Bitcoin-backed Loan No Liquidation Solution

With SALT Shield™, you and your Bitcoin can enjoy total peace of mind—no matter what the market does. One simple fee. No margin calls. No forced sell-offs. Experience never before seen market volatility protection from the moment you upgrade until the end of your loan.

Log in to your SALT Loan now

Market Drops? You’re Not Worried!

SALT Shield™ is SALT Lending’s no-liquidation loan upgrade. For a one-time fee, get no more margin calls and market-triggered liquidations, keeping your collateral safe even in a market downturn.

Upgrade any time up to 3 months before your loan matures, and stay covered for the rest of your loan term!

It’s simple. It’s secure. And it’s the perfect solution for anyone tired of watching market volatility jeopardize their plans.

How it works?

A Safety Net Built for the Volatile World of Bitcoin Lending

Get a SALT Loan

Apply for a SALT loan. Once your loan is funded, eligible loans can upgrade to SALT Shield™. It’s that easy!

Upgrade to SALT Shield™

Pay the one-time fee to upgrade. You’ll have a 3-day refund/cancellation period as long as SALT Shield™ is not triggered.

Relax & Celebrate Life!

No more liquidations—your loan will not be subject to a margin call for the remainder of its term. Enjoy life, no market watching!

Why choose SALT Shield™?

Set It, Shield It, Forget It

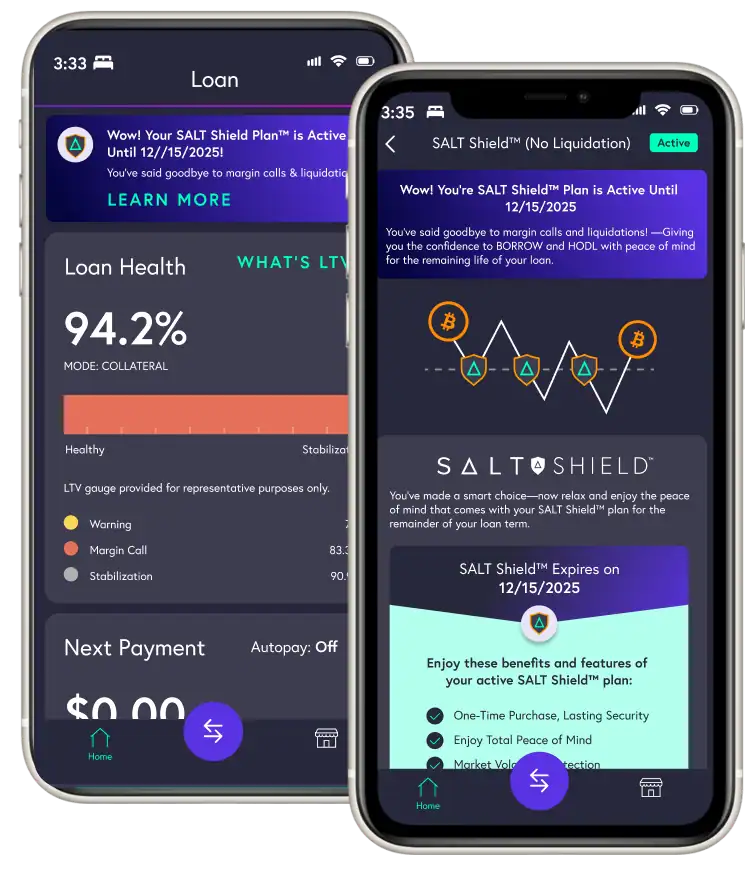

Activate SALT Shield™ once—then relax knowing your assets are protected. You only manage your loan payments in accordance with your terms.

Total Peace of Mind

One simple signup. One simple fee. No margin calls. No panic. Just lasting security of your precious collateral for the life of your loan.

Market Volatility Protection

SALT will forbear the triggering of margin calls and liquidation events for the duration of the coverage, regardless of market fluctuations.

No Tax Surprises

With SALT Shield™, your collateral remains in your account - ensuring no disruption to your tax strategy and planning.

And Because Life is Too Short to Worry About the Market...

Pricing & Plans

SALT Shield™ Eligibility Terms

3 Month Minimum Plan Length Required

The plan must be purchased at least 3 months before your loan’s maturity date.

Available to Loans Above $50,000

As long as your loan funding amount is over $50K, you can upgrade to SALT Shield™!

Available to Loans with LTVs Under 70%

If your loan’s LTV is currently under 70%, you can upgrade to SALT Shield™!

Only Available in Certain Jurisdictions

Unfortunately, not all jurisdictions where SALT lends can qualify for this offer today.

SALT Shield™ Plan Fees

SALT Shield™ offers flexible and competitive pricing designed to meet a variety of borrower needs. The cost is personalized based on factors like your loan’s collateral amount, Loan-to-Value (LTV) ratio, and remaining term length.

This ensures you get an affordable solution tailored to your unique financial situation, making it easy for Bitcoin holders to access the peace of mind that comes with protection against liquidation.

Whether you’re looking for a short-term or longer-term option, SALT Shield™ offers a range of pricing plans to suit your requirements while keeping your assets secure.

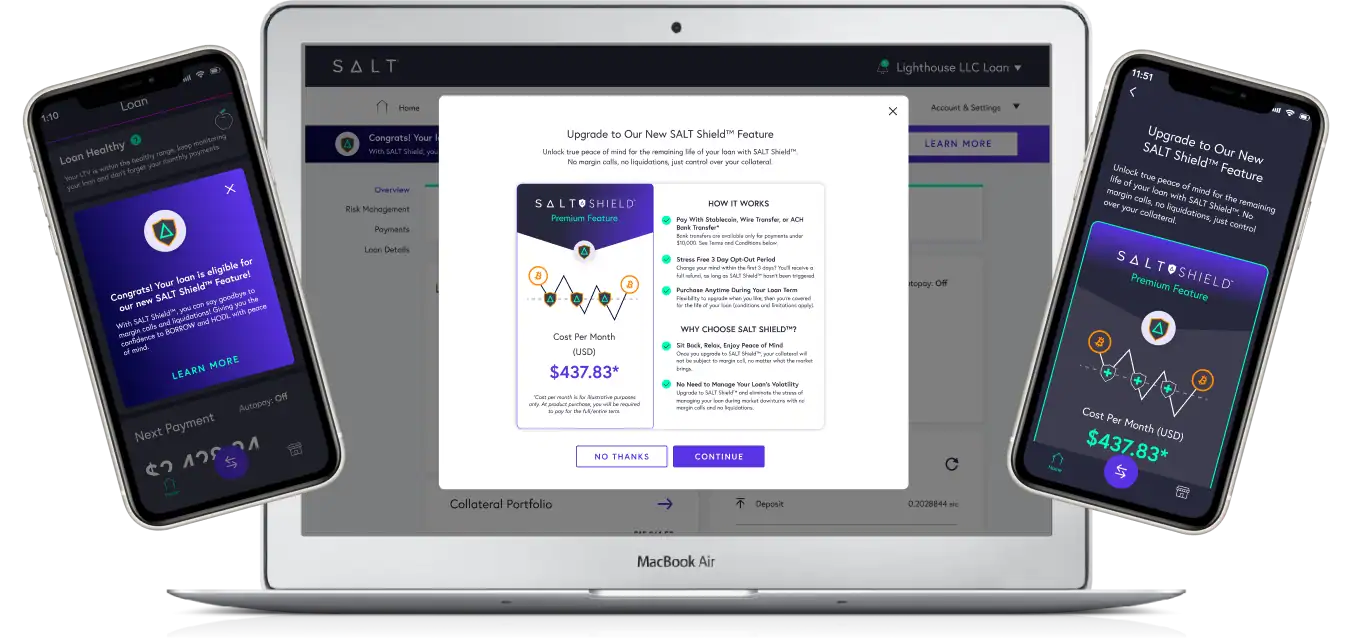

How SALT Shield™ Works

SALT Shield ™ is now available for active SALT loans larger than $50,000, with an LTV below 70%, and more than 3 months away from their maturity date.

If eligible, when you log into your active SALT loan, you’ll see a SALT Shield™ banner across the top. You can also access it from the Loan’s Risk Management page.

Want to learn more, click the button below!

Trusted by Smart HODLers Like You

Your SALT Shield™ Questions, Answered!

Everything you need to know about SALT Shield™ — No stress, no guesswork.

What is SALT Shield™?

SALT Shield™ is designed to help you stay confident during crypto market swings. As long as you’re enrolled and making your loan payments, your BTC collateral won’t be liquidated due to short-term price drops — even if the market gets volatile.

What loans are eligible for SALT Shield™?

SALT Shield™ is currently available for select borrowers with loans that meet certain requirements relating to, among other items, loan amount, LTV, jurisdictional eligibility, and term. If your loan qualifies, you’ll have the option to enroll.

When can I enroll in SALT Shield™?

Eligible borrowers may at any time after your loan begins, up until three months before your loan matures.

When does SALT Shield™ start?

The product starts after you enroll and the applicable fee payment is processed.

How long does SALT Shield™ last?

SALT Shield™ protection lasts until your loan’s maturity date, unless you refinance or repay early.

Can I withdraw my BTC while enrolled in SALT Shield™?

No — to keep your collateral protected, withdrawals are not allowed while you’re enrolled in SALT Shield™.

How is SALT Shield™ priced?

Pricing is dynamic and is based on several market factors, including but not limited to, the price of Bitcoin, your loan’s current LTV, and the time remaining until your loan matures. The lower your LTV, the lower your SALT Shield™ fee. Fees are paid upfront, and you’ll see the exact fee amount before you commit.

Can I refinance or adjust my loan with SALT Shield™?

Yes, you can refinance your loan or increase your loan amount during the term. If you do, you may be eligible to receive a credit for a portion of the original SALT Shield™ fee which may be applied toward re-enrollment in SALT Shield™ with respect to the new, refinanced loan.

Once your new loan is activated, you can choose to re-enroll in SALT Shield™ for the new term, provided you meet the eligibility requirements. If you do not immediately re-enroll or your refinanced loan is not eligible, you may not be able to utilize any SALT Shield™ fee credit.

When your loan matures, you can also refinance or take out a new loan and re-enroll in SALT Shield™.

For more details, please refer to the Terms and Conditions.

What happens if my LTV is over 70% at maturity?

At maturity, your loan is due and payable regardless of the LTV. You may also refinance and enter a new loan with a new maturity date. In order to refinance your loan, however, you will need to meet standard LTV requirements. Once you enter into a new refinanced loan, you will then have the option to re-enroll your new loan in SALT Shield™.

What are the SALT Shield™ Terms & Conditions?

You can find the SALT Shield™ Terms & Conditions here.

What if I repay my loan early?

You can repay your loan early anytime. SALT Shield™ fees are non-refundable, including if the loan is fully repaid before the scheduled maturity date.