Unlock Cash Without Selling Your Ethereum

Unlock liquidity without selling your ETH with SALT Lending: get complete security, transparency, and support which you can’t typically get in DeFi.

DeFi vs. CeFi: Borrow Against Ethereum with Confidence

When it comes to getting a loan backed by your ETH, you’ve got two choices: trust code or trust experience.

DeFi loans might promise quick access, but behind the flashy interfaces are risks: smart contract exploits, no customer support, and zero accountability.

With SALT Lending, you get something DeFi can’t give you:

- Security you can count on

- Transparent terms

- Real people to guide you

The Hidden Dangers of DeFi Loans

DeFi platforms may work for some, but beneath the surface are risks every borrower should watch out for:

Smart Contract Exploits

A simple bug or a malicious hack can wipe out your Ethereum in seconds.

No Regulation

Without consumer protections, there is no recourse if your funds disappear.

No Safety Net or Support

When things break, there’s no support team, no recovery, no one to call.

Wild Rate Swings

Interest rates can surge 20-40% or more when demand spikes.

Forced Liquidations

Algorithms can auto-sell your collateral without warning during volatility.

Complicated Setup

Requires technical understanding of wallets, smart contracts, and gas fees.

Bottom line: With DeFi, you’re trusting anonymous code with your ETH. With SALT, you’re backed by a licensed lender, proven security, and real human support.

Why Ethereum Holders Choose SALT (CeFi Done Right)

With SALT, your ETH-backed loan is simple, secure, and supported:

Proven Track Record

One of the first licensed digital asset lenders, since 2016!

Flexible Collateral Options

ETH, BTC, and more.

Stable, Transparent Loan Terms

Fixed rates, no surprise liquidations, and no hidden changes.

Compliance-First

Regulated and secure custody.

Dedicated Support

Real people available every step of the way.

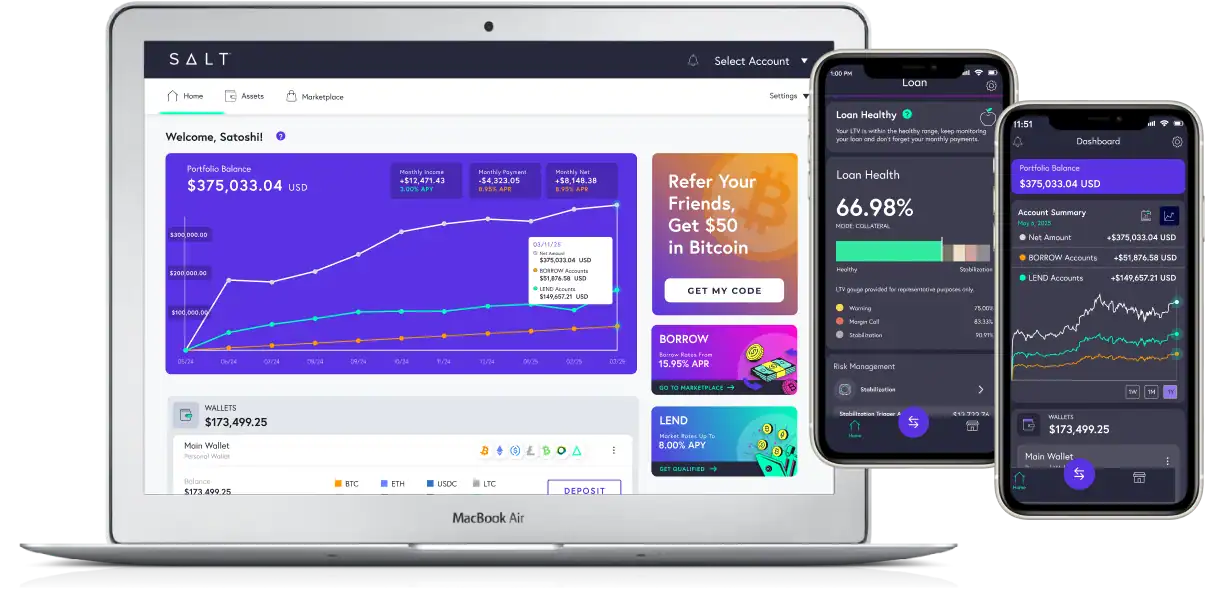

Enhanced User Experience

Intuitive interface with loans funding in 24-48 hours.

CeFi vs. DeFi: The Clear Difference

| Cefi (with SALT) | Defi | |

|---|---|---|

| Who’s in Charge | A licensed, regulated company | Anonymous developers & code |

| Custody of ETH | Secure, institutional-grade custody | Locked in a smart contract – hackable |

| Loan Terms | Clear, predictable, transparent | Complex, hidden liquidation triggers |

| Support | Real people you can contact | None – you’re on your own |

| Risk | Lower: compliance + custody | Higher: bugs, hacks, rug pulls |

| Regulation | Licensed and compliant | Unregulated, uncertain |

| User Experience | Simple, guided 3-step process | DIY, technical |

So Easy To Complete.

Get Started Today!

Complete the Form Below to Get Started

You’ll be emailed a custom promo offer link to include in your loan application.

Use Your Ethereum as Your Loan’s Collateral

With collateral-backed lending, no credit checks are needed.

Get Cash Without Selling Your Ethereum

All set! Once approved, your loan should be funded in 24-48 hours.

Unlock a Special SALT Offer Just For You!

We have a special offer, exclusive to Ethereum HODLers. Enter your name and email on the form below to get your offer along with instructions on redeeming your promo code.

This offer is for new or existing SALT ETH based customers applying for a new loan only. This is our way of helping you move closer to financial independence.

Ethereum Loans with SALT vs. DeFi FAQs

Everything you need to know about ETH-Backed Loans. No stress, no guesswork.

What is CeFi?

CeFi (Centralized Finance) refers to financial services run by licensed, regulated companies that act as trusted intermediaries. With SALT, CeFi means you get stable loan terms, secure custody for your ETH, and real human support — all within a regulated framework.

What is DeFi?

DeFi (Decentralized Finance) uses blockchain-based smart contracts to offer lending, borrowing, and trading without intermediaries. While innovative, DeFi carries higher risks like hacks, smart contract bugs, and no customer support.

What is TradFi and DeFi?

TradFi (Traditional Finance) is the legacy financial system — banks, credit cards, and centralized institutions. DeFi is decentralized finance, with no central authority but also no regulation or safety net. SALT bridges the gap by combining the innovation of crypto with the protections of licensed finance.

What is a DeFi wallet?

A DeFi wallet is a self-custody crypto wallet that lets you connect directly to decentralized apps (dApps) without intermediaries. Examples include MetaMask and Trust Wallet.

Is a DeFi wallet safe?

A DeFi wallet is only as safe as your practices. If you lose your private keys, you lose access to your funds — permanently. There’s no password reset or customer service. That’s why some users prefer SALT’s regulated custody and human support.

How to contact DeFi wallet support?

Most DeFi wallets don’t have traditional customer service. If something goes wrong, you’re typically directed to community forums or self-help guides. By contrast, SALT offers dedicated support from real people before, during, and after your loan.

Why not just use DeFi?

DeFi may look attractive, but it comes with serious risks: smart contract bugs, hacks, no human support, and unclear rules. SALT gives you a safer alternative — with stability, transparency, and a real team to guide you.

Is my ETH safe with SALT?

Yes. SALT uses proven custody solutions and operates as a licensed lender. Your ETH is securely stored and returned once your loan is repaid.

Can I borrow stablecoins against ETH?

Absolutely. With SALT, you can borrow against your Ethereum and receive either stablecoins or fiat, depending on your needs.

What happens if the price of ETH drops?

With SALT, you’ll always know your loan-to-value (LTV) ratio. Our team provides clear communication and options to manage your position — unlike DeFi, where liquidations can be sudden and automatic.

How quickly can I get my loan?

Once your ETH is deposited as collateral, loans are typically funded quickly — often within 24 hours.

Do I have to sell my ETH to access cash?

No. That’s the beauty of an ETH-backed loan with SALT. You keep ownership of your crypto while unlocking liquidity.

What makes SALT different from other lenders?

SALT was one of the first licensed digital asset lenders. We combine regulatory compliance, secure custody, and personalized support — things you simply won’t get in DeFi.

What if I want to repay my loan early?

You can. SALT offers flexibility to repay early without hidden penalties, and you’ll get your ETH back once the loan is closed.

Don’t gamble your ETH. Borrow with confidence.