exceeds $36 trillion, with interest payments skyrocketing to over $1.6 billion daily. By holding Bitcoin as a reserve asset, nations could see a hedge against inflationary pressures that devalue fiat currencies over time.

For instance, Bitcoin’s proven ability to retain and grow in value outpaces the depreciation of traditional currencies, offering a shield against currency devaluation. Additionally, Bitcoin’s role as a store of value becomes increasingly important as governments and institutions look for alternatives to the traditional reserve system, especially amid economic instability.

Risks and Challenges to Strategic Bitcoin Reserves

Though the benefits of Bitcoin are clear, its incorporation into strategic reserves does not come without challenges:

- Volatility: Bitcoin’s notorious price fluctuations can create uncertainty in the short term. However, its long-term growth trajectory has proven more resilient, making it an attractive choice for long-term investment strategies.

- Regulatory Uncertainty: The regulatory environment surrounding Bitcoin remains fluid, with different jurisdictions developing their own rules. This uncertainty may pose challenges to broader adoption, particularly on a national scale.

- Security: Safeguarding Bitcoin holdings requires institutional-grade storage solutions, such as cold wallets or multi-signature accounts. Without proper custodial measures, Bitcoin reserves could be vulnerable to hacking or theft.

These risks must be mitigated through strategic planning, diversification, and the implementation of secure technologies.

Global Examples: Bitcoin’s Growing Role in Reserves

As Bitcoin continues to gain traction, several forward-thinking institutions and countries are leading the charge in embracing digital assets as part of their financial strategies. From nations like El Salvador, which has officially adopted Bitcoin as legal tender, to global banks like Intesa Sanpaolo, which have integrated Bitcoin and other cryptocurrencies into their portfolios, the momentum for Bitcoin adoption is undeniable.

Countries and institutions around the world are increasingly considering Bitcoin as part of their financial reserve strategies:

- El Salvador became the first nation to adopt Bitcoin as legal tender in 2021, with a current reserve of over 6,000 BTC. Their strategy has proven that Bitcoin can function as a reserve asset, generating wealth and financial stability for future generations.

- Intesa Sanpaolo, an Italian bank, made waves with a small purchase of 11 Bitcoin in January 2025. This purchase reflects growing institutional confidence in Bitcoin, signaling that it’s no longer just a speculative asset but a legitimate tool for treasury management.

These examples show that Bitcoin’s journey from a volatile digital asset to a cornerstone of national financial strategies is gaining momentum.

Practical Steps for Establishing a Bitcoin Reserve

For people interested in building a Bitcoin reserve, the process involves several steps:

- Define Objectives: Establish a clear purpose for Bitcoin holdings, focusing on long-term economic stability.

- Gradual Accumulation: Bitcoin should be purchased gradually to avoid market disruption, using trusted exchanges or over-the-counter (OTC) desks to minimize market impact.

- Secure Custody Solutions: Employ secure storage methods like cold wallets, multi-signature systems, or third-party custodians to safeguard assets.

- Compliance: Ensure adherence to local and international regulations, collaborating with policymakers to create a robust legal framework for Bitcoin reserves.

The Future of Bitcoin Reserves

Bitcoin’s integration into strategic reserves offers a promising path toward long-term financial resilience. Whether used by nations like El Salvador or by global banks like Intesa Sanpaolo, Bitcoin is proving to be more than just a speculative asset—it’s a vital tool for securing financial futures.

While the risks of volatility, regulatory uncertainty, and security remain, the benefits of Bitcoin’s inclusion in national reserves are clear. As more people adopt strategies for incorporating Bitcoin into their portfolios, its role as a hedge against inflation, a store of value, and a potential driver of economic growth will become more pronounced.

Bitcoin’s potential to reshape the global financial system is just beginning, and with a thoughtful, measured approach, it could serve as a cornerstone of future financial security.

SALT Lending’s Role in Financial Innovation

As Bitcoin continues to gain traction and its role in the global financial ecosystem solidifies, institutions need innovative solutions to unlock its potential without sacrificing its long-term value. SALT Lending provides just that, a platform where individuals, businesses and accredited investors can access liquidity, manage volatility, and maintain the integrity of their Bitcoin reserves.

With SALT Lending’s advanced solutions, businesses and individuals are empowered to navigate the future of finance with confidence. The ability to leverage Bitcoin as collateral while keeping its value intact allows institutions to maximize their financial strategy, ensuring that their Bitcoin reserves serve as a catalyst for long-term success.

As we progress through 2025, Bitcoin’s role in treasury management is poised to grow, driving the adoption of decentralized and forward-thinking financial solutions.

As Bitcoin continues to play a central role in shaping the future of finance, SALT Lending stands as a trusted partner in helping institutions realize the full potential of their digital assets, ensuring they are well-positioned for a decentralized and financially secure future.

Looking for a bitcoin-backed loan? Get started with a free SALT Lending account here.

Disclaimer: This content is for informational purposes only and should not be considered financial, legal, or investment advice. Always consult with a qualified financial advisor or professional before making any financial decisions or investments. Cryptocurrency investments carry significant risks, and past performance is not indicative of future results. Do your own research and consider your financial situation and goals before proceeding.