During unpredictable financial times where economic uncertainties seem endless, safeguarding your wealth has never been more important. Traditional assets often come with risks tied to inflation, currency devaluation, and market instability. This is where private Bitcoin reserves come in, offering a unique opportunity to secure and grow your wealth in volatile markets.

1. Bitcoin as a Hedge Against Inflation

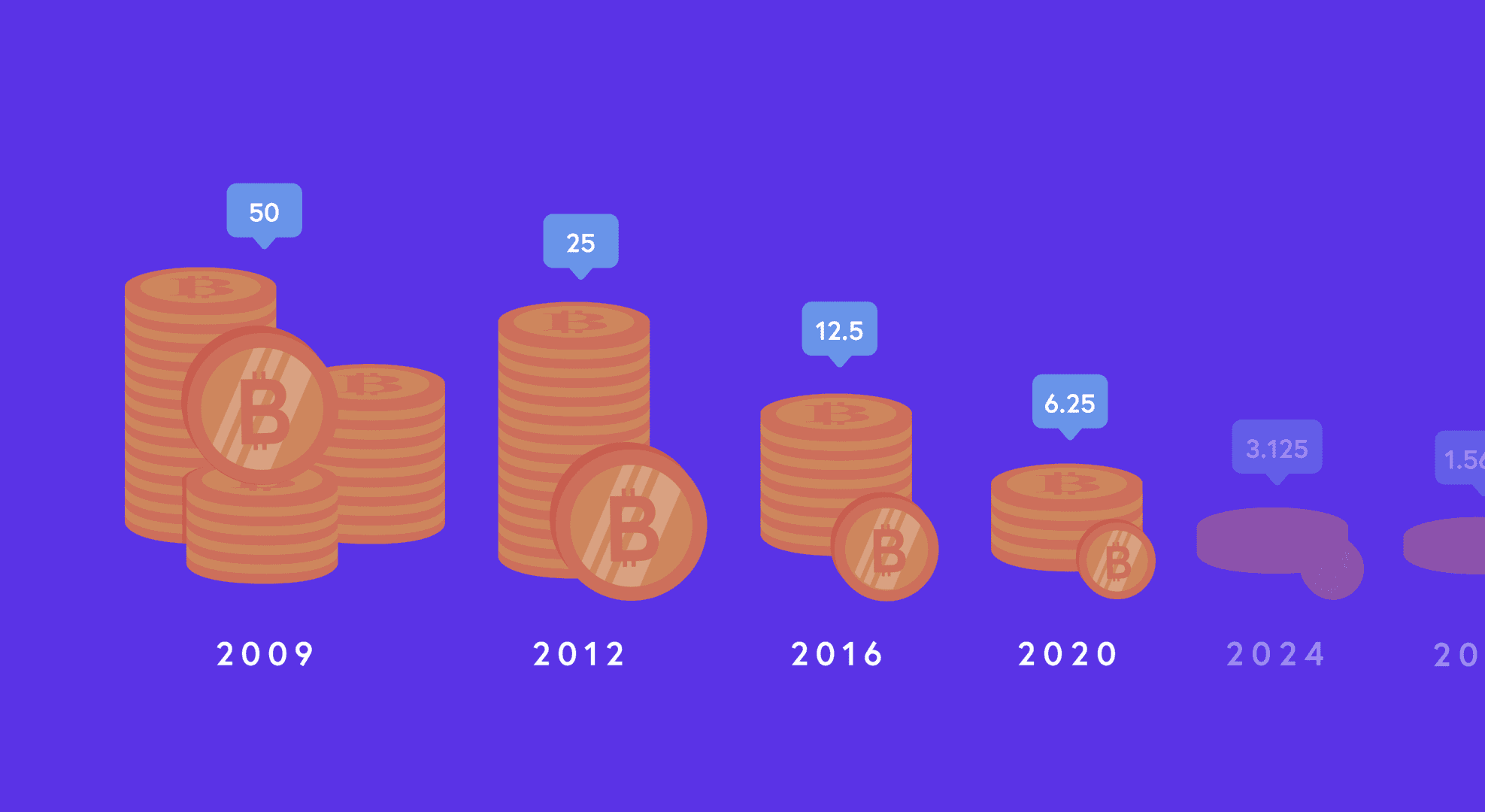

As central banks across the world continue to print more money to fuel economies, inflation has become a growing concern. In times of rising inflation, traditional currencies lose their purchasing power, but Bitcoin operates outside traditional monetary systems. With its limited supply of 21 million coins, Bitcoin is inherently deflationary. This makes it an attractive option for investors looking to preserve their wealth over the long term.

By holding Bitcoin in a private reserve, you shield your assets from the erosion of value that can happen when fiat currencies are devalued. It’s like creating your own personal store of value that isn’t tied to the whims of global economic policies.

2. Stability Through Diversification

While Bitcoin can be volatile in the short term, over longer periods it has shown to be a reliable store of value. When combined with other assets in a portfolio, Bitcoin helps balance out risk by diversifying your holdings. A private Bitcoin reserve serves as a strategic asset that can absorb losses during down markets while potentially capitalizing on future upswings.

For instance, when stock markets are declining or other asset classes are underperforming, Bitcoin might perform better, acting as a counterbalance. In addition to traditional savings accounts or bonds, holding Bitcoin in your portfolio could increase your overall resilience against global financial shocks.

3. Security in a Decentralized Network

Unlike centralized banking systems or investment vehicles, Bitcoin operates on a decentralized network that isn’t controlled by governments or banks. This decentralization provides an added layer of security, especially in politically unstable regions. In times of crisis or government-induced currency restrictions, Bitcoin can act as a safe haven, allowing you to access and protect your assets when other systems fail.

Moreover, with advancements in security protocols, Bitcoin can be securely stored in private wallets, making it virtually inaccessible to external threats. This gives you control over your assets, ensuring that no one but you has access to your private reserve.

4. Instant Liquidity and Global Accessibility

Bitcoin also offers significant liquidity. Whether you’re dealing with domestic or international markets, Bitcoin allows you to move your funds quickly and without the limitations posed by traditional financial institutions. In times of economic turmoil, access to liquid assets is crucial. With Bitcoin, you can convert your holdings to cash or stablecoins within hours, without the hassle of traditional banking hours or geographical restrictions.

Additionally, Bitcoin’s global nature ensures that it can be accessed from anywhere in the world, even in countries facing currency crises or economic collapse. This makes it an ideal reserve asset for those seeking international diversification and security.

5. Bitcoin’s Long-Term Growth Potential

Despite the short-term volatility, Bitcoin has consistently demonstrated long-term growth potential. Over the last decade, Bitcoin’s value has increased exponentially, far outpacing many traditional investment options. Holding Bitcoin in a private reserve allows you to benefit from this growth while maintaining the flexibility to adapt to market conditions. With the global adoption of cryptocurrencies increasing, Bitcoin’s long-term value trajectory remains highly promising

SALT Lending: Leverage Your Bitcoin Holdings for Cash Liquidity

SALT Lending provides an option for those who want to maintain liquidity while keeping their Bitcoin in reserve. With SALT Lending, Bitcoin holders can access cash without needing to sell their Bitcoin. By using Bitcoin as collateral for a loan, investors and businesses can secure cash in times of need—without triggering a taxable event from selling their assets. This is especially useful during market downturns when selling might lock in losses.

Whether you’re an individual investor needing quick access to liquidity or a business aiming to bridge cash flow gaps, SALT Lending offers the flexibility to use Bitcoin reserves as collateral to receive loans, preserving both your assets and financial stability.

Other Benefits of Using Bitcoin with SALT Lending

- Access to cash without liquidation: Keep your Bitcoin reserve intact while accessing liquidity.

- No taxable event: Unlike selling Bitcoin, using it as collateral doesn’t trigger capital gains taxes.

- Flexible loan terms: SALT offers personalized loan terms based on the value of your Bitcoin collateral, giving you control over repayment schedules.

Get started with a free account today.

Disclaimer: This content is for informational purposes only and should not be considered financial, legal, or investment advice. Always consult with a qualified financial advisor or professional before making any financial decisions or investments. Cryptocurrency investments carry significant risks, and past performance is not indicative of future results. Do your own research and consider your financial situation and goals before proceeding.