Bitcoin’s unique characteristics make it an appealing asset for a diverse range of people and organizations. Whether you’re an individual investor, a business owner, or a financial institution, setting up a private Bitcoin reserve could be a strategic way to protect your wealth and secure your financial future. Let’s break down who stands to benefit from holding Bitcoin as a private reserve and how you can get started.

1. Individual Investors Looking for Diversification

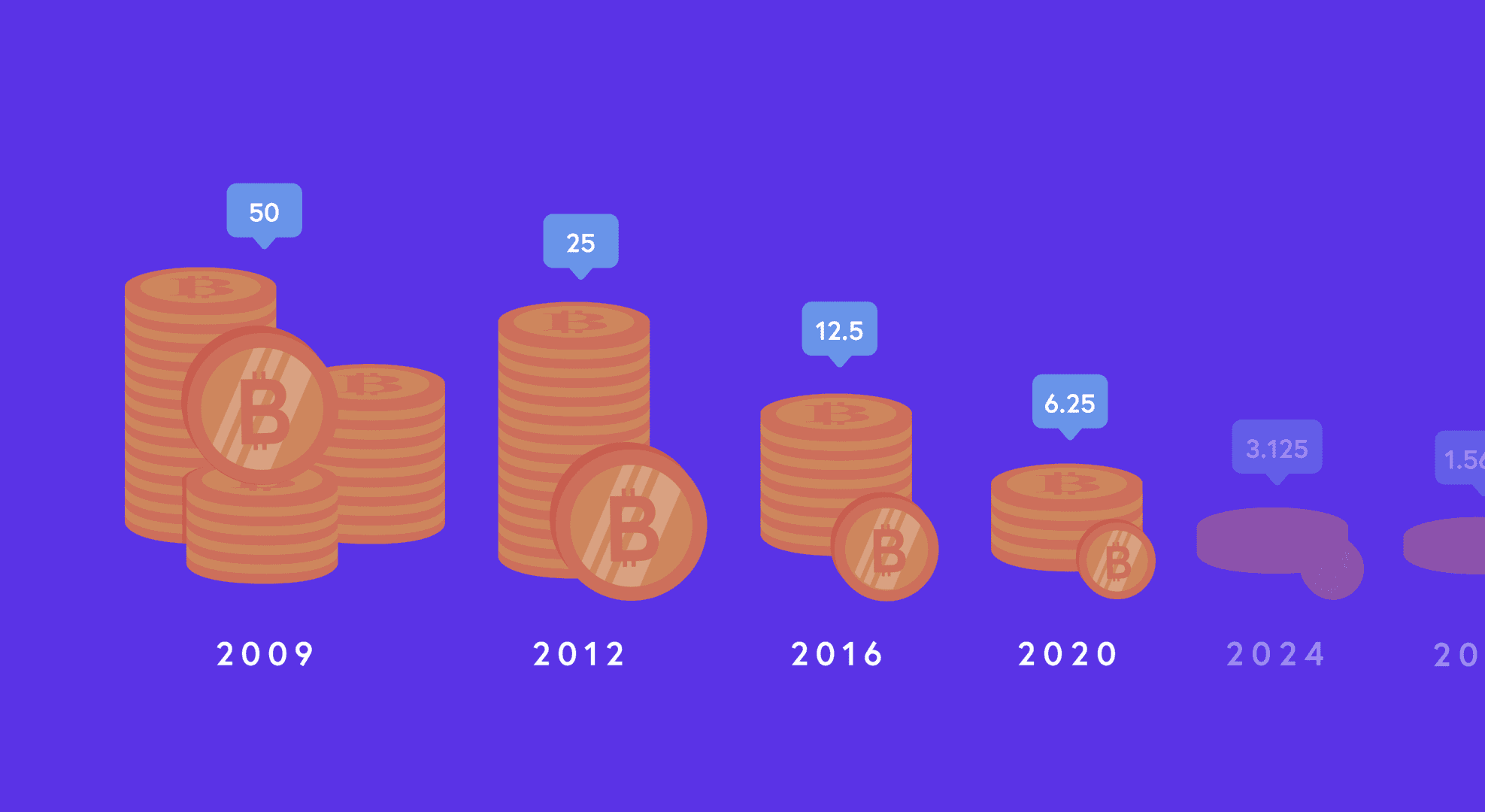

For individual investors, building a private Bitcoin reserve provides an opportunity to diversify away from traditional assets like stocks, bonds, and real estate. With Bitcoin’s limited supply and its increasing acceptance as a store of value, holding Bitcoin can help protect against the devaluation of fiat currencies. Investors can use Bitcoin as a hedge against inflation or as a way to secure a portion of their wealth outside the reach of centralized financial institutions.

How to Get Started:

- Create a secure wallet: The first step to building a Bitcoin reserve is setting up a secure wallet, either hot (internet-connected) or cold (offline storage), depending on your preferences for security and convenience.

- Purchase Bitcoin: After setting up your wallet, purchase Bitcoin through a reputable exchange or OTC (over-the-counter) service.

- Store securely: Once purchased, transfer your Bitcoin to your private wallet for safe storage.

SALT Lending: Getting More from Your Bitcoin

For individual investors who want more flexibility with their Bitcoin holdings, SALT Lending offers a solution that allows you to use your Bitcoin as collateral for a loan. This service enables you to keep your Bitcoin while still accessing the liquidity you may need. Whether for personal expenses or business needs, SALT Lending can help you use Bitcoin as an asset without the necessity to sell it.

How to Get Started with SALT Lending:

- Apply for a loan: After securing your Bitcoin reserve, you can apply to SALT Lending for a loan by using your Bitcoin as collateral.

- Receive a loan: Get access to cash or stablecoin loans with no need to liquidate your assets.

- Repay the loan: Enjoy flexible repayment terms based on the loan agreement.

This solution works especially well for those who want to avoid taxable events and still make the most out of their Bitcoin investment.

2. Businesses Seeking Financial Flexibility

Businesses can greatly benefit from holding Bitcoin in a private reserve, especially those looking to diversify their financial portfolios or tap into the growing crypto space. Bitcoin can act as a hedge against inflation, while also providing businesses with an alternative way to handle transactions, particularly in international markets. Many businesses are already incorporating Bitcoin as part of their treasury management, using it as a strategic reserve asset.

How to Get Started:

- Consult with financial advisors: Businesses should work with financial advisors familiar with cryptocurrencies to understand the risks and benefits.

- Set up a secure crypto wallet: For businesses, a multi-signature wallet (requiring multiple approvals for transactions) can provide additional security.

- Acquire Bitcoin: Businesses can acquire Bitcoin through exchanges, brokers, or direct sales.

- Integrate Bitcoin into treasury management: Businesses can use Bitcoin as part of their broader financial strategy, holding it as a reserve asset or leveraging it for payments and transactions.

SALT Lending: Helping Businesses Unlock Value

For businesses holding Bitcoin reserves, SALT Lending enables businesses to unlock the value of their crypto holdings without liquidating them. By using Bitcoin as collateral, businesses can secure financing or working capital, all while retaining their Bitcoin for future growth.

How to Get Started with SALT Lending for Businesses:

- Assess your collateral: Review your Bitcoin holdings and determine how much you’d like to use as collateral for a loan.

- Apply for a loan: Submit your loan application through SALT’s platform.

- Get funding: Once approved, receive funds to support your business while preserving your Bitcoin reserve.

For businesses in need of liquidity but reluctant to sell their Bitcoin, SALT Lending provides an invaluable tool to balance financial flexibility and long-term security.

3. High Net-Worth Individuals (HNWIs) and Family Offices

High net-worth individuals and family offices are always looking for innovative ways to protect and grow their wealth. Private Bitcoin reserves offer a high degree of security, liquidity, and privacy, making them an appealing option. For those looking to preserve wealth for future generations, Bitcoin’s growth potential and secure, decentralized nature can help protect assets in times of uncertainty. Moreover, Bitcoin’s accessibility allows HNWIs to have a flexible and portable store of value.

How to Get Started:

- Work with wealth managers: HNWIs may want to consult wealth managers who are familiar with cryptocurrency investments.

- Secure storage solutions: Consider using cold storage solutions, such as hardware wallets or even custodial services, for added security.

- Strategic allocation: Allocate a portion of your wealth to Bitcoin, balancing it with other assets to minimize risk while maximizing potential growth.

4. Crypto Enthusiasts and Long-Term HODLers

For crypto enthusiasts and long-term holders (often referred to as “Hodlers”), holding Bitcoin as a private reserve is a natural extension of their belief in the currency’s future. These individuals see Bitcoin not only as a speculative investment but as a fundamental shift in the global financial system. For them, Bitcoin is a way to retain full control over their assets while contributing to the growth of the decentralized economy.

How to Get Started:

- Start small: If you’re new to Bitcoin, start by acquiring a small amount and gradually increase your holdings over time.

- Focus on security: Given the volatility of crypto markets, ensure your Bitcoin is stored securely, either offline or through reputable exchanges with strong security measures.

- Be patient: The key to building a successful Bitcoin reserve is a long-term mindset. Bitcoin’s potential growth requires time, so be prepared for the ups and downs.

Get financial flexibility with a bitcoin reserve

Whether you’re an individual looking to protect your wealth or a business aiming for financial flexibility, private Bitcoin reserves offer a wealth of advantages. By providing a secure, decentralized store of value with long-term growth potential, Bitcoin is emerging as a strategic asset for those seeking financial security in an increasingly volatile world.

To get a bitcoin-backed loan, start with a free SALT account here.

Disclaimer: This content is for informational purposes only and should not be considered financial, legal, or investment advice. Always consult with a qualified financial advisor or professional before making any financial decisions or investments. Cryptocurrency investments carry significant risks, and past performance is not indicative of future results. Do your own research and consider your financial situation and goals before proceeding.