From business closures to event cancellations and stay-at-home orders, the coronavirus pandemic has had its way with the United States. Millions are unemployed, and millions of small businesses struggle to stay afloat in the punishing economic downturn.

The Federal Reserve, or “the Fed,” has been making headlines as it tries to limit the pandemic’s economic damage, including by lending $2.3 trillion that the government called for in its relief package, dubbed the CARES Act. This action has left many Americans wondering where the Fed got so much money, what the Federal Reserve can and can’t do, and what power the Fed has over our nation’s economy.

What Is the Federal Reserve, anyway?

It’s essential to define what the Fed is to understand its role in our economy. The Federal Reserve is America’s central banking system. Before the Federal Reserve, people panicked their bank would fail when a neighboring one closed its doors. Hordes of customers would run to withdraw their money, ultimately causing those banks to go belly up, too.

After a particularly terrible panic in 1907, Congress stepped in to create the Federal Reserve in 1913 through the Federal Reserve Act. The initial goal was to avoid these bank runs and provide banks with emergency funding. But today, the Federal Reserve System takes other measures to ensure the health and stability of the economy and a secure banking system.

How does the federal reserve work?

The Federal Reserve Act created a decentralized bank that functions without government financing or approval but still protects both public and private interests as a mixed organization.

It has three key entities:

- Board of Governors

At the heart of the Fed is the Board of Governors, made up of seven officials appointed by the government and confirmed by the Senate. It acts as an independent federal agency, and its job is to direct the monetary policy — the money supply and interest rates. Its goal is to make sure we maintain a stable economy.

- Reserve Banks

There are 12 Federal Reserve Banks spread throughout the U.S., each one having nine directors. Six directors are elected by commercial banks and three by the Board of Governors, protecting interests from both parties.

Reserve Banks are structured similarly to private corporations. They oversee member banks and carry out the monetary policy in their region. Reserve Banks act independently, but the Board of Governors supervises their actions.

These banks also have other vital roles like distributing currency to other banks, placing money into circulation, acting as a bank and fiscal agent for the U.S. government, and providing critical information about their local, national, and international economies to the Federal Open Market Committee.

- Federal Open Market Committee (FOMC):

The FOMC is a committee comprising the Board of Governors, the Federal Reserve Bank of New York President, and four members from the other 11 Reserve Banks, who serve for one-year terms.

The FOMC’s primary role is to determine whether the Federal Reserve should buy or sell government bonds, known as Open Market Operations (OMO), to maintain the economy’s stability. It also establishes a target federal funds rate, which is the interest rate banks charge one another for overnight loans.

Where does the Federal Reserve fit into the government?

The role of the Federal Reserve within the government can seem confusing since it has public and private aspects. The Fed is accountable both to Congress and the public and maintains transparency in all its operations.

Ultimately, the Fed is a product of the government because it was created by an act of Congress, which still oversees the whole system and can amend the Federal Reserve Act at any time.

But Congress created the Fed to work autonomously and to be shielded from political pressures by using a privatized structure for the Reserve Banks. It also keeps a hands-off approach by letting the three entities carry out their core responsibilities independently of the federal government.

Can anyone override Federal Reserve decisions?

There isn’t a formal legal power that can supersede the Fed’s monetary policy decisions. Still, the Federal Reserve Act allows the Treasury to “supervise and control” the Fed where jurisdictions overlap.

But the Treasury hasn’t needed to do this because a system of checks and balances keeps the Fed’s operations transparent and answerable to the public and Congress. Just because the Fed can influence the economy, doesn’t mean it doesn’t have to follow the rules.

Independent public accounting firms audit Reserve Banks annually. The Board of Governors also gets audited by its Office of Inspector General and an outside auditor. The Board of Governors annually publishes the results on its website.

The House of Representatives and the Senate hold the Fed accountable by requiring it to report twice a year on its monetary policy and economic decisions. Fed officials also deliver speeches throughout the year to the public so that everyone understands the reasoning for its decisions and actions.

Does the Federal Reserve print money?

If you’re a Bitcoiner, or you spend a decent amount of time on Twitter, you’ve most likely seen the “money printer go brrrr” meme that went viral in March of this year. It cropped up in response to the Fed’s announcement on March 12, 2020, that it would offer $1.5 trillion in short-term loans to banks to help combat “unusual disruptions” in financial markets as a result of the coronavirus. The meme, while more of a social commentary than an accurate depiction of the Fed’s responsibilities, expresses frustration regarding the government’s role in inflation and the devaluation of the US Dollar — as evidenced by the meme’s numerous likes and shares, many Americans share this same sense of frustration. While the meme is accurate in many ways, it unintentionally brings to light the common misconception that the Fed prints money. In reality, printing money is the responsibility of the U.S. Treasury. The Bureau of Engraving and Printing prints paper currency, while the U.S. Mint makes coins. The Treasury oversees both offices.

While it doesn’t print money in the literal sense, the Fed does buy cash as needed from the Bureau at cost to put into circulation, but the monetary base in circulation and at central banks typically stays the same.

The Fed manages the money supply by creating and destroying money. It swaps old, ragged bills for fresh ones or adds and deducts from digital balances. But it also manipulates the amount of money in circulation. The FOMC decides on whether to add or remove cash from the economy by buying or selling government bonds and other securities. This influences the amount banks will lend out and keep on deposit, which then affects interest rates.

That being said, where the misconception holds some truth is in the way the Fed puts more money into circulation; the Fed can’t print money, but it does have the power to essentially create money out of thin air. As a banker’s bank, it does so by making “large asset purchases on the open market and adding newly created electronic dollars to the reserves of banks.” In exchange, the Fed receives large amounts of bonds including US Treasury securities, mortgage‐backed securities, corporate debt and other assets. Rather than paying for these bonds in cash or gold bars, the Fed instead credits the account of the bank selling the bonds so that digital money moves from one place into the other.

The process is like taking out a personal loan of $10,000 at the bank. The bank doesn’t give you a suitcase full of cash. What you get is a credit that shows up as some numbers on a screen, reflecting your new account balance.

Because the Fed operates digitally, it can create money with a few keystrokes and use it to purchase assets or lend money. On a televised interview with “60 Minutes,” Former Fed Chairman Ben Bernanke said, “To lend to a bank, we simply use the computer to mark up the size of the account they have with the Fed. So it’s much more akin, although not exactly the same . . . to printing money, than it is to borrowing.”

The Fed did this when it promised to lend Americans $2.3 trillion, as called for in the CARES Act for economic relief and stability across the nation for those who were struggling because of the pandemic.

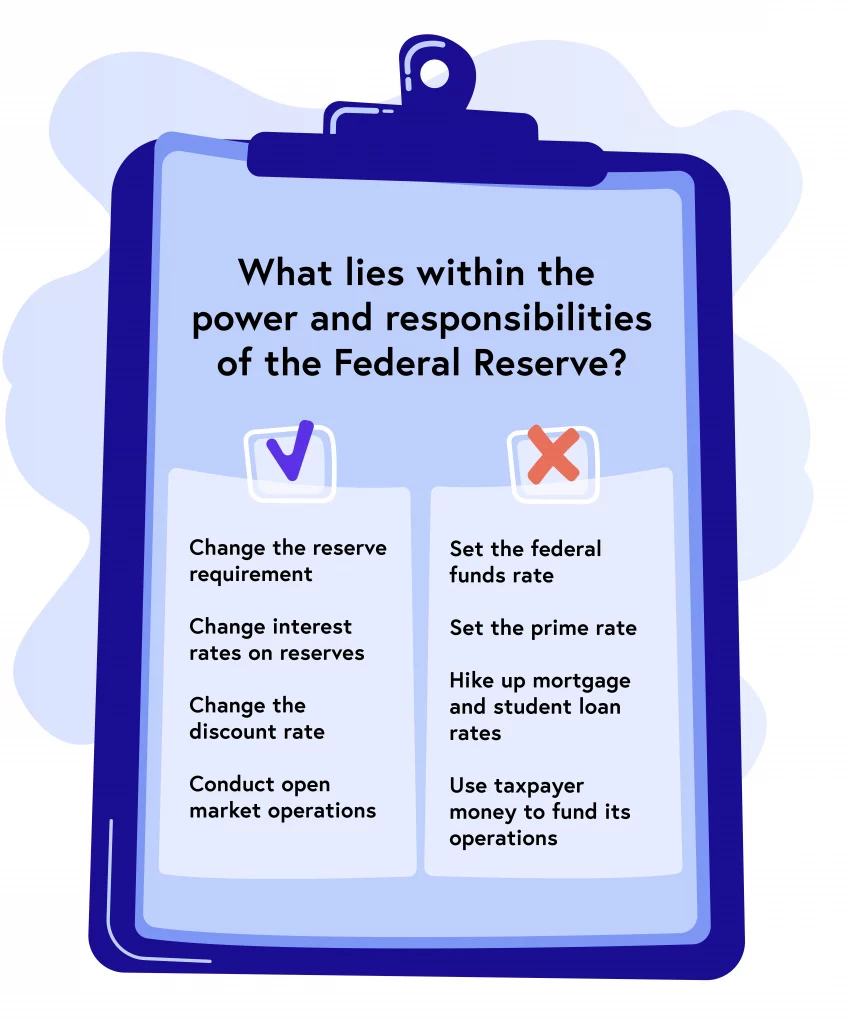

What can the Federal Reserve do or not do?

If the Fed can make money but not print it, what other actions is it able to take or is prohibited from taking?

What can the Federal Reserve do?

The Fed is an emergency lender for banks in financial distress, so it can lend money to failing banks to keep them afloat. But the Fed’s core responsibility is to manage the money supply, which has far-reaching effects on regulating the financial market.

It’s permitted to use four main tricks to change the amount of money in the economy:

- Changing the reserve requirement

The Fed dictates what percent of deposits banks have to keep on hold. It usually ranges from zero to 10 percent and is currently set at zero because of COVID-19. The more banks have to keep on reserve, the less there is to go out into the market.

- Changing interest rates on reserves

The Fed pays commercial banks interest rates on their required and excess reserves, a rule that went into effect in 2008. When the Federal Reserve wants to speed up the economy, it lowers the interest rate so that banks have less of an incentive to hold on to money.

- Changing the discount rate

The Fed encourages and discourages banks from borrowing money from it by raising or lowering its lending interest rates. When the discount rate is low, banks borrow more to lend to each other and the public.

- Conducting open market operations

The FOMC decides how many bonds to buy or sell. When it wants more money in the market, it buys these bonds from banks to put more money into their account. When it wants to slow down the economy, it sells the bonds to take away bank money.

This is the Fed’s most common tactic to influence the economy. For example, from 2008 to 2009, it bought over a trillion dollars of government bonds to inject money into the stumbling financial market. This lowered interest rates on short-term loans to almost zero percent.

But the recession went too deep. So, the Fed did something it hadn’t done before. It started buying long-term assets from banks in a process that’s known as quantitative easing (QE), boosting the money supply further and stimulating lending and investment.

What can’t the Federal Reserve do?

The Fed can only indirectly influence the nation’s economy. This means it does not have the power to take any of the following actions:

Set the federal funds rate

The federal funds rate is the amount of interest banks charge to lend their excess cash reserves overnight to each other. Banks frequently do this to meet the Fed’s reserve requirement.

While the Fed can’t set this number directly, the FOMC sets a target federal funds rate depending on what direction it wants the economy to go. Then, it works within what it’s permitted to do to influence banks and reach the benchmark rate.

Set the prime rate

Banks use the prime interest rate for commercial and consumer borrowing for things like credit cards and personal, car, and home equity loans. Banks often set the prime rate based on the Fed’s target federal funds rate.

Hike up mortgage and student loan rates

Mortgages and student loans are long-term assets whose rates are determined more by market-driven factors than FOMC decisions.

That said, the Fed purchased mortgage-backed securities to lower long-term rates on mortgages in 2008 so that banks wouldn’t need to borrow from each other to meet the reserve requirement. But these actions still affect federal funds rates significantly more than mortgage and student loan interest rates.

Use taxpayer money to fund its operations

The Fed doesn’t get any funding from taxpayers because its money comes from interest accruals on government securities and treasuries purchased through its OMO. There are other sources, too, such as foreign currency investments. After paying its expenses, the Fed turns any extra money over to the U.S. Treasury because it’s not operated for profit.

What’s the potential impact of the Federal Reserve’s powers on the economy?

Although the Fed can only work behind the scenes to stabilize the economy, it exerts a massive influence on its operations.

For example, the Fed can speed up or ease the economy by manipulating the money supply to increase or decrease consumer spending. It starts by influencing bank lending rates through selling and buying government bonds.

When banks have more excess reserves, there’s more to lend to the public, so interest rates are lower. Lower interest rates encourage people to borrow money, which is then spent on goods and services. More consumer spending generally means a better economy, while “even a small downturn in consumer spending damages the economy” and can even lead to a recession. Below is how the Fed’s actions impact specific aspects of the economy.

Interest rates

The Fed uses a trickle-down effect to influence interest rates. Remember, they can’t set federal funds or prime interest rates, but they can bend them to their will through OMO.

The Fed buying back government bonds from banks leaves more money for banks to play with while selling them means banks have to be more cautious about lending out their reserves. The economics of supply and demand shows excess cash in the market will drive down the interest rates banks charge to each other and the public, while a lack of money has the opposite effect.

The Fed also raises or lowers the discount rate and reserve requirements to change the interest rates commercial banks ultimately offer customers.

Inflation and deflation

When federal funds rates drop because of the Fed’s actions, prime rates usually drop with them. Consumers then borrow money for business and personal purposes to take advantage of lower interest rates. With greater amounts of money in their pockets, people spend more on goods and services, creating a spike in demand.

The larger demand pushes wages and costs higher to meet the production necessary to keep up with supply, causing a ripple effect. Prices increase across sectors, leading to reduced purchasing power. This is inflation and explains why a dollar today is worth less than a dollar last year.

Some annual inflation is good. It’s a sign the economy is doing well because consumers are spending. The Fed has a target core inflation rate of two percent. When inflation goes above or below the benchmark amount, the Fed steps in and works within its limits to move the needle toward inflation or deflation.

International relations

Although directing the U.S. monetary policy for the nation’s economic benefit is a crucial part of the Fed’s job, it also has foreign concerns.

Financial crises within our borders often have a global impact. The 2008 recession strained international markets because many countries have at least some assets and liabilities dominated by the dollar, causing them to sometimes borrow and lend in dollars.

To address the dollar scarcity, the Fed started swapping currencies with foreign economies in dire need of U.S. currency — over 583 billion dollars’ worth — at a predictable and fixed rate to keep struggling foreign banks afloat and prevent their economies from plummeting.

Sometimes the Fed also works with foreign central banks to set new banking regulations, as it did after the Great Recession.

Private bonds

As the pandemic continues to threaten the nation’s physical and financial health, the Fed is getting creative with its strategies, as it did in 2008 when it began buying long-term assets from banks.

Historically, the Fed has only purchased government securities. This time it’s buying 250 billion dollars’ worth of corporate bonds through exchange-traded funds (ETFs) to keep business up and running and workers employed. While this is good news in the short term, the long-term effects of this unprecedented move on the economy are uncertain.

The Federal Reserve: A system of the People, by the People, and for the People?

The Federal Reserve’s power and influence over our economy leaves many asking if it’s an unconstitutional entity. Though Congress takes a laissez-faire approach to the Federal Reserve, the system teeters between public and private domains.

The effect of its present monetary policy decisions on the future economy could determine which direction future reform sways. It could also decide if the century-old institution modernizes into a structure more accurately reflecting the concerns and voice of the people, and one maintaining greater transparency while ensuring the long-term economic stability of the nation.