Unlock the Wealth Potential of Your Bitcoin

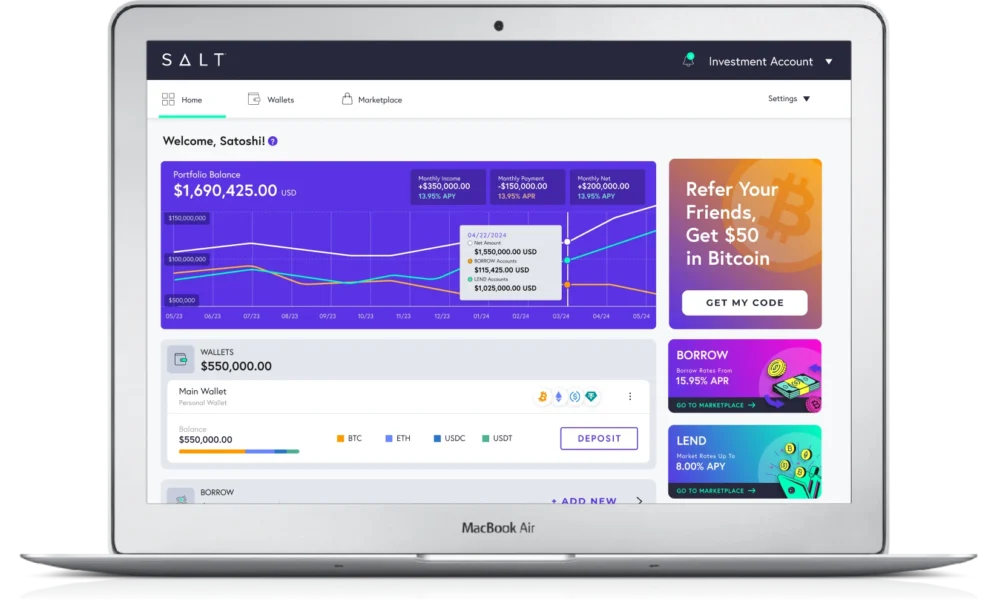

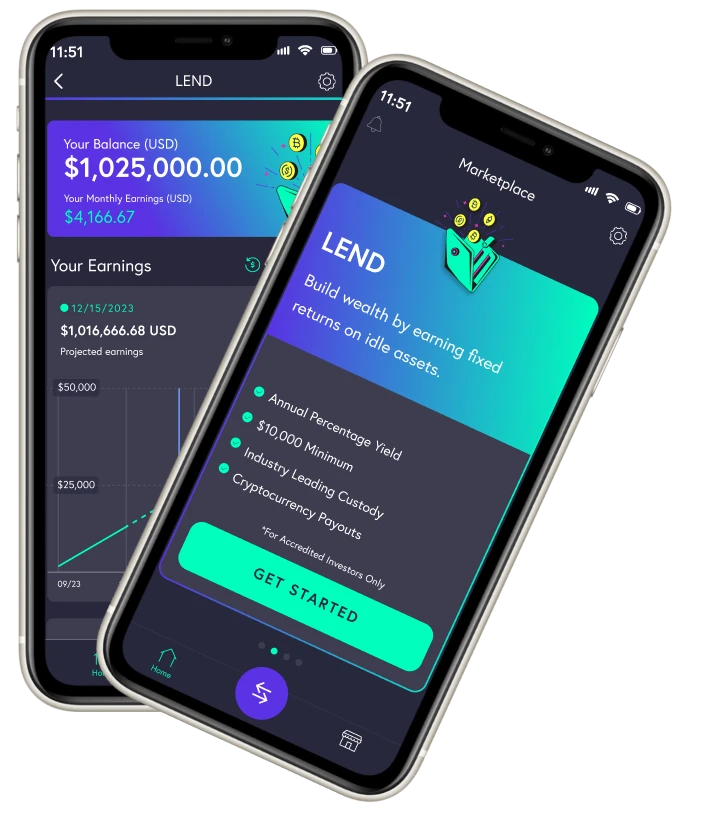

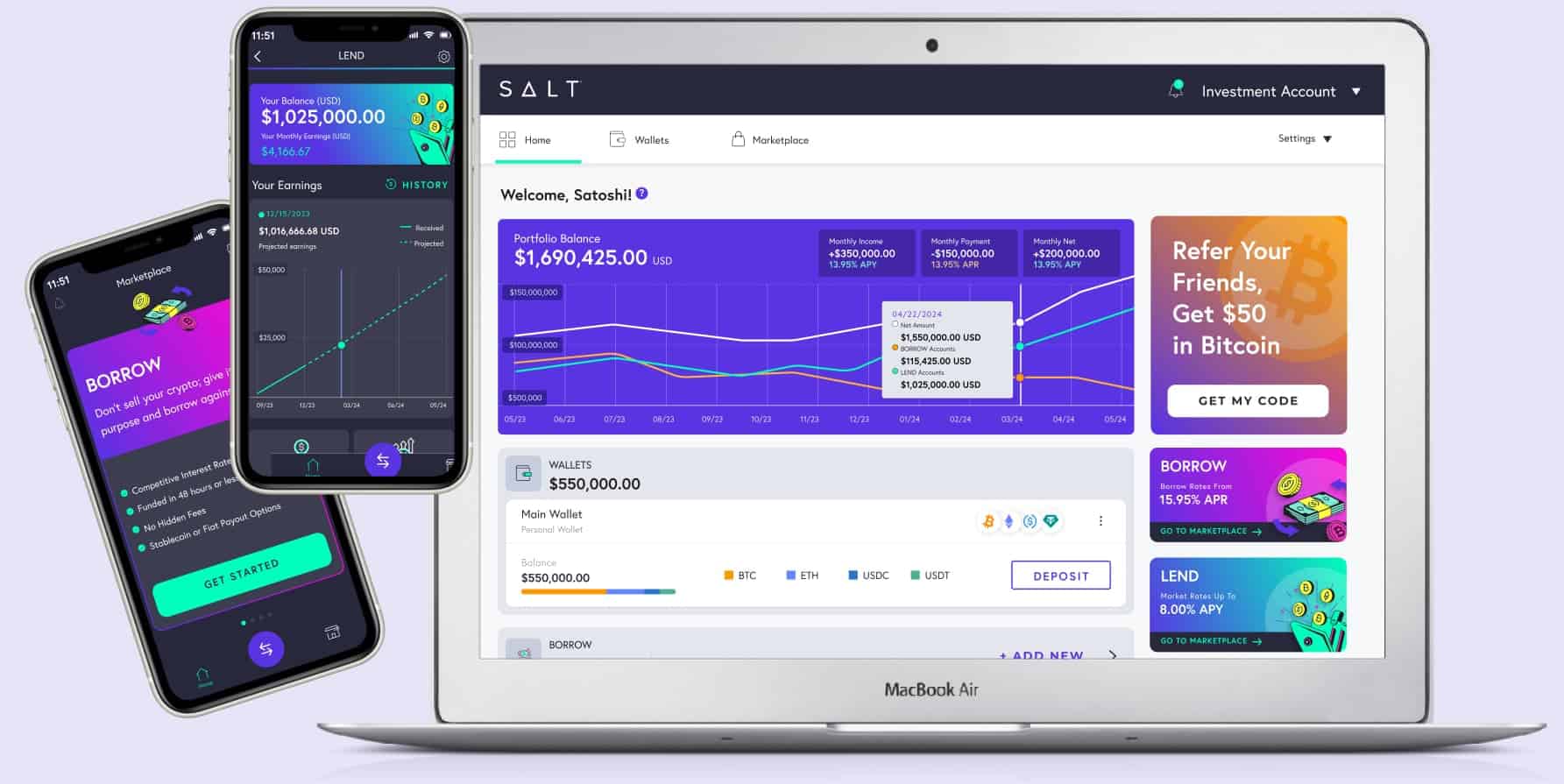

Designed for individuals, businesses, and investors to leverage digital assets. Access cash loans without selling your Bitcoin, earn yield, and invest strategically.

Trusted & Secure Since 2016

SALT, the original Bitcoin lender and trusted provider since 2016.

National & Global Presence

Largest licensed provider in the US + global coverage.

Well Proven Track Record

Collateral held with industry leading custodians and zero customer collateral losses.

Live Your Best Life Using Your Digital Assets.

Life is full of adventure, and bitcoin and other digital assets can fuel them. Who said you can’t have the best of both worlds? HODL and access cash. Take out a SALT loan to better leverage your digital assets.

Open an account in under 60 seconds

The Original Bitcoin-Backed Loan

Crypto-backed, not credit-based

Unlike traditional loans that rely on your credit score, SALT offers loans backed by your cryptoassets, meaning you can borrow without impacting your credit. We call that the smarter way to get cash, preserve your crypto, and take advantage of your crypto holdings.

Rates starting at

8.95%

Term duration

12-Months

Borrow up to

70% LTV

Prepayment Fees

None

Our audience

For Personal:

Access Cash, Leverage Your Bitcoin

Live Your Life: Get Financial Freedom

Use your digital assets as collateral to get the liquidity you need, while holding onto your Bitcoin for future growth.

Fast Access to Funds

Get cash in as little as 24-48 business hours, with the flexibility to borrow up to 70% of your collateral’s value.

Stabilize and Protect Your Assets

Protect your investments during market downturns with Stabilization. It automatically converts your crypto collateral to USDC, preserving value and allowing you to re-enter the market when the time is right.

Think About Net Benefit of Borrowing

With an average Bitcoin growth rate of 50%, inflation at 7%, and borrowing costs at 13%, your net benefit is a 40% gain. Borrowing becomes a smart financial move — liquidity today, growth tomorrow.

For Businesses:

Unlock Capital, Achieve Growth

Raise Business Capital With Ease

Access cash in just 1-2 business days through Bitcoin-backed loans, fueling your business goals without selling your assets.

Leverage Growth Opportunities

Maintain liquidity and take advantage of market opportunities without sacrificing your assets’ potential, long-term growth.

Get Cash for Operational Expenses

Use your digital assets to cover expenses, meet payroll, or manage monthly needs—all while holding onto your crypto.

Manage Volatility

Earn up to 10% APY on Bitcoin, Ethereum, and stablecoins, managing volatility while keeping your investments secure.

For Private Clients:

Exclusive Wealth Strategies

Leverage Your Digital Asset Potential

As a sophisticated investor, do more with your digital assets. Gain access to tailored strategies that set you apart.

Effortless Access to Liquidity

Get cash when you need it, with personalized lending terms and quick access to funds, without selling your digital assets.

Dedicated Relationship Manager

Experience the convenience of having a personal point of contact, offering proactive, C-suite-level support tailored to your unique needs. Enjoy speed, flexibility, and expert guidance every step of the way.

Flexible Wealth Solutions

Access a variety of borrowing and lending options designed to maximize the flexibility of your digital assets. Access personalized strategies to enhance liquidity, drive growth, and protect your wealth.

Your Bitcoin. Fully Secure. Always. Since 2016.

Since 2016, we've weathered the highs and lows of the crypto market while maintaining a flawless record. While many competitors were wiped out, we’ve stood strong, never losing a single client’s assets.

Proven Security Processes

Our trusted, battle-tested processes have kept your assets safe through market volatility.

We’ve built a track record that proves we protect what matters—your crypto.

Comprehensive Cyber Insurance

We back our security with robust cyber insurance, covering you against breaches, theft, and extortion.

Your assets are secure, whether they’re in storage or on the move.

Top-Tier Infrastructure

We partner with only the most trusted names in the industry, ensuring your assets are managed and protected using cutting-edge, reliable infrastructure.

Agile Risk Management

By distributing risk and implementing advanced security protocols, we speed up loan funding and enhance wealth preservation—always keeping your assets fully protected.

Don’t just take our word for it, see what SALTINEs are saying...

Assets We Accept

Combine multiple cryptocurrencies to borrow funds in USD or Stablecoin.

Got a Minute?

- Sign Up Quickly: Set up your account in under a minute.

- Easy Application: Follow our simple process to apply for a loan without a credit check.

How SALT Shield™ Works:

- Click the Button: To go to the SALT Shield landing page.

- Sign Up: Complete the wait list form to see if you’re eligible.

- Once Eligible: Review and Pay the One-Time Fee

- Sit Back and Relax: Simply continue your loan payments without the stress of being margin called.

The SALT Difference: The Preferred Choice

- US Jurisdictional Head Start: SALT operates under US jurisdiction, providing the most comprehensive coverage with trusted and regulated solutions. Get trusted and regulated solutions that give you peace of mind.

- Security & Trust Built on Experience: With real-world experience since almost a decade, we’ve developed proven processes to ensure your assets are always protected. We understand the crypto space inside and out, and our security measures are designed to keep you safe in any market environment.

- Leverage Your Digital Assets for Growth: We help you unlock the full potential of your digital assets—whether for business growth, personal investments, or building private reserves. Leverage your bitcoin easily without the need to sell.

- Stabilization: Protecting Your Collateral: Stabilization is at the core of our offering. We actively protect your collateral through market-leading risk management techniques, ensuring your assets are safeguarded while you continue to leverage them.