Leverage Your Bitcoin for Living Your Life

The original digital asset-backed lender: trusted since 2016. Get cash in as little as one day after signing your loan agreement.

Borrow Against Your Bitcoin for Financial Freedom and Flexibility

Build your private reserves

Our tools allow you to build and leverage your digital assets as private reserves, giving you the freedom to use your wealth without giving up long-term growth. With SALT, you can:

Access Liquidity

Get access to cash when you need it without having to sell your assets.

Growth Appreciation

Hold your assets, allowing you to benefit from long-term growth.

Maintain Control

Use your assets strategically to enhance your financial flexibility.

Borrowing for Growth:

A Smarter Approach

Use a crypto loan to unlock financial opportunities, grow your wealth, and live on your terms. Build wealth, access liquidity, and enjoy the freedom to make the choices that matter.

No Taxable Events

Avoid a taxable event by not selling your Bitcoin.

Fast Cash Access

Get funds in 24-48 business hours.

No Rehypothecation

Borrower collateral is only used to manage their loans.

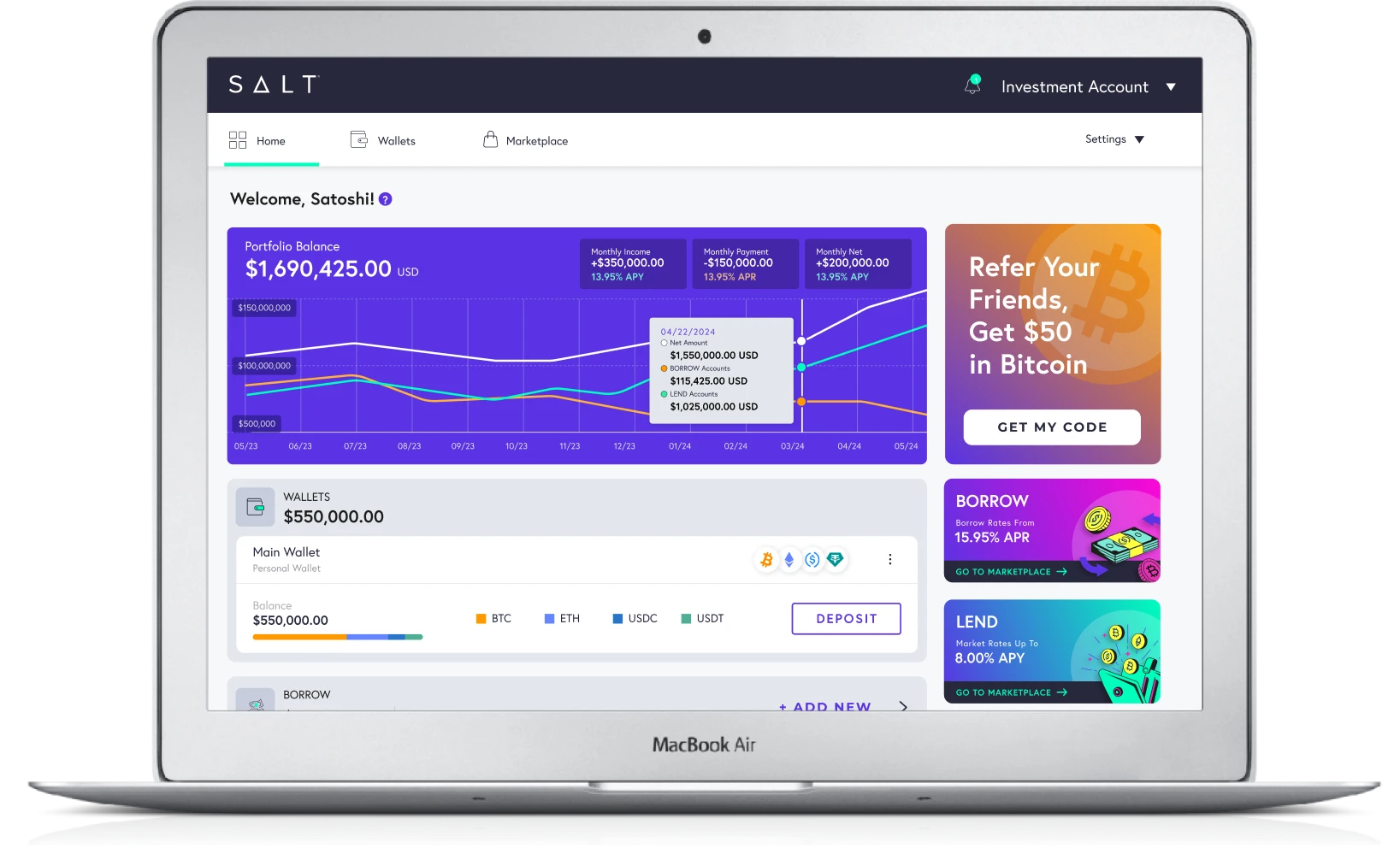

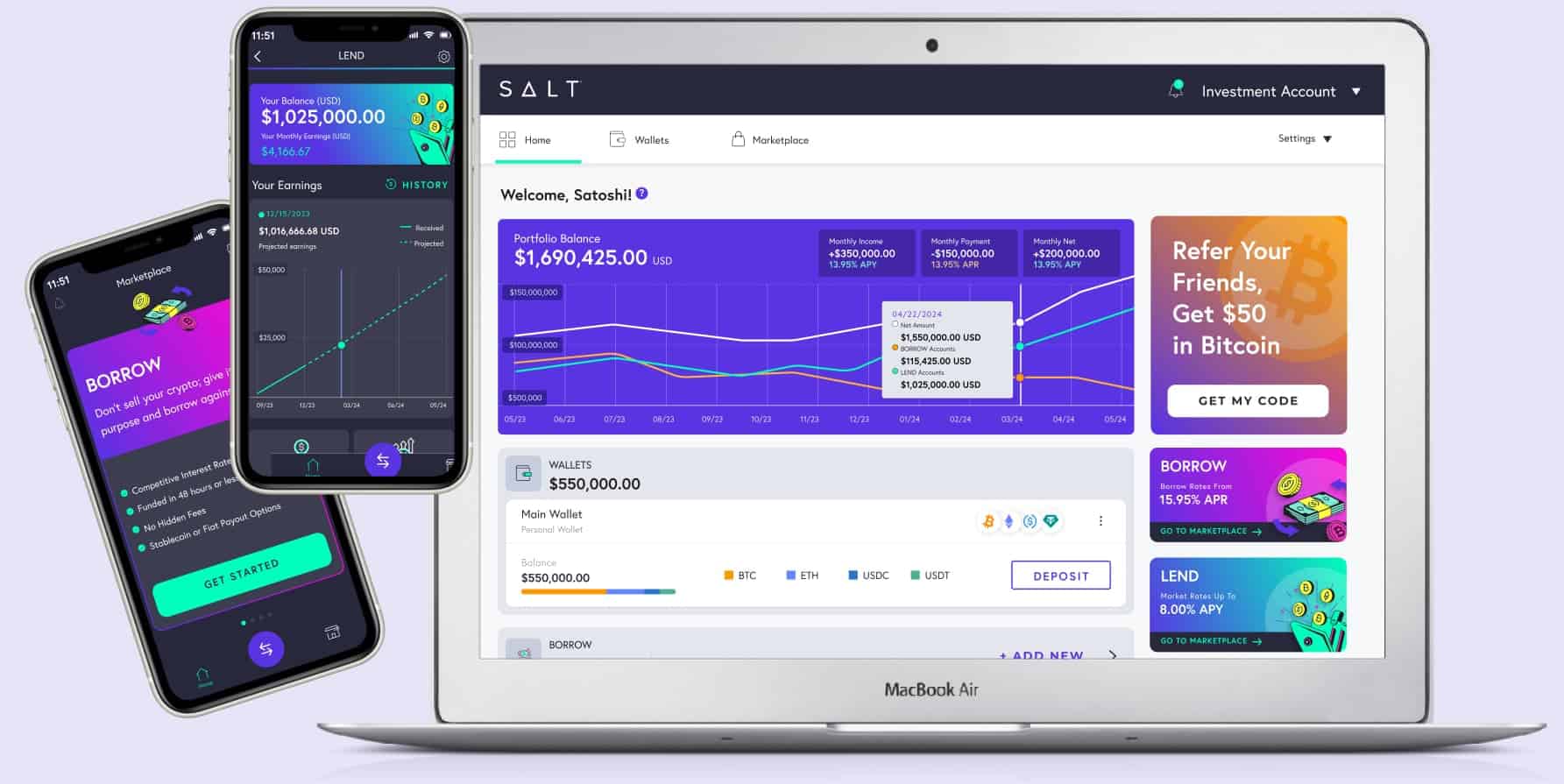

Loan Management Tools

Monitor and manage your loan on the go with real-time alerts.

No Hidden Fees

No prepayment penalties, no withdrawal fees, no fees for on-time payments.Proven Trust

Trusted since 2016 for security and reliability.

Capture Greater Growth

SALT’s individual loan options allow you to benefit from greater asset appreciation to grow your wealth faster than the alternatives.

| LENDER | 5 Years of Financing Costs | Potential Profit From BTC Reinvestment |

|---|---|---|

| SALT | $26,718.58 | $69,714.04 |

| LEDN | $33,940.78 | $62,491.83 |

| FIGURE | $41,035.66 | $55,396.95 |

| TRADFI | $36,754.58 | $59,678.03 |

| SOFI | $40,441.78 | $55,590.84 |

*The above details are for a $47,000 USD loan at 50% LTV assuming Bitcoin’s current value is $94,000, and BTC’s price in 2030 based on a CAGR of 25% would be $286,865.23.

Power Your Plans with Bitcoin-Backed Loans

Turn your crypto holdings into opportunities. Borrow against your digital assets while keeping your portfolio intact.

Life's Big Moments

Fund life’s big purchases, like buying a car or planning a dream vacation.

Adventures

Unlock the cash to pursue your next adventure, while keeping your assets.

Daily Expenses

Access liquidity for everyday expenses without selling your crypto.

Investments

Reinvest in crypto or other opportunities, accessing leverage without liquidating.

Rainy Day Fund

Have liquidity on hand for life’s unexpected challenges.

Financial Management

Consolidate high-interest debt. Save on interest while maintaining your holdings.

Finance Your Future Using Bitcoin

Use your digital assets as collateral to secure flexible loans and access liquidity without selling your investments.

HODL and Spend: Keep your crypto while accessing fiat.

Market-Leading Rates: Enjoy rates as low as 9.95% APR.

Flexibility That Fits: Borrow up to 70% of your collateral’s value, with no prepayment fees.

Are You an Accredited Investor Looking to Earn Yields?

If so, check our our Private Clients page to learn more.

Key Loan Terms

| Terms | Details |

|---|---|

| Borrower Eligibility | Eligibility is determined on a case-by-case scenario subject to KYC/AML requirements and varies based on the amount of the loan |

| Loan Minimum | $5,000 *availability based on jurisdiction |

| Loan Terms | 1, 3, or 5 year terms |

| Available APR's | 9.95% to 14.45% APR **APR is inclusive of interest and origination fees, where applicable |

| Payout Options | US dollars or stablecoin (USDC / USDT) |

| Prepayment Option | Loan is repayable at any time with no penalty |

| Payment Options | Elect to pay monthly payments of interest or accrue the interest and pay at maturity *availability based on jurisdiction |

| Loan-to-Value (LTV) Range | 30% - 50% - 70% *availability based on jurisdiction and loan term lengths |

| Available Collateral Types | BTC - ETH - USDC - USDT - SALT |

| Refinancing | All loans are eligible for refinancing at any time subject to current rates and fees |

Open a FREE Account in 3 Easy Steps! Test Drive the Platform.

- Create Your FREE SALT Account: No commitment, see rates in 60 seconds or less.

- Choose Loan Amount and Loan Terms: Select the loan terms that work for you. Instantly see your rate!

- Receive Approval and Funding Quickly: Get funded in as little as 24-48 business hours.

New! Introducing SALT Shield

Preserve Your Digital Asset Portfolio with SALT Stabilization

During market downturns, Stabilization automatically converts your crypto collateral to USDC to protect its value, giving you the flexibility to re-enter the market when the time is right.

- Preserve Wealth: Convert your portfolio to USDC to protect its value during a market downturn.

- Reduce Stress: Stabilization gives you time to manage loans and re-enter the market confidently.

- Grow Holdings: Reconvert to your original crypto mix during dips to grow your total holdings.

What Happy HODLers Say:

Want cash within 24-48 hours without selling your Bitcoin?

Your Bitcoin-Backed Loan Questions, Answered!

We understand the importance of transparency, and we're here to provide it.

What are the loan terms?

Our loans come with flexible 1, 3, or 5 year terms and Loan-to-Value (LTV) ratios of up to 70%. You can customize your loan when you apply to best suit your needs.

Will you check my credit?

No, we don’t check your credit. Your crypto is your credit. As long as you have crypto assets, we can fund your loan quickly—typically within 24-48 hours.

How quickly will I receive my bitcoin-backed loan?

Once approved, your loan can be funded within 24-48 hours. We move fast so you don’t have to wait.

Can I pay off my loan early?

Yes, you can pay off your loan at any time without any prepayment penalties or hidden fees. Pay back as much as you want, whenever you want.

Can I manage my loan after I’ve received the funds?

Absolutely! You can track and manage your loan at any time using our mobile app, LTV Monitor, and real-time alert system. Stay on top of your loan wherever you are.

How do I receive my funds?

We offer stablecoin payouts, meaning you can receive your loan even outside of traditional banking hours. No bank? No problem!

Are there any hidden fees?

No hidden fees here. We believe in transparency, so there are no prepayment fees or surprise charges.

How do stablecoin deposits work?

Stablecoin deposits make it easy to manage your loan on your own schedule. You can stabilize your Loan-to-Value (LTV) ratio whenever you choose, without needing to adhere to standard banking hours.

How does SALT protect my assets?

We’ve designed strategic reserves to safeguard your assets during market swings, giving you extra peace of mind.

Why should I choose SALT over other lending options?

SALT has been trusted since 2016 for crypto-backed lending. Our competitive rates, flexible terms, no credit checks, and 24/7 accessibility through stablecoins make us a top choice for miners, traders, and Bitcoiners.

Have Questions? Contact Us

By Direct Email

[email protected]

Office Hours

Monday – Friday | 9AM – 5PM (MST)