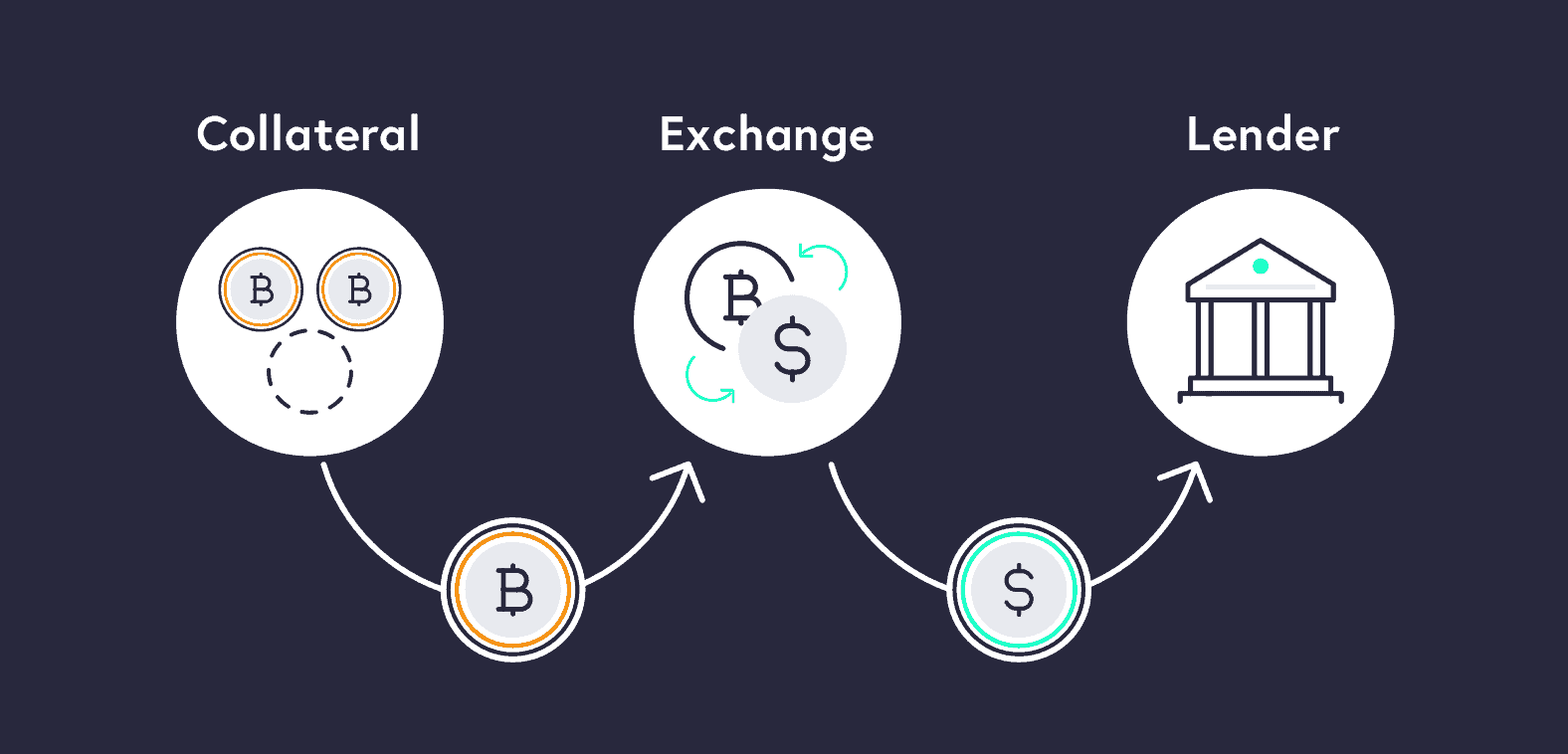

Your collateral is what protects your loan. It’s why SALT doesn’t need to perform income checks or credit checks when issuing a loan. But cryptocurrencies are volatile, so what happens if the value of your collateral begins to fall? Declining collateral value negatively impacts your Loan-to Value-Ratio (LTV) — that is the amount of outstanding principal still owed on your loan divided by the value of your underlying collateral: Outstanding Principal / Value of Collateral. LTV is the key metric SALT uses to determine the health of a loan. The lower the LTV, the healthier the loan. If the value of your collateral goes up, your LTV goes down. If the value of your collateral goes down, your LTV goes up. It’s that simple.

Choosing your Loan-to-Value (LTV)

When choosing your LTV, the most important consideration is your risk tolerance. We offer starting LTV options of 30%, 40%, 50%, 60%, and 70%. If you go with a 30% LTV, you are choosing the safest level of overcollateralization, or cushion. With a 70% LTV, you won’t have to deposit as much crypto to begin with, but you’ll have the least amount of cushion. The higher the starting LTV, the higher the risk. Choose the LTV option that’s right for you.

What can you expect from us when your collateral declines in value and your LTV begins to rise? Lots of notifications.

If your collateral continues to go down in value, your LTV will steadily climb. As your LTV crosses certain critical thresholds (75%, 83%, 88%, and 90.91% as of the time of this writing) SALT’s robust monitoring and notification technology kicks in to help protect your loan.

- At 75%, we give you a heads up, letting you know to monitor your loan more closely given your collateral is declining in value.

- At 83%, we inform you that things are not looking so good, and you may want to consider paying back some of the loan or depositing extra collateral.

- At 88%, we issue a final warning to let you know that if you don’t pay back some of the loan or deposit more collateral, you run a high risk of having your assets liquidated.

- At 90.91%, SALT is contractually obligated to liquidate a portion of your collateral in order to prevent the lender from losing their investment.

After all, lenders wouldn’t be willing to lend the money in the first place if SALT couldn’t guarantee its safety.

How you respond to a rising LTV and warning notifications is up to you. Here are the current options:

- Pay back a portion of the loan — You can make a payment in USD via wire or ACH, or you can make a payment using a stablecoin instead. SALT currently accepts PAX, USDC and TUSD. With this option, you are choosing to lower your LTV by paying down the principal on your loan.

- Deposit more collateral — You can quickly and easily deposit additional collateral (it can be the same collateral your loan is backed by or a different collateral type that we offer). With this option, you are choosing to lower your LTV by increasing the total value of the underlying collateral.

- Do nothing — You can choose to ignore the warnings. If your collateral continues to decline in value, SALT may eventually be forced to liquidate a portion of your assets on the open market.

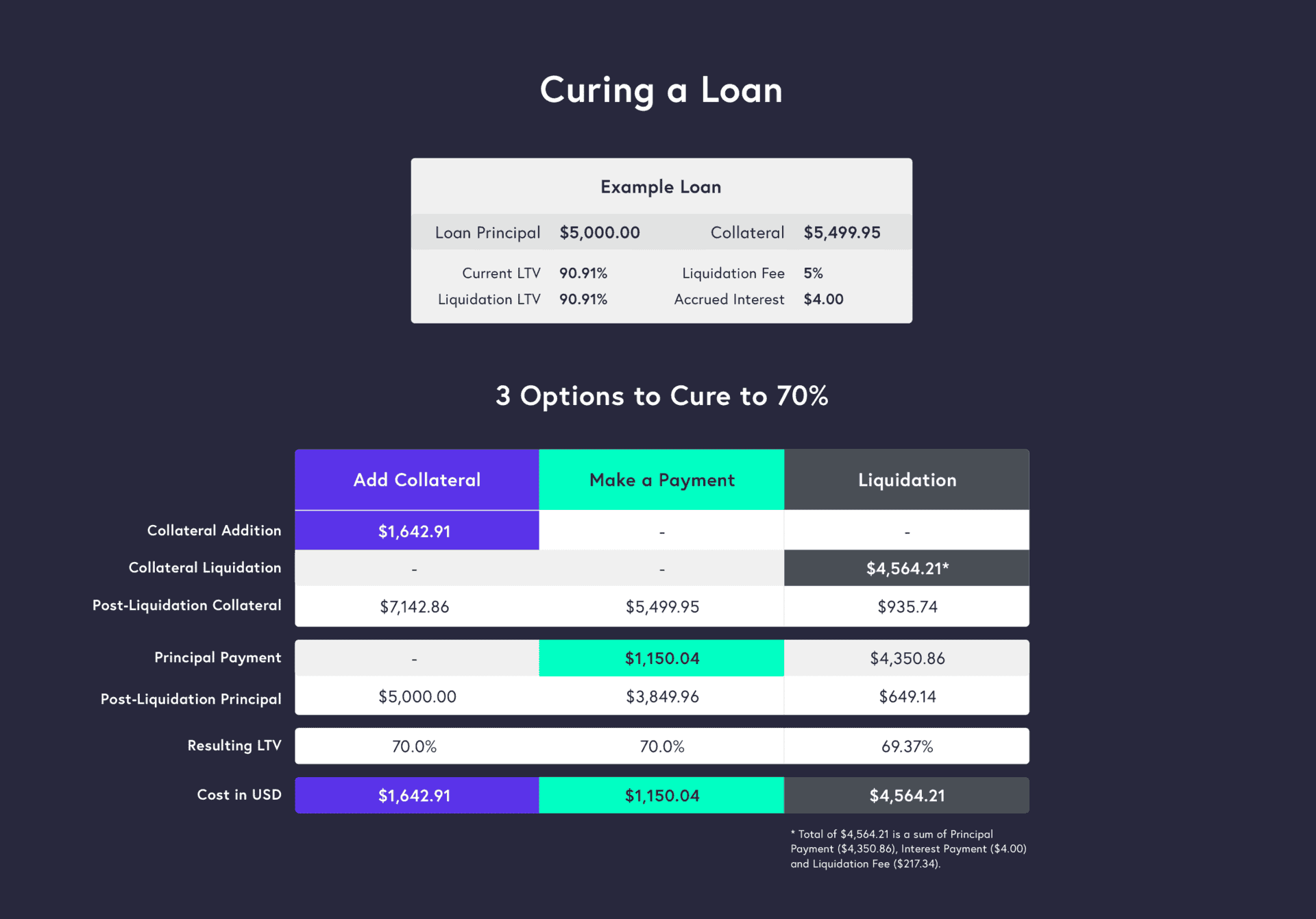

We’ve done the math to show you how each of these options impacts your assets, remaining principal, and required payment.

Based on the above calculations, if you want to avoid any loss of assets, it’s best to respond as quickly as possible with options one or two. Otherwise, option three is available if that’s what you prefer. Either way it’s important to think through the options and know where you stand before your LTV crosses our liquidation threshold.

Keep tabs on your loan health from anywhere via the real-time LTV widget on your web dashboard or by logging into your account through our mobile app.

It’s on us to monitor your loan health and keep you updated. It’s on you to take action (or not take action) when your collateral value is on the decline.